America’s inflation hot (and cold) spots revealed – including the scenic Florida beach city where prices are cooling fastest

In America, there is inflation because prices have risen in supermarkets, restaurants and gas stations.

But fascinating new data shows just how much price changes vary by state and even by city.

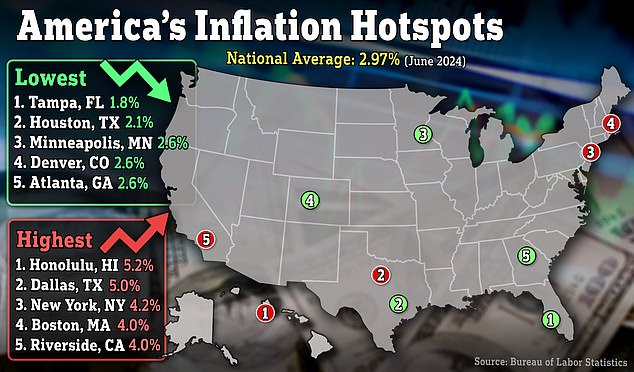

Tampa, Florida had the lowest inflation rate of 23 metropolitan locations in the U.S., according to data from the Consumer Price Index.

In the 12 months through May, inflation reached 1.8 percent in the Tampa-St. Petersburg-Clearwater region of the Sunshine State. By comparison, the national inflation rate hovered around 3 percent in June.

Meanwhile, the “urban Hawaii” area, anchored by Honolulu — also a picturesque beach location — ranked first in the nation with the highest inflation rates, at 5.2 percent in May.

Over the past two years, inflation in the Sunshine State’s Tampa-St. Petersburg-Clearwater region has been just 1.8 percent. (Image: A look at the Tampa suburbs)

The “urban Hawaii” area, anchored by Honolulu — another picturesque beach location — ranked first for the highest inflation rates in the country, after seeing rates rise 5.2 percent since 2022. (Pictured: Hotels and resorts around the beach in Honolulu)

The Florida city’s stable inflation rates are due to the region’s massive economic development and housing construction.

Thanks to Tampa’s booming housing market, home prices have remained stable and affordable for buyers.

During the COVID pandemic, many remote workers and baby boomers fled their busy lives and moved to the Florida coastal city, CNN company reported.

They did this to enjoy the warmer weather and lower cost of living. From 2021 to 2022, Florida as a whole was crowned the fastest growing state in the country, according to Census data.

Brian Adcock, president of the Tampa Bay Chamber, explained why Tampa is seeing such a decline, especially when compared to other major cities in the state.

“Tampa is a fast-growing area and there is a lot of construction going on because we have a lot of land available in the surrounding areas, like Hillsborough County and Pasco County,” he said.

“There are a lot more neighborhoods now and that’s the big difference from Miami.”

That hasn’t always been the case for the Tampa metropolitan area, where inflation hit a record high of 11.3 percent in 2022.

Red fin reported that the average rent in the city has fallen by six percent in a year since June.

In addition to affordable housing, Tampa is also undergoing “an incredible transformation” due to developments throughout the area.

The Florida city’s stable inflation figures are thanks to the region’s booming economic development and housing construction. (Pictured: Construction workers work on Tower II of The Ritz-Carlton Residences on July 17)

“We are fortunate to have fantastic developers in our region, not just individuals who come here, build skyscrapers and then leave,” said Tampa Mayor Jane Castor. start of July.

“We have people who are involved in our community.”

By comparison, prices in Hawaii are rising much faster.

Many have moved to the small state in search of a tropical lifestyle, but they are also faced with the costs that come with it.

A major factor in the high cost of living in Hawaii is the location of the state, which is just over 10,900 square miles long.

Because it is so difficult to travel across the Pacific Ocean, transporting materials and goods is very expensive.

Moreover, it has become increasingly difficult to keep up with the influx of residents, let alone the many tourists who come there.

In May, the shelter index — which measures housing costs — for “urban Hawaii” came in at an annual rate of 10.7 percent, more than double the national rate of 5.2 percent recorded in June.

“It’s common knowledge that we have an affordability crisis, a housing crisis, across the state,” Carl Bonham, an economics professor at the University of Hawaii, told CNN.

As for the state’s housing market, it has become increasingly difficult to keep up with the influx of residents, not to mention the many tourists who travel there. (Pictured: A neighborhood of single-family homes in Honolulu)

“We are simply not building enough homes and some of the homes are being bought by people who don’t live there and are being used as second homes, which just makes things worse.”

According to Roseann Freitas, executive director of the Building Industry Association of Hawaii, many families are forced into multi-generational living due to housing issues.

Freitas added that the Lahaina wildfires, which ravaged the state in August 2023, also had a “huge impact on the rental market” in the area, which was already down about 10,000 homes before the devastation.

Besides Tampa, other major cities including Houston, Minneapolis and Denver have also experienced a decline in inflation due to an increase in housing construction, economists said.

In addition to Honolulu, Dallas, New York, Boston and Riverside are also expected to see significant increases in inflation between 2022 and 2024, according to the Bureau of Labor Statistics.

After Tampa, Houston (Texas) is the place where prices are falling fastest.

Prices in Houston rose 2.1 percent from 2022 to 2024.

Dallas, Texas is the second highest priced city after Hawaii.

In two years, interest rates in Dallas rose to five percent.