SCHRODER JAPAN TRUST: Fund that believes Japan is the land of rising profits

No one can accuse the board overseeing London-listed investment fund Schroder Japan of complacency. Far from it. Led with aplomb by chairman Philip Kay, it is determined to ensure the £304m fund remains one of the first calls for investors seeking exposure to the Japanese stock market.

While stellar fund manager Masaki Taketsume has delivered strong returns on investment, the trust has struggled to attract buyers for its shares – a problem that plagues most investment trusts. The result is a share price that, frustratingly, does not reflect the value of the trust’s assets. Over the past year, shares have traded at an average discount of 10 percent.

Rather than sit still and wait for the tide to turn, Kay and his fellow supporters on the foundation’s board have taken a bold, two-pronged approach.

Last month, the fund announced measures to make it more shareholder-friendly, hoping to reduce the discount and boost returns for investors.

First, the company said it would aim to pay a higher dividend to investors in the future – 4 percent annually, compared to the current 2 percent.

While much of this ‘enhanced’ income will be funded from dividends paid by the trust’s underlying holdings, some will be funded from the assets (in effect, a return of capital). The logic is that many patient investors like to be rewarded with a stream of regular income – annual in the case of Schroder Japan.

Secondly, it said that if the trust failed to beat its benchmark index – the Tokyo Stock Price Index Total Return – in pounds over the next five years, it would give shareholders a partial opt-out. This would allow them to sell a quarter of their holdings at a price that reflected the value of the trust’s assets, not the shares (in other words, a better price).

Kay has described the measures as a “great package for all our investors.” While they will put pressure on Taketsume to continue outperforming, he doesn’t seem to be feeling the pressure. Five days ago, the manager said from Tokyo that his investment philosophy – based on buying undervalued companies – would not change.

“The fund has performed very well since I took over five years ago,” he said.

‘Hopefully these new measures will reduce the discount at which the shares are trading, making the trust even more attractive.’

Taketsume’s investment record is exemplary: a five-year return of 50 percent, compared with 28 percent for the trust’s peer group average. More importantly, he is confident it can continue.

“There is potential for more upside in the stock market,” he says. “Inflation is coming back in Japan and this helps companies that have pricing power, especially those that focus on the domestic economy. This in turn drives up corporate profits.”

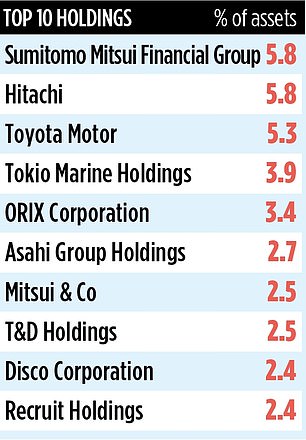

The 62-company portfolio has a bias toward domestically focused companies. A good example is Fukushima Galilei, a manufacturer of energy-efficient refrigerators for the food and medical industries. The trust began investing in the company in late 2019 and it now represents 1.2 percent of the fund’s assets.

“Fukushima has a great franchise in the domestic market,” Taketsume says. “Although the cost of materials and labor has gone up, it has passed it on to customers and increased profits.”

The trust’s stock code is 0802284 and ticker SJG. The ongoing annual charges are reasonable at 1.14 percent.

DIY INVESTMENT PLATFORMS

AJ-Bel

AJ-Bel

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive investor

interactive investor

Fixed investment costs from £4.99 per month

Saxo

Saxo

Get £200 back on trading fees

Trading 212

Trading 212

Free trading and no account fees

Affiliate links: If you purchase a product, This is Money may earn a commission. These deals are chosen by our editorial team because we think they are worth highlighting. This does not affect our editorial independence.