Couple who earn $200,000 a year in key swing state say they can’t afford a house OR a baby – and reveal what this means for their vote in November

A couple making $200,000 a year can’t afford a home in Nevada. Fierce competition and sky-high prices are driving millennials away. It could have implications for the presidential election in this swing state.

Kashmir Martin, 31, and her husband are almost ready to give up their dream of owning their own home and have decided to postpone having a child until they can, they said NBC News.

Martin alone earns $140,000 a year as an accounting manager for a mining company, and her husband earns about $65,000 as an audio engineer. Their budget for a house is a whopping $550,000.

“On paper, I’m making more money, I’m doing better,” she told the outlet. “But I feel less financially secure than I did in 2015, when I was a freshman accountant after graduating from college.”

They have been looking for a home in the Old Northwest or Old Southwest neighborhoods of Reno, Nevada for years, but can’t find any options under $3,000 a month. What’s more, they need a home they can’t afford.

Kashmir Martin, 31, and her husband are almost ready to give up their dream of owning a home and have decided to postpone having a child until they can. Although she earns more money, she feels “less financially secure than I did in 2015.”

Martin alone earns $140,000 a year as an accounting manager for a mining company and her husband earns about $65,000 as an audio engineer. Their budget for a house is a whopping $550,000

“On paper I’m making more money, I’m doing better,” Kashmir (pictured here with her husband) admitted, before adding: “I just don’t foresee prices coming down.”

In Washoe County, single-family home prices have increased 46 percent since 2019, with the median price just under $600,000, according to the The office of the provincial tax inspector.

People who struggle to find affordable housing tend to gravitate toward Democratic and third-party presidential candidates who promote housing policies.

Martin and her husband currently live in a townhome that costs $2,300 a month. If she were to purchase a home of comparable value, she estimates it would cost her $3,700 a month in mortgage payments.

The stress of buying a home has prompted her to support presidential candidates who support unions, such as presumptive Democratic nominee Kamala Harris, who ate a grape in her 20s to support the boycott in her home state of California.

Martin prefers these candidates because she believes it will increase wages, allowing more people to afford homes.

“At the federal level, anything that can help raise wages and get people into good, well-paying jobs is going to help this situation,” she said. “I just don’t foresee prices coming down.”

The current vice president has advocated for more affordable housing, and for giving tax credits to first-time homebuyers. She has also advocated for rent caps.

Republican presidential candidate Donald Trump said he would lower housing prices by encouraging the construction of new homes in America’s suburbs, where land is cheaper.

“Working-class people are being squeezed out of the housing market, rents are sky-high and there are a lot of injustices that haven’t been addressed,” Ted Pappageorge, secretary of the Culinary Workers Union of Nevada, told NBC News.

“I think the political class is not being as aggressive about this as it needs to be. We’re seeing some of the Democrats on housing, but it just needs to be much more aggressive.”

Philip Chavez recently bought a house for $470,000, which leaves him with a monthly payment of $3,700. He spends about half of his salary on his mortgage and has to stretch the rest of his budget to pay for his family.

In Washoe County, where Martin and her husband are looking for a home, single-family homes have risen 46 percent since 2019, averaging just under $600,000, above their budget. The stress of buying a home has prompted her to support presidential candidates who support unions, like presumptive Democratic nominee Kamala Harris, who ate a grape in her 20s to support boycotts

“I’m really praying that the interest rate goes down so I can try to refinance quickly because it’s a big payment,” he told NBC News. “It’s going to be a little bit thin here and there, but you know, I’ll eat less or whatever. We’ll figure it out.”

He doesn’t believe the Republican Party will fix the economy. But he does have a personal connection to Harris, who walked the UAW picket line with him and his colleagues in 2019.

“If we want to have a country the way it is or make it better, we’re not going to do it by voting Republican,” he said. “Trickle-down economics doesn’t work because trickle-down economics depends on a benevolent person trickling it down, and that’s not the world we live in.”

According to the government, housing is a major issue in Reno, where an additional 21,000 affordable homes are needed by 2022 to meet demand. state housing reportsAnother 4,300 units will be added over the next seven years.

The homeless population has increased by 4 percent this year and more than 3,000 low-income residents are on a waiting list for government-funded housing vouchers, NBC News reports.

The Food Bank of Northern Nevada has also seen an increase in clients, with high housing prices and a dire job market leaving Americans struggling to make ends meet. They’re helping 15 percent more people since last year and nearly 35 percent more in the past two years, NBC News reported.

“People have to pay their rent and are buying less food or don’t have money to buy food. We see that a lot,” Jocelyn Lantrip, the food bank’s director of marketing and communications, told NBC News.

In addition, many Californians have left and settled in the Reno area. This has led to houses being offered for cash and salaries being raised. This also drives up prices considerably, so that people like Martin can no longer afford the house she grew up in.

Housing is a major issue in Reno, which needed 21,000 additional affordable housing units to meet demand in 2022, according to state housing reports. They will add 4,300 additional units over the next seven years

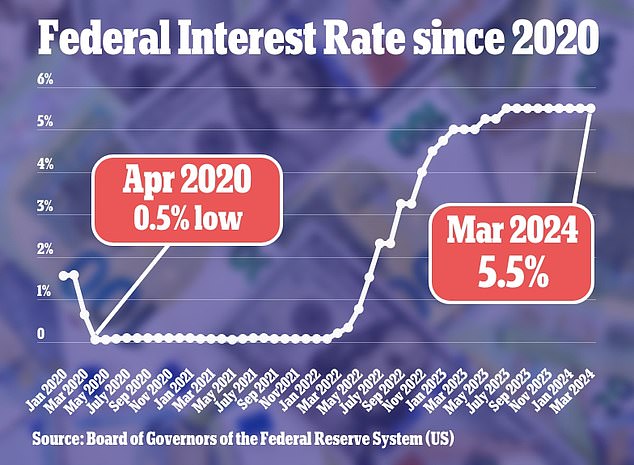

Shown: Federal mortgage rates from January 2020 to March 2024

“I’ve taken all the steps I thought I needed to take to be better than my parents,” she told NBC News. “But I feel like I’m not making progress. I’m actually a little behind.”

Her parents, who worked as a teacher and casino worker, bought the house decades ago, but at the 7.5 percent interest Martin was offered, she can’t afford it, even on her $140,000 salary.

The average monthly mortgage rate in the region is about $3,000 per month, nearly doubling since 2019. To afford a home — with a 20 percent down payment — a household would need to earn more than $100,000 per year.

According to NBC News, the median household income is just $80,000.

And it’s not just in Reno where first-time homebuyers are struggling to put down roots. Owning a home has become nearly impossible for many Americans across the country — and the situation isn’t going to improve anytime soon, according to the NBC News Home Buyer Index.

Home prices rose 6.4 percent from a year ago, according to the S&P CoreLogic Case-Shiller Index, with San Diego, Chicago and Detroit hit hardest.

Renters are also struggling, with many spending more than 30 percent of their income on rent and utilities, according to Harvard University’s Joint Center for Housing Studies.