Aussie couple break down during The Project interview after their dreams were crushed when cruel scammer stole $100,000 in life savings

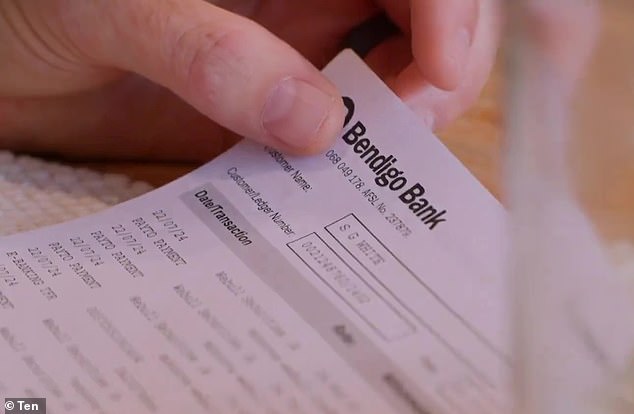

A heartbroken couple were forced to postpone their plans to start a family after a scammer stole almost $100,000 in savings from their Bendigo Bank account.

Scott and Danielle White are now left with just $1,500 after falling prey to a scammer who called them on Monday posing as an employee of their bank.

The man asked Mr. White to give him a personal security code and within minutes the fraudster stole more than $98,000.

The couple is sad and disappointed and struggles with the question of what to do next.

Mr White explained that the scammer knew all of his online banking details.

“I have almost no online footprint. I’ve never had social media. I don’t do much on my phone other than the usual stuff,” he said The project on Tuesday.

“He knew my access codes. He knew the security systems that Bendigo Bank used. He knew details about me that you can only get if you’re logged in.”

Mr White asked the man to prove he worked at the bank and received a text message that appeared to be from the bank.

Scott and Danielle White (pictured) are now left with $1,500 after receiving a call Monday from a scammer they thought was their bank

“He knew details about me that you can only see if you’re logged in.”

The text message was identical to several previous conversations he had had with the bank via the messages on his phone.

Mrs White said the couple are now struggling financially, on top of sky-high vet bills to care for their sick dog.

“We have no money left, only what I earned from my work, and that won’t last much longer,” she said.

“We recently discovered that our dog has cancer throughout her body, so we’re going to need a mountain of vet bills to keep her alive a little longer.”

The Project presenter Sarah Harris listened in horror to the couple’s harrowing story.

Mr White is currently receiving an Income Protection Payment following recent knee surgery.

The couple are also trying to start a family and are saving money for IVF treatment.

Mrs White struggled to hold back her tears and burst into tears as she tried to explain how their future plans had been disrupted.

“We wanted to start IVF because we had been trying for a while, but with no success – not even a little bit of hope. So a lot of it went to IVF,” Mr White said.

Mr White said his family does not know what happened and that he plans to undergo at least 10 IVF cycles.

“We’ve been trying to have a baby for a long time. This literally happened next month to start all of our treatments. So it’s just really hard,” Ms. White said.

The Project’s Sarah Harris was shocked when she heard the couple’s heartbreaking story

The couple, who had plans to start a family, are now strapped for cash and are also faced with skyrocketing medical bills to care for their dog, who has cancer (see bank statement)

According to a report by the ACCC, Australians lost more than $2.7 billion to scams in 2023, with more than 600,000 scam reports made.

The largest sums were claimed through investment fraud, with Australians losing as much as $1.3 billion.

A Bendigo Bank spokesperson said the bank tries to refund money lost to fraud where possible.

“If the bank is in default, we will reimburse the customer for the loss of money,” the spokesperson said.

Daily Mail Australia has contacted Bendigo Bank for further comment.