Ford delays plans to go all-electric from 2030 as EV boss says deadline was ‘too ambitious’

Ford has reversed its plans to sell only electric vehicles in Europe from the end of the decade, its EV division’s chief operating officer said.

In an interview with CoachFord Model E boss Marin Gjaja said “uncertainty” surrounding electric vehicle demand and legislation had led the company to delay its 2030 target to phase out petrol and diesel models.

He said 2030 was “too ambitious” when he confirmed the company continue to offer new hybrid cars in Europe after that date.

Ford’s electric vehicle chief has said the brand’s plans to go all-electric in Europe from 2030 are “too ambitious” as he confirmed the company will continue to offer hybrids

In February 2021, the US auto giant said sales in Europe would be all-electric or plug-in hybrid by mid-2026, and all-electric cars by the end of the decade.

However, the recent downturn in demand for battery-powered cars has led to these and several other major manufacturers adjusting their own deadlines for pulling internal combustion engine models from showrooms across the continent.

Marin Gjaja, Chief Operating Officer of Ford’s ‘Model E’ electric vehicle division

Gjaja told Autocar: ‘I don’t think we can fully commit to anything until our customers do. And that happens at different paces around the world.’

He added that ‘Customers have indicated through recent purchases that they are not yet ready for battery cars and that the ambition to sell only electric cars in Europe from 2030 is ‘too ambitious’.

Gjaja’s comments come just days after Ford unveiled its third purpose-built electric model, reintroducing the controversial Capri name for its new sporty electric SUV.

He went on to say that others in the industry, such as Ford, have learned “the hard way” that drivers are not switching to electric cars as quickly as manufacturers expected.

“We don’t think moving to fully electric in 2030 is a good choice for our business, and certainly not for our customers,” he told the automaker.

In the UK, electric vehicle sales are up around 9 per cent year-on-year, but the vast majority of demand is driven by the fleet sector, while private purchases are declining.

Sales of electric cars to paying citizens – rather than through leasing, fleet management and business purchases – are down 10.8 percent in 2024. Less than one in five new electric cars go to private buyers.

Gjaja told Autocar in a recent interview: ‘I don’t think we can go all the way with anything until our customers choose it, and that happens to varying degrees around the world’

European EV registrations fell 1% in June, with major markets Germany and France seeing declines of 18.1% and 10.3% respectively

This falling demand for electric cars means the UK automotive industry has had to revise its sales forecasts for 2024. The market share of electric cars has now fallen to 19.8 per cent, well below the 22 per cent target of the Zero Emission Vehicle (ZEV) mandate, which manufacturers must meet to avoid large fines.

In Europe, EV registrations fell 1 percent in June, with key markets including Germany and France showed declines of 18.1 percent and 10.3 percent respectively.

A total of 712,637 new battery-electric cars were registered on the continent in the first half of 2024, a modest increase of 1.3 percent compared to the same period the previous year.

This means that approximately one in eight new models that have appeared on the European road network this year is a fully electric car.

Automakers are adjusting their EV targets

Ford isn’t the only automaker reconsidering its plans for electric vehicles.

Fiat’s boss confirmed this week that the to relaunch a petrol version of the 500 city car due to a lack of demand for electric cars, especially among older drivers.

CEO Olivier Francois said the new ‘mild-hybrid’ Fiat 500 Ibrida will hit the market in early 2026 due to the ‘slower than expected uptake of electric cars across Europe’.

Fiat CEO Olivier Francois said the car company would reintroduce a petrol engine version of its 500 city car due to the lack of demand for electric vehicles, particularly among older drivers

German auto giant Mercedes-Benz announced this year that it will extend the production cycle of one of its best-selling internal combustion engine cars amid concerns about the acceptance of electric cars.

The A-Class hatchback, which was due to go out of production at the end of this year, will remain in production until 2026 as part of a “more flexible” strategy by Mercedes for its transition to electric cars.

CEO Ola Källenius has said the company will continue to produce internal combustion engine cars based on existing platforms well into the next decade, as price parity between electric and gasoline cars “will take many years.”

Audi has cut back on electric car production due to falling demand, while VW has also scaled back production due to a combination of parts shortages and lower-than-expected sales.

Other manufacturers are reluctant to phase out combustion engines.

Toyota Chairman Akio Toyoda said in January that battery electric vehicles will never dominate the auto market and will account for no more than a third of global sales.

Toyoda said switching to electric vehicles is not the solution with a billion people worldwide living without electricity: “We also supply vehicles to these regions, so a single electric car option cannot provide transportation for everyone,” he said.

“No matter how much progress electric cars make, I think they will still only have a 30 percent market share.”

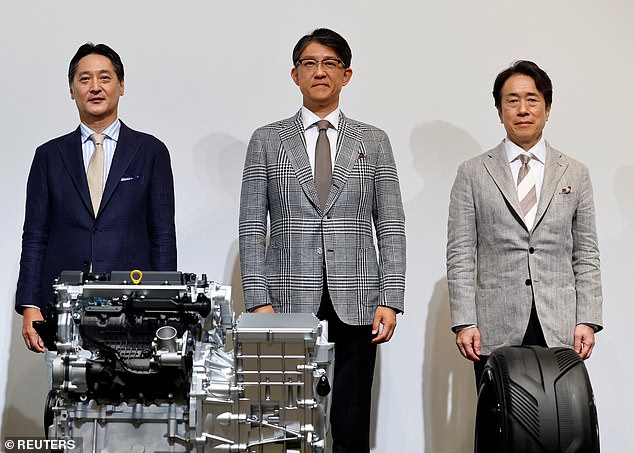

From left to right: Subaru CEO Atsushi Osaki, Toyota CEO Koji Sato and Mazda CEO Masahiro Moro confirm that the three automakers have joined forces to develop new compact combustion engines in a bid to achieve carbon neutrality without relying solely on electric vehicles.

In May, Toyota, Mazda and Subaru pledged to introduce smaller gasoline engines that can be used alongside hybrid technology and to implement green biofuels to reduce vehicle emissions.

Toyota, the world’s largest car seller, described the development as “an engine reborn”.

Aston Martin chairman Lance Stroll has also said the British sports car company will continue producing petrol cars until manufacturers are forced to stop by regulators due to falling demand for electric cars.

“We will continue to make them (gasoline cars) as long as we are allowed to make them. There will always be demand, although it will shrink,” he said in April.

But while many car brands are postponing their plans to switch to electric driving, this does not apply to Jaguar.

The British carmaker, now owned by India’s Tata, is ending production of all but one internal combustion engine car as it seeks to become a luxury, all-electric brand from next year.

The European Union has set 2035 as the date by which the sale of new petrol and diesel vehicles will be banned across the continent.

However, exceptions are allowed for cars with a combustion engine, which will be allowed to remain in showrooms after 2035, provided they can run on sustainable e-fuels that are CO2-neutral.

In the UK, the Labour government has already promised to Ban on the sale of new cars with combustion engines from 2030 – although no mention of this was made in the Speech from the Throne earlier this week.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free. We do not write articles to promote products. We do not allow commercial relationships to influence our editorial independence.