Dacia’s budget-friendly Sandero tops European sales charts – as Tesla’s 2023 bestseller drops down the rankings

Motorists across Europe will be on the lookout for new bargains in 2024, as Dacia’s budget-friendly Sandero is revealed to be the best-selling model in the first half of the year.

With a price starting at £13,795, the Sandero is officially Britain’s cheapest new model. However, it has failed to crack the UK’s top 10 most popular cars in its first six months.

While Dacia celebrates its success, Tesla has seen demand for its expensive electric vehicle wane. Last year’s best-seller in Europe – and globally – the Model Y, has fallen in the rankings for 2024, according to registration data from across the continent.

Cheap thrills: Dacia’s Sandero supermini is the best-selling new car in Europe in the first half of 2024. But what happened to last year’s most popular car, the Tesla Model Y?

With 143,596 units sold across Europe between the beginning of January and the end of June – an increase of 18.5 percent compared to the same period in 2023 – the Sandero has become the top of the sales charts.

The affordable supermini has been a huge success in European countries. Motorists have been buying these cheap and cheerful little models in droves since the budget-friendly Romanian car brand was relaunched by Renault over a decade ago.

Since 2017, this has been the most popular new model in Europe every year for retail sales to private individuals using their own cash.

However, the jump to the top of the registration rankings in 2024 is for sales across all channels, including fleets and corporate purchases.

Dacia says sales results suggests that ‘demand for and confidence in the vehicle are stronger than ever’.

Since its first introduction in 2008, more than 3.1 million Sanderos have been sold.

However, only 6,721 Sanderos were sold in the UK in the first half of 2024.

To put this figure into perspective, the most popular new model, the Ford Puma, has collected 26,374 registrations.

Left in the dust of the Dacia: Sandero has collected 143,596 registrations on European car markets so far in 2024

In second place in the European sales charts is the Volkswagen Golf with 126,993 units sold.

The Golf has been a car favorite for decades. Sales figures rose by a whopping 43 percent in the first half of the year. In 2023, the car has dropped to seventh place in the registration list.

The top three is completed by Renault’s Clio with 114,623 units sold.

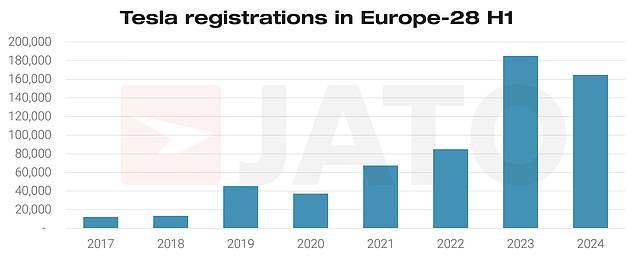

Tesla registrations on the slide

The most popular new car sold in Europe in 2023 was Tesla’s Model Y, which cost £31,000 more than the bank account-friendly Dacia.

The SUV, which cost just over £44,990, was the first electric car to top the continent’s sales charts, and in the same year it was also the first battery car to claim to be the world’s best-selling model.

However, there are few signs that Tesla can repeat this feat.

Registrations in Europe are down by more than a quarter (26 percent) compared to the first half of last year. So far in 2024, only 101,181 Model Ys have been purchased, dropping the brand to eighth place in the rankings.

The Tesla Model Y was the most-purchased new car in Europe last year, but has dropped to 8th position in the rankings in 2024.

According to Felipe Munoz, global analyst at Jato Dynamics, the decline in Tesla sales is due to three issues, including the rise of cheaper Chinese EV brands

In fourth place was the VW T-Roc (111,381), followed by the Peugeot 208 (107,097), Skoda Octavia (102,945) and Citroen C3 (102,304) in seventh. The Toyota Yaris Cross SUV (99,694) and Yaris supermini (99,576) completed the top 10.

Jato Dynamics, which collects sales figures from across Europe to compile regulatory reports, says Tesla is starting to show “signs of slowing” after years of sustained growth, with brand sales down 13 percent.

Global analyst Felipe Munoz said: “This is very similar to what we saw in the US and there are three reasons for this.

‘First, we know that no brand can sustain growth with a limited product line that starts to become outdated.

‘Secondly, increasing competition from other brands, such as BMW, will undoubtedly have an impact on registrations. And finally, Tesla’s price-cutting strategy will no longer have the same effect in 2023, as more and more Chinese manufacturers offer vehicles at competitive prices.’

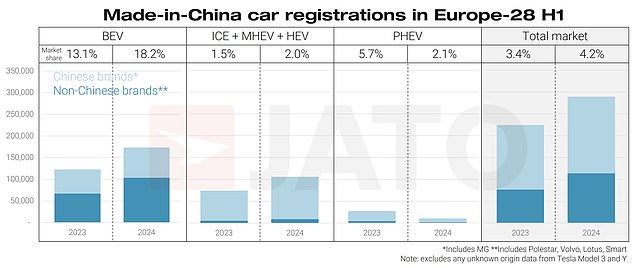

Chinese brands on the rise – but tariffs could thwart them

Sales figures show that Chinese car brands are becoming increasingly popular on the continent.

Geely Group, owner of Volvo, Polestar and Lotus, saw EV registrations rise 52 percent in the first half of 2024, outpacing Hyundai-Kia, Mercedes and Renault Group.

BYD also registered 17,000 electric cars, 14,000 more than in the first six months of 2023.

BYD’s rapid growth has seen it surpass Nissan, Smart, Toyota, Polestar, Citroën, Dacia, Ford, Mini, Porsche and Mazda. As a result, BYD is now the 16th best-selling EV brand in Europe – the second Chinese brand after MG, which ranked 8th in the electric car rankings.

Chinese brand BYD outsells Nissan, Ford, Mini and Porsche in electric vehicle market

Xpeng registered 2,214 electric cars, compared to just 51 in the first half of 2023, while Great Wall Motors doubled its sales volumes.

“The fierce domestic competition is the driving force behind the extraordinary progress seen in China,” Munoz explains.

‘However, the associated effects of market saturation, oversupply and a price war mean that for many, expanding abroad will be crucial to achieving their growth ambitions.’

Chinese carmakers are increasing their presence in European markets, especially in electric vehicles

The popularity of Chinese brands in Europe could also plummet if the huge new tariffs the EU imposed on them earlier this month remain in place.

The new additional duties on individual manufacturers range from 17.4 percent to 37.6 percent and come on top of the existing 10 percent duties already in place on all electric cars from China.

The move is expected to push up prices of cheap Chinese electric cars, especially MG models, as parent company SAIC is forced to pay the highest import duties, now approaching 50 percent.

And the decision could also lead to a price increase for Teslas and electric Minis.

The allowances are ‘provisional’, meaning they will be added up but will not have to be paid until after EU governments vote in November.

And the EU will only impose the tariffs if it is again established that the European car industry would have suffered material damage without the tariffs.

The move follows an eight-month EU investigation into China’s EV sector.

It showed that companies producing electric cars in China benefit from huge government subsidies, allowing them to undercut the prices of competitors in the EU.

This has unfairly helped Chinese brands gain market share, while putting European car companies and jobs on the continent at risk, the study concluded.

The EU is now the largest export destination for Chinese electric vehicles, accounting for 33 percent of the total in 2023, the European Commission said.

“The European Union’s measures to impose tariffs on BEV imports from China target models that accounted for 17 percent of BEV registrations in Europe in the first half of 2024, excluding potential units imported by Tesla,” Munoz said.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free. We do not write articles to promote products. We do not allow commercial relationships to influence our editorial independence.