Best current accounts for kids: is Monzo the perfect card for under 16s?

- Monzo has launched a free current account for children aged six to 15

- There is a waiting list to sign up. The account will be rolled out over the next few weeks.

- We look at what the account has to offer

Digital bank Monzo is the latest bank to offer debit cards for children.

The account is completely free for children aged six to fifteen.

Parents can now join a waiting list to sign their children up for the new account, which will be rolled out to customers in the coming weeks.

You must have a Monzo current account to be added to the waiting list.

Monzo has launched a new current account for children aged 6 to 15, which comes with a free debit card

At This is Money we support the freedom to still use physical cash, but we also know that in an increasingly digital world, primary and secondary school-aged children love using apps and want a card to make purchases.

It is often their first introduction to financial independence.

Monzo said the new account would give children the chance to experience financial milestones such as saving, budgeting, receiving pocket money or using a card to pay in a shop.

What does the new account offer?

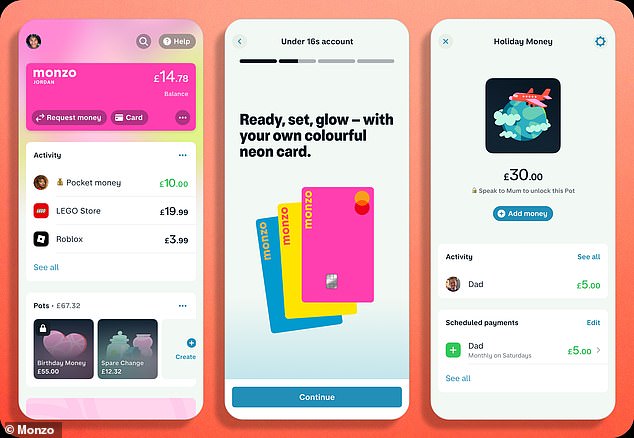

Monzo’s new account comes with a debit card for children aged six to 15. Kids can choose from a neon pink, yellow or blue card, which sets it apart from the coral red main account and current account.

The account has the usual Monzo features, such as savings pots, instant notifications and scheduled pocket money payments.

Kids can set savings goals, split money into pots, receive pocket money and personalise their Monzo app.

Monzo has fixed pots, which allow you to withdraw some of your money from your main account, and savings pots that earn interest.

The account is completely free and there are no registration, top-up or subscription fees. There are also no costs associated with spending abroad.

Parents link their child’s account to their own, so they must have a Monzo account to join the waiting list.

Parents can choose to receive notifications when their child spends money. Parents can also set spending limits and use customizable controls to enable or disable ATM withdrawals and online payments.

You will also find tips for safe saving, budgeting and spending online in the app.

Children can open a 16-17 account once they turn 16 and a full Monzo account once they turn 18.

The 16 and 17 year old current account has almost all the features of a regular current account, but Monzo blocks spending on things that are illegal if you’re under 18, such as gambling.

TS Anil, CEO of Monzo, said: “This is an important step in our mission to make money work for everyone. We’re welcoming a new generation who we’re excited to support from the start of their financial journey and for many years to come.”

> Five best free checking accounts for kids: see the overview of This is Money

Children can choose from a neon blue, yellow or pink card and can also use pots

SAVE MONEY, MAKE MONEY

Investment boost

Investment boost

5.09% on cash for Isa investors

Cash Isa at 5.17%

Cash Isa at 5.17%

Including 0.88% bonus for one year

Free stock offer

Free stock offer

No account fees and free stock trading

5.78% savings

5.78% savings

Invoice with a notice period of 365 days

Fiber optic broadband

Fiber optic broadband

£50 BT Rewards Card – £30.99 for 24 months

Affiliate links: If you purchase a product, This is Money may earn a commission. These deals are chosen by our editorial team because we think they are worth highlighting. This does not affect our editorial independence.