Asking prices for property are falling, says Rightmove, as home sellers price their homes lower to attract cautious buyers

According to Rightmove, asking prices for properties have fallen over the past month as new sellers attempted to attract buyers by pricing their homes lower.

The average price of a new home for sale fell by 0.4 per cent to £1,617.

This is a slightly larger drop than normal for this time of year, according to the property website. Asking prices in July have fallen an average of 0.2 percent over the past two decades, due to the quieter holiday season.

That means the average house on the market is now selling for £373,493, when they normally sell for less: the average sale price of a house is just over £288,000, according to the latest data from Halifax.

The average asking price is still 0.4 percent higher than a year ago.

Tempting: Rightmove says new sellers are trying to cut through the distractions of the general election, sporting events and the summer holidays with lower asking prices

Rightmove attributes the drop in new asking prices to homebuyers having more distractions than usual, including the 2024 European Football Championship and the general election.

According to the latest research from the Royal Institution of Chartered Surveyors, buyers are still hesitant about the first rate cut.

At the start of the year, the general consensus was that the base rate would be cut six or seven times this year, with the first cut taking place in March. This led many to hope that mortgage rates would also be lower.

But with persistent inflation rates, both here and in the US, there has been no talk of a cut in the base rate. Mortgage rates have actually risen, although banks have been cutting rates in recent weeks.

Markets are now predicting that the base rate will only be cut once or twice this year, with the first cut taking place in August or September.

Although rate cuts have been delayed, Tim Bannister, property expert at Rightmove, believes the political certainty of a new government will boost homeowner confidence in the second half of the year.

He said: ‘There were three big uncertainties in the housing market at the start of this year: when the first rate cut would happen and the timing and outcome of the general election.

‘We now have the political certainty of a new government with a large majority, and we expect that this will increase confidence among homeowners.’

Dip: Typical asking prices fell 0.4% last month, Rightmove says

He added: ‘It’s early days yet, but Labour’s announcements on housing targets and planning reform are positive signs that the government is keen to start delivering on its manifesto promises.

“There are many areas in the market that can be improved. We hope that the new government can implement its plans and implement a sustainable housing policy that will benefit the market in the medium to long term.”

Asking prices rise the most in Northern England

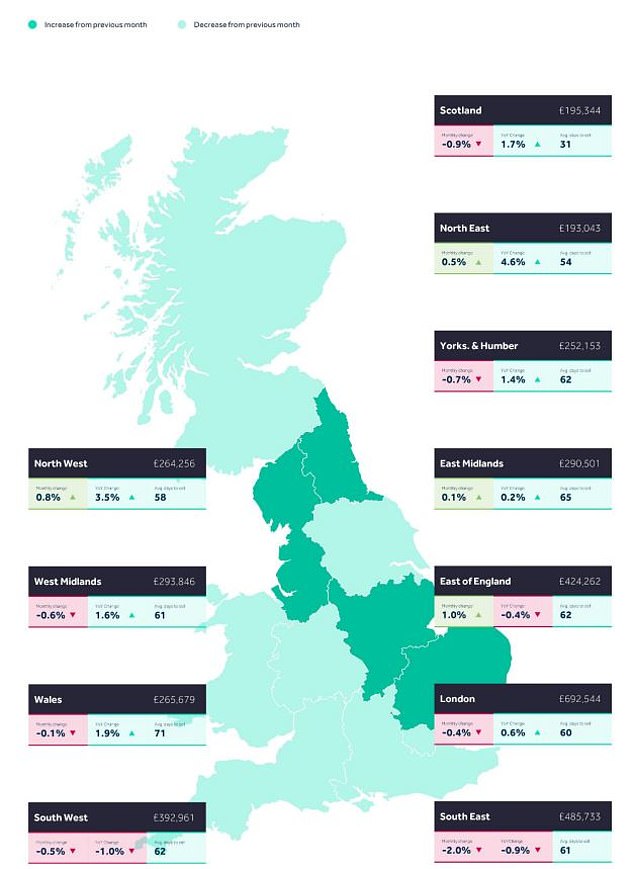

There is also a north-south division in terms of asking prices.

In the North West of England, the average asking price rose by 0.8 percent last month, an increase of 3.5 percent year-on-year.

In the North East of England, average asking prices for new homes rose by 0.5 percent this month, up 4.6 percent year-on-year.

However, in the south-east of England, average asking prices fell by 2 percent this month and in the south-west by 0.5 percent.

North-South divide: asking prices in the north of England are rising, while in the south they appear to be falling

Signs of an improving real estate market

The latest Rics survey painted a bleak picture for the market, with agents and valuers reporting that there were fewer buyer enquiries and fewer sales in June. However, Rightmove suggests the situation is slightly better.

The report shows that the number of products sold is now 15 percent higher than the same period a year ago, at a time when mortgage rates were at their peak.

The number of new sellers entering the market in the past four weeks is also up 3 percent from last year.

The average number of properties listed per agent has also risen steadily this year, with an average of 61 per office in June, compared to 49 at the start of the year.

However, fears of an oversupply of homes on the market are allayed by the fact that Rightmove’s data also suggests it is taking sellers less time to find a buyer.

According to the real estate website, the average time to find a buyer has dropped from 78 days to 59 days since the beginning of the year.

Rightmove also reports that the number of potential buyers contacting agents about homes for sale has remained stable over the past four weeks compared to the same period last year.

However, there has been a slight decline in first-time homebuyers, with some waiting for interest rate cuts to improve their affordability.

“These positive sales figures highlight that serious house hunters have not been deterred by the General Election and are continuing their search,” said Tim Bannister of Rightmove.

‘Many people looking to move home are very concerned about when the first Bank of England rate cut will come, and there are signs that some homebuyers are waiting for this before taking action.

‘A reduction in the base rate is expected to lead to lower mortgage rates. That could be a breakthrough for people who want to move and who are already faced with significantly higher monthly mortgage payments.’

Some brokers also seem to think that things can only get better from here.

Matt Nicol, director at Nicol & Co in Worcestershire, said: ‘With CPI inflation down to 2 per cent and potential base rate cuts on the horizon, the outlook remains optimistic.

‘The new government is focused on maintaining low taxes, inflation and mortgage rates, combined with plans to improve the planning system and enable much-needed housing construction. This was positive news, as the new Finance Minister stressed earlier this week. We hope this contributes to the positive outlook for a healthy autumn market and the future.’

However, Jeremy Leaf, a North London estate agent and former chairman of Rics Residential, does not think house prices will rise any time soon.

He said: ‘Over the past month, and especially since the election results, we have seen a recovery in confidence and activity.

“But we shouldn’t go too far, as increased choice and ongoing economic concerns will keep homeowners’ price increases in check.”

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free. We do not write articles to promote products. We do not allow commercial relationships to influence our editorial independence.