Property market flat as buyers and sellers ‘sit on the fence for first rate cut’, latest Rics research shows

According to appraisers and real estate agents, the housing market is in a slump.

Latest research from the Royal Institution of Chartered Surveyors (Rics) shows there are fewer buyers in the housing market, leading to fewer sales and falling house prices.

This closely monitored monthly survey takes the temperature of Rics members and provides a snapshot of what is really happening in the housing market across the country.

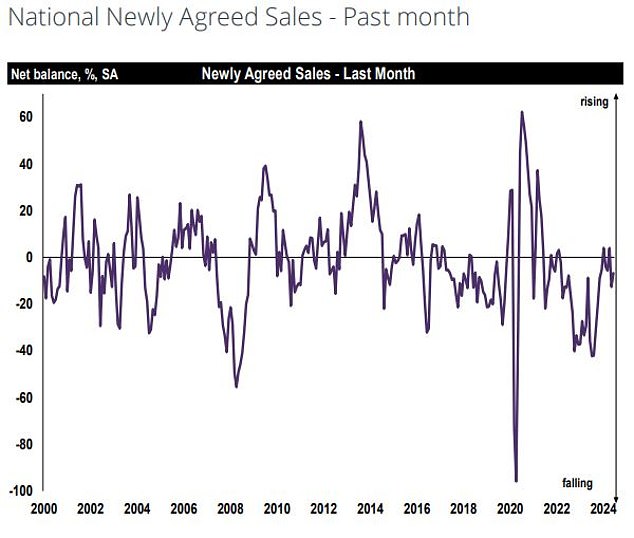

The survey found that a larger proportion of members, including real estate agents and appraisers, experienced fewer buyer inquiries and fewer sales in June.

> What is the future for mortgage rates?

Falling interest: More Rics members reported fewer buyer enquiries in June than reported an increase, according to the closely watched survey

The slowing demand from homebuyers marks the third straight month in which the number of buyer inquiries is reportedly declining.

Meanwhile, the flow of homes coming onto the market slowed in June, Rics members said.

More agents reported fewer homes for sale than agents who saw more sellers’ homes for sale.

This ends six consecutive positive monthly readings in which agents reported more sellers coming to market.

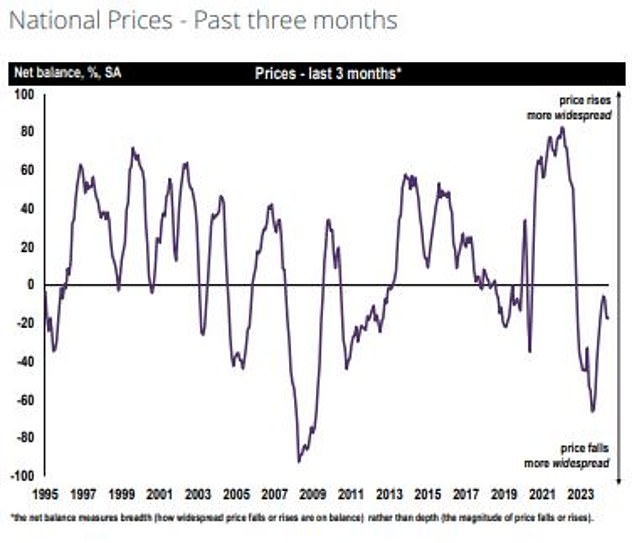

When it comes to house prices, more Rics members reported that house prices fell in June than those who reported that prices would rise.

The results of the survey differ depending on where in the country a Rics member lives.

East Anglia, the South East and South West of England all showed significantly negative house price figures in June.

> When will interest rates fall?

House prices falling: More Rics members still report house prices falling than those saying they are rising

Rob Swiney, member of the Rics in Bury St Edmunds, Suffolk, said: ‘(The market is) still flat and many people are still hesitating about the first rate cut.’

“The market is very difficult to understand at the moment as people are waiting for the general election results and would rather go on holiday than buy and sell a house,” said Christopher Clark, a Rics member in Eastleigh, Hampshire.

David Hickman, a Rics member in South Devon, paints a more dramatic picture: there are too many houses for sale and too few buyers.

He said: ‘There has been no spring rush. Properties are coming onto the market at prices lower than last year and quick discounts are needed to attract a buyer.

“Also long chains and long lead times. Redundancy contributes to delays and repossessions where higher fixed rates can’t be served. Too many new homes.”

Rics members say there were fewer sales in June in the run-up to the general election

In contrast, prices in Northern Ireland and Scotland continue to rise, according to Rics members.

Rics member Kirby O’Connor, based in Belfast, said: “The sales market remains strong. Prices are rising and there is demand.”

Craig Henderson, member of Rics in Ayrshire, Scotland, added: ‘The market remains largely the same through to 2024, with demand outstripping supply.

‘Homes are still coming onto the market slowly because many buyers are still waiting for what they want to buy before they come onto the market. I don’t see any reason why this will change anytime soon.’

Better times for the housing market?

Although Rics members report that sales figures are declining, they are more optimistic about the future than in previous months.

More and more members expect home sales volumes to recover over the next three months.

In fact, the June survey presented the most optimistic picture for near-term sales expectations since January 2022.

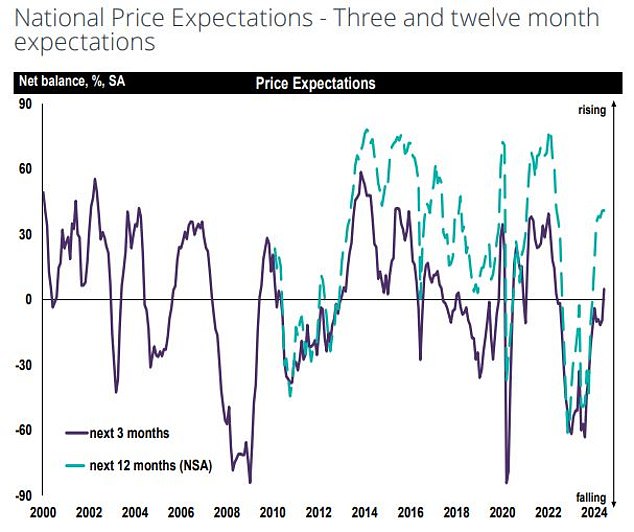

There is also more optimism about future house price growth.

Slightly more Rics members expect house prices to rise over the next three months than expect them to fall.

And the majority of Rics members expect house prices to rise over the next 12 months.

Tarrant Parsons, senior economist at Rics, believes the market could gain strength in the coming months.

“While housing market activity remained subdued last month, there has been a slight improvement in the outlook,” Parsons said.

‘There are now a number of factors that could support the recovery in the coming months.

‘If the Bank of England decides that the current inflation situation is favourable enough to ease monetary policy next month, this could lead to a further fall in lending rates.

‘Moreover, the recent elections have produced a clear outcome, with housing moving higher up the political agenda.’

Onwards and upwards: Rics members expect house prices to rise over next 12 months

As for Rics members, many agree with this view, even in the more southern parts of the country where house prices are falling the most.

Sean Steer, member of the Rics in Reigate, Surrey, said: ‘The coming fall in interest rates will lead to a rise in demand and prices in the coming months.’

Tony Jamieson, member of the Rics in Guildford, said: ‘It is a wait and see situation as both sellers and buyers await the outcome of the general election and the Bank of England’s interest rate cut.

“I believe the market will become more positive if both situations occur, as there is currently a high demand for relocation.”

Jeremy Leaf, a Rics member from Finchley, added: ‘The fact that mortgage costs remained high for longer proved more relevant to property decision-making than the election result.

“However, buyers and sellers have told us that they have hit the pause button, not the stop button. We therefore do not expect any major changes in prices or activity in the coming months.”

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free. We do not write articles to promote products. We do not allow commercial relationships to influence our editorial independence.