Temasek invests in cross-border venture in America, first in China in a decade

By David Ramli and Low De Wei

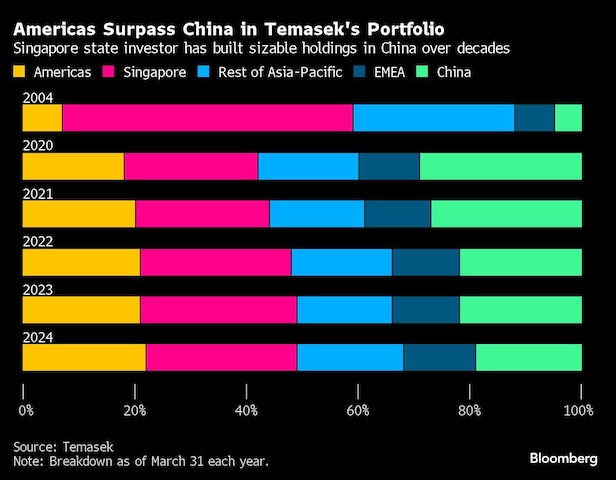

Temasek Holdings Pte.’s investments in China are now smaller than those in the Americas for the first time in at least a decade, underscoring continued caution among global asset managers about Asia’s largest economy.

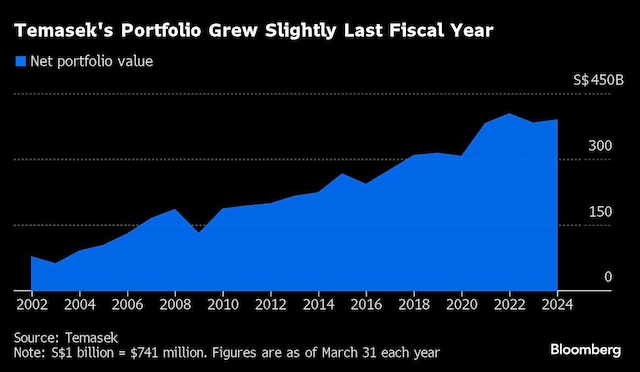

The Singaporean state-owned investor on Tuesday reported a modest total shareholder return of 1.6% for the year ended March 31. The firm said Chinese capital markets fell in value, offsetting better returns from the US and India.

The performance was an improvement on Temasek’s one-year return in fiscal 2023, which was down 5.07%. The company’s net portfolio value reached S$389 billion ($288 billion) in March, up from S$382 billion a year earlier.

Temasek has long been one of the largest institutional investors in China, accounting for 29% of its portfolio in 2020. But four years later, its stake in the world’s second-largest economy has fallen to just 19% of the firm’s portfolio in March, while investments in the Americas accounted for 22% of assets, behind Singapore at 27%.

The relatively modest fiscal 2024 revenue comes at a critical time for Singapore and Temasek, which celebrates its 50th anniversary this year. The investment firm’s proceeds, along with those from sovereign wealth fund GIC Pte and the Monetary Authority of Singapore, help form the second-largest source of funding for the national budget. Singapore’s ruling party is facing its first election in decades without a member of the Lee family as prime minister, and the next poll will be a major test of voter support for its policies and performance.

Temasek executives said the U.S. would remain the largest destination for the company’s capital and that it would maintain a cautious approach to China. It also plans to increase its bets on India, which accounted for 7% of its portfolio in March. In America, the company sees investment opportunities in artificial intelligence enablers and adopters, and companies that benefit from U.S. industrial policy.

“I see tensions between the US and China only increasing, not decreasing from here,” Chief Investment Officer Rohit Sipahimalani said in an interview with Bloomberg Television. He said China’s real estate market needs to stabilize before consumer confidence in the country can revive.

“It’s clearly something that the Chinese government is not unaware of. They’ve made statements to help do that — we haven’t seen the results yet,” Sipahimalani added.

Temasek said most of the change in its exposure to China was due to falling valuations rather than a retreat from the country. But it comes as global fund managers have reduced their exposure there amid heightened scrutiny from Washington DC and geopolitical tensions.

The main U.S. federal government pension fund said late last year it would exclude investments in Hong Kong, along with mainland China, from its $68 billion international fund. China fell to 19th place in the California State Teachers’ Retirement System’s ranking of land asset exposure in May last year.

More divestments

Temasek has stakes in many private and listed companies, including Singapore’s largest bank, port operator, airline and other government-related companies. It recorded net divestment of S$7 billion, the largest since fiscal 2009 during the global financial crisis.

The company made S$26 billion in investments in fiscal 2024 and received S$33 billion in divestments. The latter included about S$10 billion in capital repayments from Temasek subsidiaries Singapore Airlines Ltd. and Pavilion Energy Pte.

The national carrier redeemed convertible bonds it issued during the coronavirus pandemic, while the liquefied natural gas trader redeemed preferred shares it issued to Temasek to shore up its financing during fiscal 2022. Temasek said last month it would sell Pavilion to Shell Plc.

Temasek’s net investment pace has slowed since 2022, when Sipahimalani said it was taking a cautious view on deals amid rising interest rates and deteriorating geopolitical conditions.

The percentage of investments in unlisted assets fell slightly to 52%, with the company saying the net portfolio value would have been S$420 billion if such holdings had been valued on a mark-to-market basis. That compares with S$411 billion a year ago.

These unlisted assets include property manager Mapletree Investments Pte. and Singapore Power Ltd. Temasek’s overseas investments include China’s Ant Group Co. and positions in private equity and credit funds managed by KKR & Co., TPG Inc. and others.

Performance Indicators

While Temasek’s one-year total shareholder return lagged well behind stock market indices such as the S&P 500 and Nikkei 225, which rose 28% and 44% respectively in the company’s 2024 fiscal year, it outpaced the Hang Seng and Straits Times indices.

Chia Song Hwee, deputy CEO of Temasek International, defended the portfolio’s performance over longer periods, saying the key was that it could deliver stable long-term returns in a resilient manner.

“We don’t look at annual performance — we look at 10 and 20 years as an indication of how we’re doing,” Chia said. “Our portfolio construction is not comparable to the index or the Canadian pension funds or GIC anywhere.”

However, he acknowledged that employees at the state investment firm were not benefiting from the huge payouts seen by some of its portfolio companies, while Temasek’s total shareholder return over the past 20 years was 7%, the lowest level in four years.

“I can say with certainty that the total compensation has decreased year over year,” Chia said.

Temasek posted a net group profit – including profits from its operating subsidiaries – of S$5.4 billion, compared with a loss of S$7.3 billion in the previous period.

Weakness of China

Temasek has been a China believer for decades. One of its first overseas offices opened in Beijing in 2004, just as Ho Ching, the wife of former Singapore Prime Minister Lee Hsien Loong, became CEO of the state investment company. A Shanghai office opened shortly after, in 2005.

Shares in traditional companies such as Bank of China Ltd. were eventually followed by investments in internet giants Alibaba Group Holding Ltd. and Meituan as the economy boomed. Temasek’s real estate subsidiaries also built shopping malls and hotels in major cities, all of which boosted returns.

But the economic turmoil caused by Covid-19, coupled with a crackdown on the technology, housing and education sectors, has dented consumer confidence and hit investors hard. In the year to 31 March, China’s CSI 300 index fell 13%, while Hong Kong’s Hang Seng index fell 19%.

Although the company made a number of divestments in the country last fiscal year, Temasek International Chief Financial Officer Png Chin Yee said the decline in assets was driven by market downturns.

“At the same time, we continue to invest in new areas that we believe will benefit from the structural shift underway in China,” she added.

Sectors that Temasek executives identified as part of a “new phase” of Chinese deals included electric vehicle makers and biotech companies. Among the companies Temasek is investing in those markets, electric vehicle maker BYD Co. is facing the prospect of sectoral tariffs around the world, while WuXi Biologics Cayman Inc. and sister company WuXi AppTec Co. have seen their shares tumble on potential U.S. restrictions.

However, they said the investments would be targeted at specific companies and projects in sectors that are relatively safe from geopolitical influence, such as companies involved in drug discovery.

“We are not exiting China and we are not advising our portfolio companies to exit China,” Chia said.