How loan sharks’ own profits are used to prevent the next generation from falling into debt

At Ormiston Bolingbroke Academy in Runcorn, Cheshire, a class of year seven students are using AI software at school.

That’s not normal practice, but they’re not in a normal class.

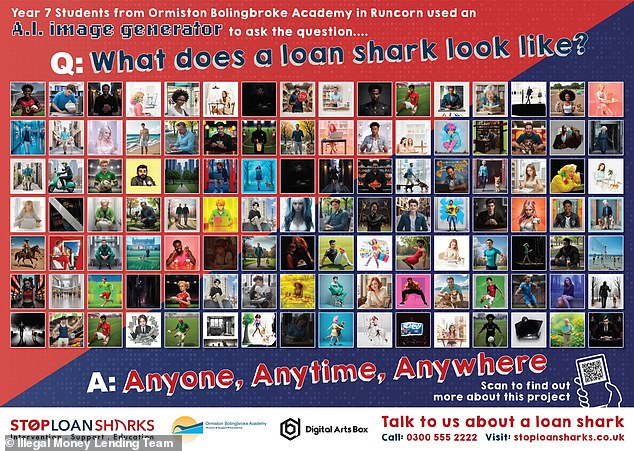

The students use the software to generate images of what a loan shark might look like, as part of a ‘lessons for life’ curriculum, which aims to prepare them for when they leave school.

Part of this includes understanding how to manage their finances, and highlighting the risks of illegal lending – something their teacher says is a problem in the region.

Lessons for life: Teacher Liam Hussey hopes to help his students manage their finances safely in the future

What they will hopefully learn from the current AI task is that there are no hard and fast rules regarding the physical appearance of an illicit lender.

“A loan shark could be someone older, it could be someone younger, it could be someone from your local community, or it could be someone who might come across as a professional,” said Liam Hussey, head of PSHE at the school.

“They get a life lesson that may not be entirely impactful for them right now. But later in life they will start to manage their own money and under certain circumstances they may need to borrow money.

“Our local security data tells us that we serve an underserved area, and we know that illegal moneylending is taking place in our area. I bet some of our (student) families have engaged in loan sharking and are currently engaging in loan sharking.”

These types of classes seek to raise awareness about illegal lenders and the risks associated with borrowing, to prevent students from getting into debt later in life, and to give children practical knowledge on how to manage their finances.

The students’ AI-generated images have now been merged into a poster to be displayed in the school, raising awareness among other students and parents, with a QR code taking them to the Stop Loan Sharks website.

Resources for the session were funded by the UK Illegal Money Lending Team, a government agency that aims to prevent profiteering using money seized from illegal lenders. An outside company, Digital Arts Box, runs the class.

Poster: The children used AI to generate images of a loan shark, showing that it can appear in many different ways – and then created this poster for their school

“They’re actually getting paid to use the proceeds of crime from convicted loan sharks, which I like because they’re loan sharks paying to train future generations not to use loan sharks,” Cath Wohlers, the operations manager of IMLT, to This is Money.

For Hussey and other teachers looking to engage students in similar life skills curricula, the IMLT-funded resources provide an opportunity to get expert input.

Hussey said: ‘When the geography teacher gets up and talks about loan sharks, or when a history teacher talks about drug abuse, in many cases it can be an abstract concept. By bringing in that external expertise, you can deliver a consistent, clear message.’

‘I think the fact that this was practical and creative made the students more engaged… and therefore they will remember more of it.’

The IMLT offers schools a wide range of resources, both in the form of free downloadable materials and funded programs such as Ormiston’s.

For primary school-age children, the IMLT highlights topics at a basic level, including ‘the difference between needing something and wanting something’. What is money? Where does money come from?’ said Wohlers.

“It’s amazing when you go to primary school and ask seven- and eight-year-olds where the money comes from, and they say things like, ‘Oh, go get it out of that hole in the wall.’

Nevertheless, Wohlers believes that in most cases children are attentive, even if they don’t understand exactly what is going on.

“We’ve had kids tell us to hide behind the couch on Thursday nights because the money man was calling,” she said.

“Years ago we got a letter from a child who had clearly seen a police drama because she gave us the loan shark’s license plate number and said, ‘My mother cries when he comes by.’

However, in some ways this can be a danger.

“One risk is that it now has an impact on their mental health and well-being,” Wohlers said. “And the other thing is that it normalizes it for them in the future, so they think that’s how you borrow money.”

For older age groups, the resources are now being used for a tougher approach, aimed at drawing attention to the dangers of illegal lending.

“We have a victim video of a man who was 17 when he first borrowed from a loan shark and ended up paying back £90,000 on a £250 loan over 17 years,” Wohlers said.

An extreme example, Wohlers admits, but the age of the victim affects students at a similar stage of their lives.

“Years ago there was a loan shark in Sheffield who gave loans to a 14-year-old, using their PlayStation as collateral for the loan,” she said.

Let alone loans to schoolchildren, Wohlers said the IMLT has previously dealt with a loan shark who sent his children to the schoolyard to find out which children did not have new football boots that year or had not been on holiday, in order to get their target parents with loan offers.

“I don’t think you’re ever too young to understand,” Wohlers said. “When you’re a kid, it’s scarier when you don’t know what your parents are dealing with, but you’re just aware of this feeling. of fear and this this shadowy figure.

“If you can put a name to it, that almost helps.”

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.