Average 401(K) balance revealed, as experts share % of salary you should be saving if you want to achieve a million-dollar balance – and the simple tricks that can help reach that goal

The average American’s 401(K) balance has been revealed – with experts also sharing the secrets to stashing away a million dollars in retirement savings.

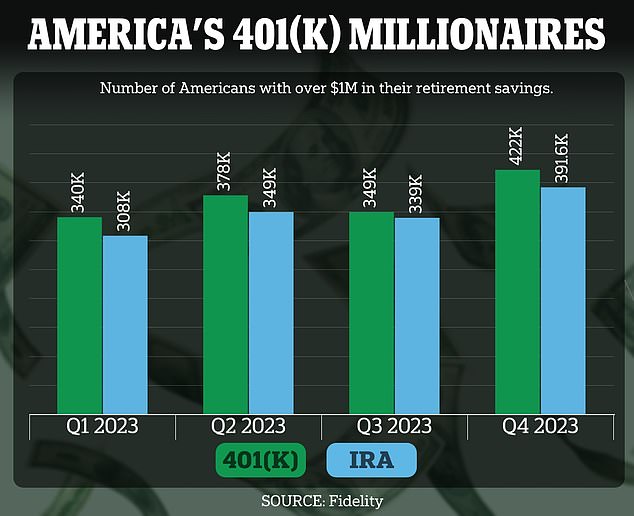

Newly released data from Fidelity Investments shows that the number of 401(K) millionaires rose to an all-time high in the first quarter of 2024.

Fidelity revealed that 485,000 people had $1 million or more in their accounts – a 43 percent increase from three months earlier.

The average 401(K) balance was $125,900, which was a six percent improvement from the previous quarter. The current balance has increased 16 percent compared to a year ago.

Thefinancefam, a popular TikToker who gives financial advice, said you should “absolutely” contribute more than one percent to your 401(K) every year. 401(K) millionaires have an average contribution rate of 17 percent

Newly released data from Fidelity Investments shows that the number of 401(K) millionaires rose to an all-time high in the first quarter of 2024. Fidelity revealed that 485,000 people had $1 million or more in their accounts – a 43 percent increase from three months earlier

Yet only about 2 percent of people with accounts enjoy “401(K) millionaire” status.

Experts have taken lessons from this small group’s success and distilled their wisdom into a series of steps.

First, 401(K) millionaires are not impulsive investors. They are patient and understand that expanding your portfolio is a long-term endeavor.

On average, 401(K) millionaires invest in their plans for 26 years with an average balance of $1.58 million. As your salary increases, it’s critical to put as much of it into your plan as possible.

Another key to their success is that 401(K) millionaires have an average contribution rate of 17 percent.

A combination of favorable market conditions and record contributions have pushed average account balances to the highest level since the fourth quarter of 2021, according to Fidelity.

On average, 401(K) millionaires invest in their plans for 26 years with an average balance of $1. 58 million

During the last quarter, overall average 401(K) savings increased to 14.2 percent – the result of high employee and employer contributions.

Thefinancefam, a popular TikToker who provides financial advice, agreed that it was important to contribute a large portion of your income.

While a one percent contribution is “great,” the financial fam said it’s “not really taking a completely aggressive approach to investing for retirement.”

“You definitely need to put in more than one percent a year,” she continued.

401(K) millionaires are also quick to take advantage of company match plans. According to Fidelity, 81 percent of employees with a 401(K) or 403b benefited from an employer contribution last year.

These contributions came either from a corporate matching plan or a profit sharing system.

The most favored type of match is a dollar-for-dollar match for the first three percent, which then becomes 50 cents on the dollar for the next two percent.

To join the 401(K) millionaires club, you must also demonstrate a high degree of equanimity.

401(K) millionaires aren’t afraid of market volatility. Instead, they view bear markets as periods when they can buy stocks and shares at lower prices.

Perhaps the most indispensable step of all, however, is the one that’s hardest to follow: 401(K) millionaires aren’t touching the money in their retirement accounts.

If you want to increase your balance, it is imperative that you stay strong in the face of temptation.

If you’re under financial pressure, you can easily tap your retirement account for help.

If you are under 59 and 1/2, this will result in you paying a 10 percent withdrawal fee, which could hurt your savings.

Weathering the storm, 401(K) millionaires leave their money untouched, allowing it to grow.

Caroline Eby told DailyMail.com that she is on the verge of becoming a 401(K) millionaire, despite never making more than $80,000 in her life.

The Washington, DC-based finance worker said, “I started saving at age 25, when I was making $22,000 a year in manufacturing.

Caroline Eby told DailyMail.com she’s on the verge of becoming a 401(K) millionaire, despite never making more than $80,000 in her life

‘Every year I increased my contribution by 2 percent if I could afford it. I have maximized my contribution at about 12 percent.”

She added: “I have never married and have always been completely self-sufficient. I am so happy and proud of myself for the sacrifices I made 30 years ago.

Eby had $990,000 in her account two years ago, but then lost $100,000, something she blamed on the broader economy. Now her account is “on its way back up,” she said.

“Like everyone told me, slow and steady wins the race.”