House prices rose in May, Nationwide says, as wage growth and falling inflation boost buyers

According to the latest figures from Nationwide, house prices rose between April and May.

According to the construction company, wage growth and falling inflation helped offset the impact of higher mortgage rates on buyers.

According to Nationwide, the average British home increased in value by 0.4 percent in May, following a decline of 0.4 percent in April, taking into account seasonal effects.

Nationwide uses seasonal adjustments to smooth out months that tend to be more and less active in the housing market. Without that adjustment, the increase would have been 0.9 percent.

Back in the elevator? House prices rose by 0.4% in May, taking seasonal influences into account. This resulted in a slight increase in the annual growth rate of house prices to 1.3%

In real terms, the average house price rose from £261,962 in April to £264,249 in May, and year-on-year Nationwide said house prices rose by 1.3 per cent.

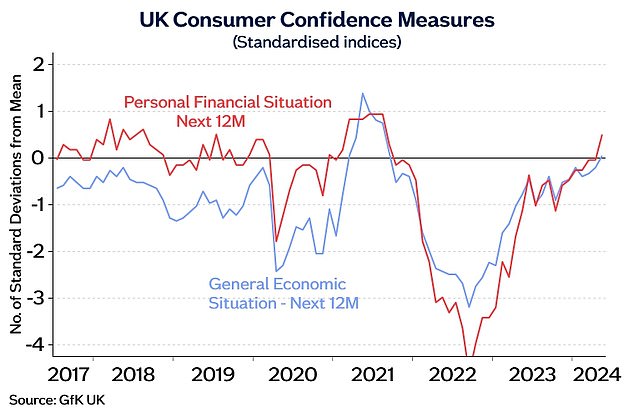

Robert Gardner, chief economist at Nationwide, said: ‘The market appears to be showing signs of resilience in the face of continued affordability pressures from the rise in longer-term interest rates in recent months.

‘Consumer confidence has improved noticeably in recent months, supported by solid wage growth and lower inflation.

Will house prices continue to rise?

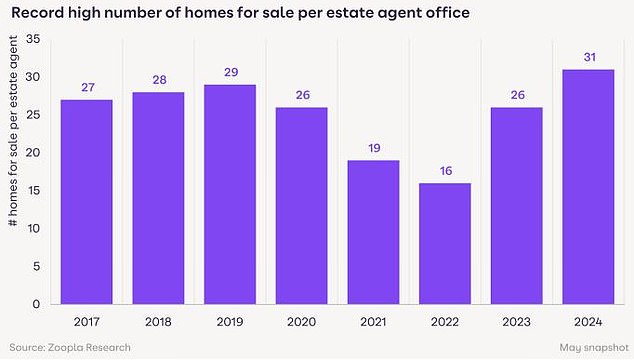

Yesterday Zoopla reported that the number of homes on the market had reached its highest level in eight years.

According to the real estate portal, the average real estate agent has 31 homes for sale, an increase of 20 percent compared to this time last year.

In terms of value, Zoopla says there is £230 billion worth of homes for sale, which is 25 percent more than a year ago.

The average agent has 31 homes for sale, the highest level in eight years, says Zoopla

It is thought that greater choice for home buyers will prevent house prices from rising further this year.

Richard Donnell, executive director of research at Zoopla said: ‘The growth in available supply is welcome news, after several years where supply shortages limited sales volumes and pushed up house prices.

“We expect this expansion of supply to keep house price inflation in check through the remainder of 2024.”

Will the elections have consequences for the housing market?

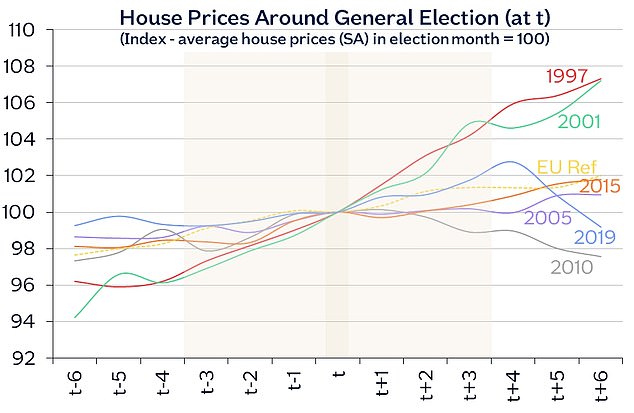

The recent announcement that the UK parliamentary elections will take place on July 4 has left many wondering what impact, if any, this will have on the housing market.

Nationwide says the recent general election has not resulted in a significant change in house price trends.

Overall, the report says that prevailing trends have continued just before, during and after the UK general election.

No election change in house price developments: nationally compared house price movements in the six months prior to each election (t-6 to t-1) and after each vote (t+1 to t+6)

Anthony Codling, head of the European housing division at investment bank RBC Capital Markets, said: House prices rose in May, confirming that house prices in Britain remain firm despite economic uncertainty.

‘It is too early to say whether the election will have an impact on house prices, but Nationwide agrees with our view that a general election does not appear to have an impact on house prices.

‘Life goes on outside the ballet box, and it seems that life in our own homes is more important than life in 10 Downing Street.’

Many in the property sector predict that cuts to the Bank of England’s base rate, when they come, will have a bigger impact on the housing market than the general election.

Verona Frankish, managing director of online estate agent Yopa said: ‘Despite a prolonged period of higher interest rates, we have not yet seen a significant fall in property values and it appears the tide has now well and truly turned, as the market begins to pick up momentum to be built following a revival in market activity so far this year.

“The possibility of a base rate cut in the coming months will only help to boost current sentiment and we expect the market will not be deterred by the political noise arising from the impending elections.”

Nationwide’s chief economist says confidence has improved noticeably in recent months, supported by solid wage growth and lower inflation

Nicky Stevenson, managing director of national estates group Fine & Country, added: ‘Previously hesitant homebuyers are feeling more confident about pulling the trigger on moving plans as financial tensions ease.

“With inflation moving closer to the government’s 2 percent target and potential rate cuts this summer, demand could rise further in 2024.

‘This will help stabilize or even push prices higher amid buyer competition – a positive development for sellers.

‘Lenders are also lowering interest rates in response to more favorable circumstances, making home ownership more feasible, especially for first-time buyers who were previously deterred by high monthly costs or excessively long mortgage terms.

‘If current trends continue, the UK housing market could see a steady recovery, with prices rising moderately in popular areas and warm markets.’

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.