How much have home prices in YOUR neighborhood increased since the eve of the financial crash in 2007?

We often get the impression that house prices will always rise in the long term. That it is one of the safest and healthiest investments you can make.

Over the past 50 years, the average British house price has risen from £8,915 in 1974 to £280,660 today, based on the latest Land Registry figures. This means an average increase of more than 3,048 percent.

If history were to repeat itself and house prices rose at the same rate over the next fifty years, it would mean that the average house in Britain would cost almost £9 million by 2074.

Given past performance, it’s easy to understand why many people believe that you really can’t go too far wrong when buying or investing in real estate.

The property market includes thousands of local markets that all behave differently from each other: pictured – Sunderland, Manchester, Bristol and Hackney (London)

But looking ahead, it is difficult to imagine a similar scenario playing out in the next fifty years. House price growth is slowing and forecasts remain tepid.

Estate agent Savills predicted last week that average prices will rise by 21.6 percent by the end of 2028.

And the reality is that while average home prices have continued to rise every decade, a lot depends on where and when someone bought something.

Many people who have bought property in London postcodes over the last seven or eight years may have seen the value of their home fall.

According to figures from the Land Registry, the average price of a home in central London has not changed since 2016. Some local governments have seen prices drop by as much as 20 percent.

Then there are those who bought the capital in the wake of the financial crisis. Many will have seen their homes double in value in some cases.

The average home in inner London has risen from a low of £291,000 in 2009 to a high of £578,000 in 2016.

What if you bought something when prices peaked in 2007?

No matter where you buy property in the country, everyone is worried that they will end up buying just before house prices collapse.

The last major house price crash occurred in 2007/2008, with prices falling by almost 20 percent.

While many local areas have since recovered, there are locations where prices remain low.

For example, according to Zoopla data, the average house in Belfast remains 21 percent lower than in 2007, while prices in Aberdeen are 18 percent lower, even though the latter is strongly linked to the oil and gas market.

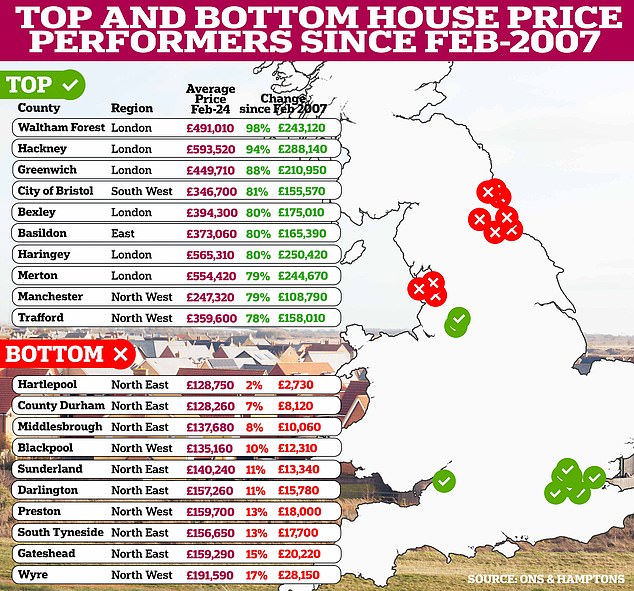

Thanks to Hamptons’ analysis of ONS data, shared exclusively with This is Money, we are able to reveal the areas in England and Wales where house prices have risen the most since their 2007 peak and where prices have performed the worst.

Although every local authority in England and Wales has seen average prices rise since the market’s previous peak in 2007, the gap between the best and worst performers is stark.

Waltham Forest, the best performing company, has seen almost 50x more price growth in percentage terms than the worst performing Hartlepool, with average prices increasing by 98 per cent and just 2 per cent respectively since 2007.

Buying at the peak: for many homeowners it would have taken years for their home to increase in value after the 2007/2008 crisis

Six local authorities in London are among the top 10 areas where prices have risen the most since 2007.

For example, Hackney has seen prices rise by 94 percent since 2007 and Greenwich has risen by 88 percent.

Outside London, the city of Bristol remains well ahead of the 2007 house price peak, with prices there rising by 81 percent.

Timothy Wood, assistant branch manager of Bristol estate agents Chappell and Matthews, said: ‘Like many other places, property values in Bristol have grown exponentially during the pandemic.

‘However, unlike other cities in Britain, values here have remained and remain strong with high demand.

‘In addition, the city has seen large numbers of buyers moving from London; Bristol City is well connected and Paddington is easily accessible via the mainline railway.

‘Other reasons why Bristol remains an incredibly attractive proposition for buyers are its rich history, culture and reputation for arts and theater and a truly diverse, multicultural population.

‘As well as the vibrant city centre, Bristol also has many surrounding rural or semi-rural satellite villages where you can seek a quieter lifestyle without being too isolated. It really offers something for everyone.’

Bristol: The city has seen large numbers of buyers moving from London

Further north, Manchester and Trafford saw prices rise by 79 percent and 78 percent respectively since the 2007 peak.

Nick Stanton, area support manager for Bridgfords estate agents in Manchester said: ‘Greater Manchester has some of the most desirable suburbs in the North West, excellent schools, a major international airport and fantastic transport links to one of Britain’s most exciting and sought-after cities . .

‘Manchester has everything to attract people from all over Britain to live permanently or rent in one of the many new and stylish urban buildings that have changed the skyline forever.

‘For investors, rental demand is huge and the number of residents in the city center is expected to increase by 200,000 in the coming years, making it a truly viable alternative to London and property prices have risen accordingly.’

Manchester: stylish urban buildings that changed the skyline forever

All but one of the worst performing local authorities since 2007 are in the North East of England.

House prices in County Durham have risen just 7 per cent since the 2007 peak, equating to just £8,120 in house price growth.

Prices in Middlesbrough have also risen just 8 per cent since the 2007 peak, equating to just over £10,000 in nominal growth.

This means in real terms – taking inflation into account – that many of the worst performing companies have seen quite significant price declines, according to Hamptons analysis

Given that £1 in 2007 buys the same as £1.63 today, according to the Bank of England’s inflation calculator, all areas that have not seen a rise in property prices of more than 63 per cent since 2007 will have since have technically fallen in real terms. – this accounts for around two-thirds of all local authorities, according to Hamptons.

Aneisha Beveridge, head of research at Hamptons, said: ‘The top ten performers over the past seventeen years have a few key similarities: they are mainly based in the city, have been benefactors of regeneration efforts, and in terms of price they are often in the middle in their regional markets.

‘As these areas tend to be more affordable towns, with good transport links, they tend to attract first-time buyers who have made up a rising share of all buyers over the past decade.

‘Conversely, those at the bottom of the list tend to be cheaper locations, all with average prices under £200,000, and all located in the north of England, where prices have yet to catch up with the south.

‘But because they are more suburban areas, with relatively limited connections to major cities, their attractiveness to buyers is more limited to locals, making their price performance dependent on the local economy.’

Where might future price growth be concentrated?

You might think that some areas where prices haven’t risen might catch up in the future, especially if they look cheap.

Peter Aves, senior branch manager at Manners & Harrison estate agents in Hartlepool, an area where prices have risen just 2 per cent since the 2007 peak, thinks there is a lot to do for the seaside resort despite the recovery taking so long.

He says: ‘After the 2007 peak, prices around Hartlepool fell and then remained stable for a number of years due to an oversupply of available properties for sale.

‘Then, post-Covid, the market became extremely busy and increased demand started to push prices up again.

‘We have always had a very active market here and the area is particularly popular with families and investors due to its good affordability and the high returns that landlords can achieve.’

Is your neighborhood becoming cool? Sam Mitchell says house prices can rise quickly in locations where artists move. They make it cool and the rest follows

According to Sam Mitchell, managing director of Purplebricks, prices in the worst-performing areas will only increase as these areas become places where people want to move.

“Some of the slower growth areas are concentrated around cities in the Northeast,” Mitchell says.

“Buyers, especially first-time buyers, are always looking for value and it’s clear there is significant value to be had in some fantastic northern cities.

“Ultimately, the really rapid price growth in these areas will be driven by one of two phenomena: infrastructure will come in to revitalize these often neglected communities, or artists will move there and make it cool. Both feel a challenge for some of these areas at the moment.”

Mitchell added: ‘Despite the work-from-home boom, cities like London are still a big draw, both nationally and internationally. With cycling routes and improved transport infrastructure, we see that people are choosing to live in the outlying areas of the capital.

‘This is partly due to the fact that it is now too expensive for most first-time buyers to live in central London.

‘It’s positive to see that Manchester and Bristol score highly – a reflection of the growing concentration of young, affluent families drawn to the cities for their great social infrastructure.’

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.