Global investors are selling Unilever India shares as sales growth falters

Hindustan Uniliver, HUL (Photo: Bloomberg)

By Alex Gabriel Simon

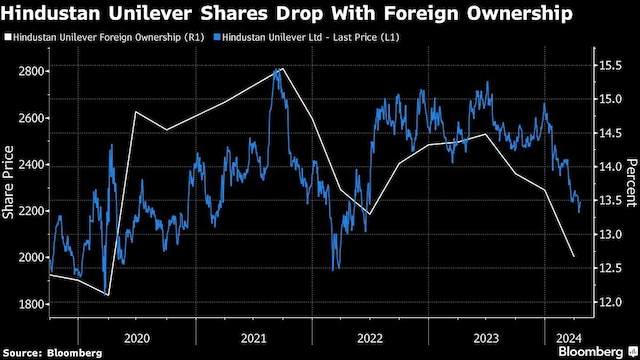

Global investors have their holdings in Hindustan Unilever Ltd. fell to the lowest level in four years as the company struggles with weak consumer demand and increasing competition.

Foreign funds cut their stake in India’s largest commodities company to 12.7 percent at the end of March, compared with 14.5 percent in June last year, data compiled by Bloomberg showed. The company’s shares have fallen more than 9 percent in the past 12 months, the second-worst performance in the NSE Nifty 50 Index.

Investors have sold Hindustan Unilever and its peer consumer giants as they find it difficult to justify the companies’ expensive valuations amid faltering sales growth. The company has faced competition from new brands, while lower agricultural yields have sapped demand among its rural customer base.

“Foreign investors will look at the parent company trading at less than half the valuation multiple,” said Abhay Agarwal, fund manager at Piper Serica Advisors Pvt. in Mumbai. Sales growth has slowed significantly and the shares’ “three-year sideways move during a bull market has created some caution,” he said.

As foreign funds have sold off, the proportion of Hindustan Unilever shares held by domestic investors has risen to a record 13.2 percent, data compiled by Bloomberg showed. Parent company Unilever Plc and other members of the group own just over 60 percent, while private investors own about 12 percent.

Local investors should buy the company given its size and weighting in the benchmark index, Piper Serica’s Agarwal said.

Still, the fall in Hindustan Unilever shares this year has helped improve its share price figures. The stock currently trades at 46 times forward earnings, which is lower than the five-year average of about 54 times.

“Consumer stocks that focus on the rural economy could see positive momentum,” said Souvik Saha, investment strategist at DSP Asset Managers Pvt. in Mumbai. Commentary from some consumer companies suggests the worst may be over and some important subsidies for rural areas will continue, he said.

Hindustan Unilever is expected to report net profit of 24.7 billion rupees ($296 million) for the three months through March, down 0.9 percent from a year earlier, according to the average analyst estimate compiled by Bloomberg were surveyed before Bloomberg announced the results on Wednesday.

First print: April 24, 2024 | 8:19 am IST