CT GLOBAL MANAGED PORTFOLIO TRUST: Smart spin that keeps investors happy with income – and growth

Investment trust CT Managed Portfolio is a rather peculiar fund that may put off some investors. Still, its eclectic structure has advantages – and should appeal to those who have focused goals or who want to change the focus of their investments as they get older.

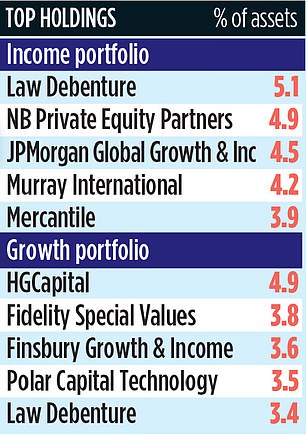

Managed by Peter Hewitt since its launch 18 years ago, the trust offers investors two portfolios: one income-oriented and the other growth-driven. Both are invested in other investment trusts and are separately listed on the London Stock Exchange.

The income shares are therefore 35 strong and have a combined market value of £56 million. The share price is £1.11.

The 40 growth companies have a total market value of £86m and the shares trade at a price of around £2.42.

Only three companies – Law Debenture, Lowland and TR Property – are retained in both portfolios.

The smart thing is that all income generated by the growth portfolio is transferred to the income account of the income portfolio, increasing the dividend prospects for income shareholders. The quid pro quo is that an equivalent amount of capital is paid to growth investors, improving their capital returns.

The final part of the puzzle is that shareholders can transfer their shares from the growth to the income portfolio (or vice versa) once a year (October) without potentially being liable for capital gains. This is an attractive arrangement given the government’s cuts to the annual profits that investors can realize without having to pay tax. On April 6, the start of the new tax year, this will drop from £6,000 to £3,000.

For income stock investors, strong dividend payments have offset the portfolio’s indifferent capital performance. Over the past twelve years, the dividends they have received have risen sharply – and there is every chance that 12 will become 13 when the final dividend payment is announced in June.

Three payments of 1.8p per share have been made so far this financial year – ahead of the 1.67p paid last year. “I would be surprised if the board didn’t approve a final dividend for the year, which meant we had another year of dividend growth,” says Hewitt. The trust is one of 32 trusts that the Association of Investment Companies has labeled as ‘next generation’ dividend heroes – with between 10 and 19 years of annual income growth.

Overall, growth investors have outperformed over the past five years, with returns exceeding 20 percent. Income investors have received a total return of just under 10 percent. Hewitt says three investment themes dominate the way he manages the fund.

Firstly, the two portfolios have significant exposure to UK equity investment trusts as they are ‘dirt cheap’ and can rise if interest rates start to fall.

Secondly, he likes trusts that invest in private equity.

Finally, a key driver of the growth portfolio is investing in key secular investment trends such as healthcare and technology. Hewitt says some of these holdings, such as Allianz Technology, JPMorgan American and Polar Capital Technology, have been major portfolio components even before 2010, with returns at least six times their original value.

The trust is part of global investment house Columbia Threadneedle and Hewitt runs it from offices in Edinburgh. The income and growth portfolios have respective stock market identifiers B2PP3J3 and B2PP252 and the market tickers are CMPI and CMPG. The respective annual fees, excluding the fees charged by the underlying investment funds, are 1.2 and 1.1 percent.