Santander, NatWest and Halifax are all increasing their mortgage rates

Several of Britain’s biggest mortgage lenders have announced plans to increase their rates this week as home loan rates continue to rise.

Santander, NatWest, the Co-op Bank and Principality Building Society have all announced they will increase rates.

Most prominent is Santander, which currently offers the cheapest two-year fix (4.53 percent) and the second cheapest five-year fix (4.17 percent) on the market.

It said some of its fixed rates for customers buying and refinancing will rise by between 0.06 and 0.43 percentage points from tomorrow.

Bad news: Lenders have been quick to reprice their mortgages this week

The bank’s free two-year fixed rate deal for those who buy with a 40 percent deposit will increase from 4.77 percent to 4.92 percent.

For a mortgage of €200,000 to be repaid over 25 years, this would mean the difference between €1,143 and €1,160 per month.

This marks a significant shift from the sub-4 percent rates Santander offered almost three weeks ago.

Santander also said all rates for residential trackers would increase by 0.06 to 0.43 percentage points.

The rest of the rate increases, as well as a small number of rate reductions, will be announced tomorrow.

Some of the deals aimed at people with smaller deposits or share levels will be scrapped.

Santander is also cutting all its fixed buy-to-let rates by between 0.09 and 0.23 percentage points, which will be a boost for landlords.

Meanwhile, NatWest is increasing rates for existing customers looking to switch to a new NatWest mortgage. The increases apply to both homeowners and landlords.

Halifax also announced today that some of its fixed rates will increase by up to 0.2 percentage points starting Wednesday.

The Cooperative Bank for Intermediaries also announced a series of interest rate changes, including an increase in product switching mortgages by up to 0.72 percentage points.

Buy-to-rent solutions also increase by up to 1.09 percentage points.

Speaking to news agency Newspage, Justin Moy, director of EHF Mortgages, said: ‘More disappointment in the mortgage market as some major lenders increase rates this week.

‘This is a bitter blow for borrowers, especially as we quickly move into the most important time of year for property buying and selling.

“Rates must come down, and quickly, to save both the economy and the real estate market.”

When could mortgage rates fall?

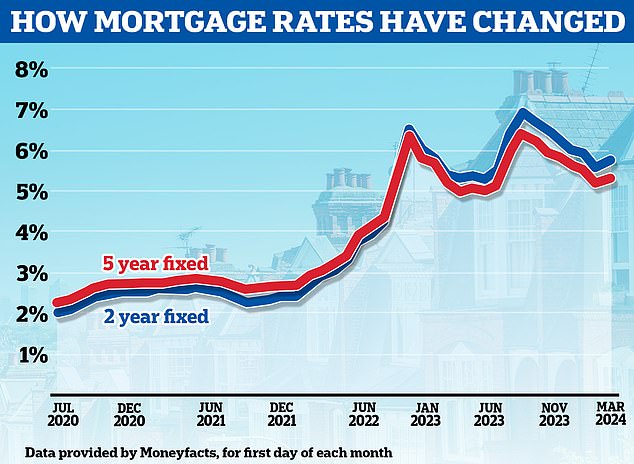

The changes announced today continue the upward trend in mortgage rates since early February.

Just a month ago, the lowest five-year interest rates were below 4 percent and the lowest two-year interest rates were just above 4 percent.

Interest rates have risen again due to a change in market expectations for the Bank of England’s base rate, which currently stands at 5.25 percent.

The base rate is important because it determines the interest paid on the reserves that commercial banks hold with the Bank of England.

By setting the base interest rate, the Bank of England can therefore control the short-term market interest rate.

Back to top: Mortgage rates are rising again after nearly six straight months of cuts

At the beginning of the year, the market was pricing in six or seven base rate cuts by 2024 alone.

The market now expects the base rate to be cut about three times this year to around 4.5 percent in December.

Looking further ahead, markets are currently only pricing in a base rate that will fall to around 3.8 percent by the end of 2025, before eventually reaching 3.5 percent in 2027.

If the base rate starts to fall, it could send good signals to the sector, meaning rates could fall further.

But this doesn’t necessarily mean there will be significant rate cuts on fixed rate products right away, as lower rates are already priced in as there is already an expectation that rates will fall.

For mortgage holders, these market expectations are reflected in the Sonia swap rate.

In the simplest terms, swap rates show what lenders think the future holds in terms of interest rates, and this determines their pricing.

So far, the five-year swaps have been 3.88 percent and the two-year swaps have been 4.49 percent – both below the current base rate. The cheapest mortgage interest rate rarely falls below the swap interest rate.

Given all this, it is likely that swap rates will have to fall before mortgage lenders will reprice downward in any meaningful way.

Rohit Kohli, director of The Mortgage Stop, said: ‘It appears lenders believe a base rate cut will now only happen later this year, which will worry the thousands of people who were hoping the Bank of England would get some of the would take over interest. promotion in the coming weeks as their fixed rates expire.’

Nicholas Mendes, mortgage technical manager at broker John Charcol, noted that five-year swaps have fallen from more than 4 percent to 3.87 percent in the past two weeks. This suggests this could tempt some lenders to cut rates in the short term.

“The five-year money supply has been moving lower in recent days, which will see a positive reversal in the pricing of five-year fixed rates in the next two weeks,” he said.

‘The market needs some stimulation, no matter how small. A 0.1 percentage point rate cut will provide enough confidence in the future movement of bank rates to allow for more favorable pricing, although it seems likely that June will be the year we see the first rate cut.”

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.