Why thousands of Aussies are seeing their insurance soar by 300 per cent

Australians living in flood-prone areas have seen their annual home and contents insurance costs quadruple – even if their properties never flooded.

Gail MacPherson, who lives in Logan, south of Brisbane, saw her annual RACQ premium rise from $1,400 to $6,000 – a 329 per cent increase.

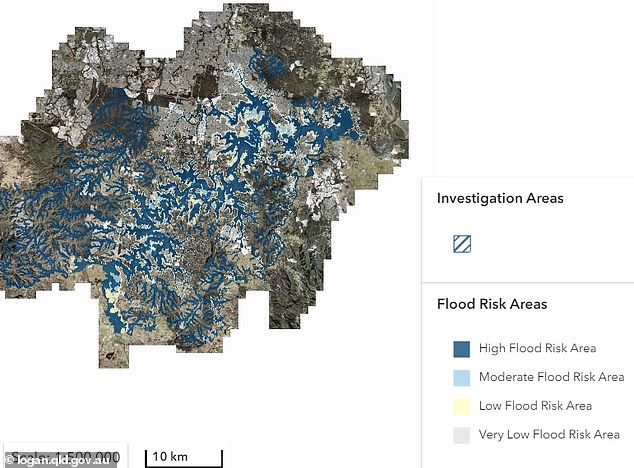

This was after Logan City Council’s new flood map, released last year, showed her Bethania home was at risk of flooding, even though her home has never been flooded.

‘I was furious, I can assure you. I was really approachable,” Ms MacPherson told 9News.

An RACQ spokeswoman told Daily Mail Australia the alternative was for residents of low-risk areas to subsidize those living in flood-prone suburbs.

Australians living in flood-prone areas have seen their annual home and contents insurance costs increase by more than 300 percent (photo is Logan, Queensland in March 2022)

“We don’t want to charge anyone high premiums,” she says.

‘However, RACQ has the responsibility to set premiums based on the likelihood of the policyholder making a claim and how large that claim may be in the future.

“We believe this is the fair thing to do so that other members do not pay higher premiums to subsidize people in high-risk areas.”

Mrs MacPherson has changed insurers after thirty years and has opted not to take out expensive flood cover.

Across Australia, average premiums have risen by double digits in the past year.

Over the past year, the average premium in Queensland rose 21 per cent from $2,049 to $2,473.

But in NSW the increase was even more severe: 26 per cent, rising to $2,658, from $2,103 in Lismore state, which has seen several floods in recent years.

Western Australia, where bushfires are raging south of Perth, saw a massive 45 percent increase, taking premiums from $1,668 to $2,424.

Victoria, now also in the grip of bushfires with areas near Ballarat threatened, saw insurance premiums rise 31 per cent from $1,538 to $2,016.

Premiums in South Australia have increased by seven per cent from $1,605 to $1,719.

This was after Logan City Council’s new flood map found her Bethania home was at risk of flooding, even though her home has never been underwater.

Finder analyzed 433 quotes from more than 45 Australian insurers to calculate the average cost of home insurance for a house worth $500,000 and contents worth $100,000.

Gary Ross Hunter, an insurance expert at Finder, said switching providers is often the best way to reduce premiums. He recommends that customers review their policies annually.

‘Loyalty does not always pay off, especially when it comes to insurance. The best deals are often offered to new customers,” he says.