The American EV boom is going bankrupt! Lithium and nickel producers begin massive layoffs and halt multi-billion dollar projects as the US says no to the rise of electric cars

Americans were sold the promise that electric vehicles would bring manufacturing companies and an influx of jobs to small towns across the country as part of a modern gold rush.

However, as interest in electric vehicles has waned, lithium and nickel factories – metals used in lithium-ion batteries for electric vehicles – are taking cost-cutting measures, including mass layoffs and suspending operations.

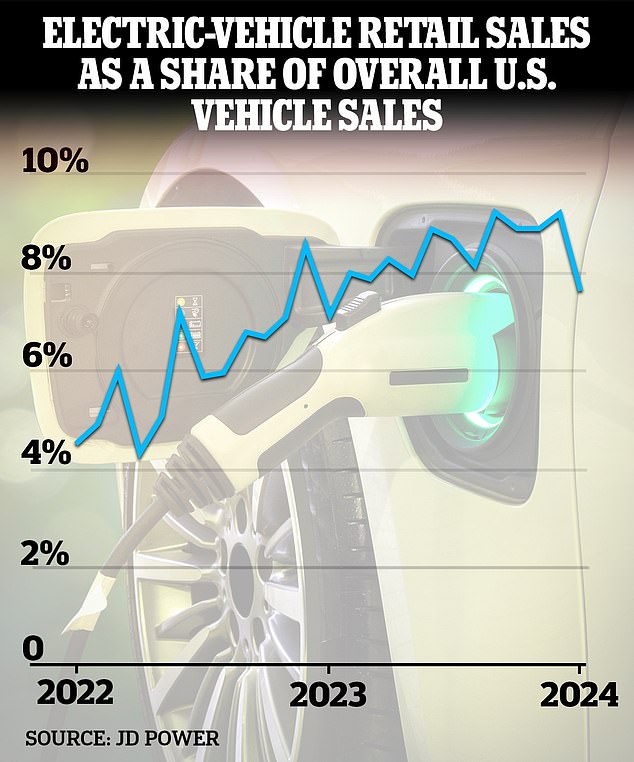

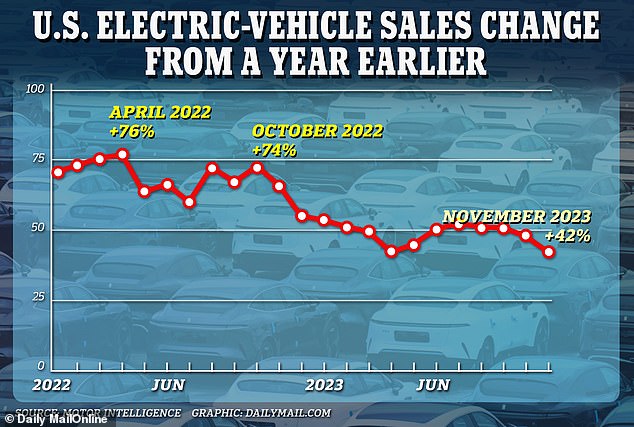

Demand for electric vehicles soared in 2022, rising 76 percent in April that year, but by the end of 2023 the number of vehicles sold fell to 50 percent.

Car buyers are still reluctant to trade in their gas-guzzling car for an electric car due to the high price tag and concerns about their ability to easily charge the car.

Ford cut 1,400 jobs at its once-promising lithium plant in Michigan, while General Motors laid off all of its nearly 1,000 workers at its Detroit plant with a promise to rehire workers in 2025.

Production from $1 billion worth of lithium mines is being suspended as demand for electric vehicles declines

“I think you’re seeing the slope change in how quickly people are willing to buy electric cars right now because they’re expensive and there are concerns about charging infrastructure,” said Alan Amici, CEO of the Center for Automotive Research. NBC News.

‘If you are an efficient car manufacturer, you try to adjust your production to demand. It makes no sense for anyone to fill a garden with electric cars that are not sold.’

Automakers take an average of three weeks longer to sell an electric vehicle than a standard gasoline vehicle, prompting companies to offer discounts and lower interest rates to attract buyers.

The price of lithium has fallen 90 percent since January last year, and demand for electric vehicles is slowing and halting production at lithium and nickel mines.

Electric vehicle sales as a percentage of total US auto sales have fallen from 9 to 8 percent in the past three months

As a result, companies including General Motors (GM) and Ford were forced to slow the expansion of electric vehicle development and battery production, even as they made new commitments to open more production plants in the next two years.

“It is true that the pace of EV growth has slowed, which has created some uncertainty,” Mary Barra, General Motors’ chairman and CEO, said in a statement. revenue calling last month.

“We will build on demand, and we are encouraged that many third-party forecasts indicate that U.S. EV shipments will increase from approximately seven percent of the industry in 2023 to at least 10 percent in 2024, marking another year of record EV sales would mean.’

She claimed that GM has 100,000 reservations for EV pickups for this year and next, but expressed the caveat that if demand for EVs changes, the company will look to building more internal combustion engine vehicles instead ( ICE).

Electric vehicle sales growth is starting to slow in the US, in a trend that is worrying automakers who are betting big on the emerging technology

“We know the EV market will not grow linearly,” GM CFO Paul Jacobson said in the earnings call, adding, “We are willing to vary between ICE and EV production.”

This marks a significant shift from GM’s 2021 goals of selling only all-electric vehicles and investing $27 billion in electric vehicles by 2035, Barra said in a LinkedIn report. after at the time.

However, while the growing pace of demand for electric vehicles has slowed, the company believes it is still moving in the right direction, James Cain, GM’s executive director of finance and sales communications, told Dailymail.com.

In February 2023, Ford pledged to build a $3.5 billion electric vehicle battery factory in Michigan to take advantage of President Joe Biden’s proposed climate bill that would make two-thirds of all U.S. cars sold by 2032 would be fully electric.

Lithium prices fell 90 percent last year in response to declining demand for electric vehicles, meaning companies cannot afford to continue operations and must pause construction of future nickel and lithium mines.

Biden is expected to withdraw from strict measures to give car companies time to switch to electric vehicles, even though more US consumers switched to hybrid vehicles last year than the all-electric alternative. The New York Times.

Hybrid vehicles accounted for 8.3 percent of car sales in 2023, while fully electric vehicles accounted for 6.9 percent of cars sold.

With electric vehicle sales not rising as quickly as auto companies expected, the slowdown in lithium and nickel production means people are losing their jobs in a once-promising industry.

This comes as lithium and nickel prices collapse, impacting major US lithium production companies such as Albemarle, which is set to start building a lithium plant in South Carolina this year.

Albemarle planned to produce enough lithium to power 2.4 million electric cars annually, but the company was forced to halt spending on the plant and lay off four percent of its workforce, which amounts to 300 employees.

“Where prices are today, the economics are not in good shape for these projects,” said Kent Masters, CEO of Albemarle.

Piedmont Lithium, located in Belmont, North Carolina, said The Charlotte Observer last week, the company announced it would hire more than 400 employees with an average salary of $82,000, while announcing it would lay off 27 percent of its workforce.

“At the end of the day, it all comes down to demand, and demand just isn’t getting to where all these CEOs were thinking.

“So a lot of the initial targets that GM or Ford put forward a few years ago may have turned out to be a little too optimistic and probably too aggressive,” Gabe Daoud, senior renewable energy analyst at TD Cowen, told NBC News.

“I think everyone expected the entire fleet to change overnight and become electric, but that’s obviously just impossible and impractical.”