Queen close to record $1.2 BILLION sale of music catalog – defying slump in song valuations since megastars like Bruce Springsteen and Bob Dylan cashed in on collections during Covid

British rock legends Queen are closing in on a record $1.2 billion sale of their entire music catalog – defying a decline in song appreciation since a series of mega-deals during the pandemic.

The remaining band members and Freddie Mercury’s estate are in advanced talks to sell their recordings, publishing rights and royalty streams for more than double the current record of Bruce Springsteen, who sold the rights to his music in 2021 for $550 million.

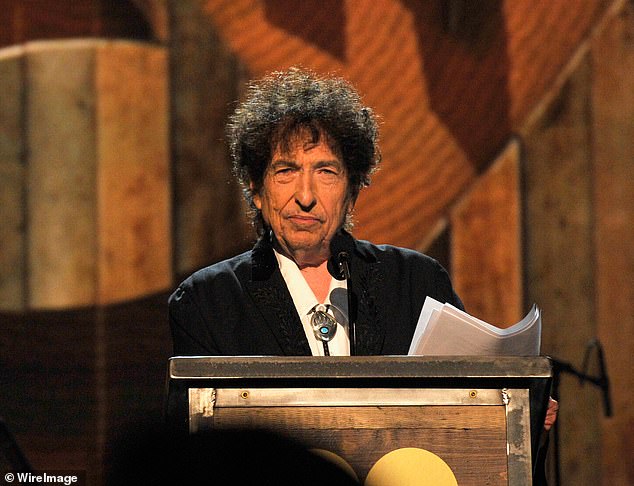

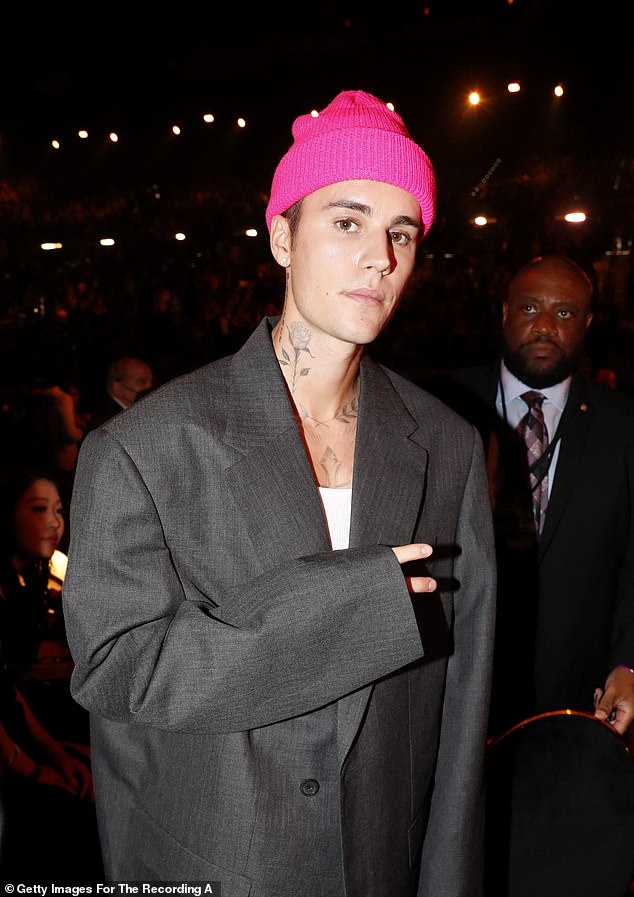

Springsteen’s deal was signed before a string of other artists, including Bob Dylan, Neil Young and Justin Bieber, also scooped hundreds of millions of dollars for their own collections. But since then the market has cooled and some major investors have devalued their song collections by as much as 14 percent.

Queen’s blockbuster deal would defy the slump and show how the world’s biggest artists can continue to command eye-watering sums for their collections, industry experts say.

Queen earned a reputation as one of the greatest rock bands of all time with hits such as We Will Rock You and Bohemian Rhapsody. The remaining members and estate of Freddie Mercury are now about to sell their entire catalog worth $1.2 billion

The Queen deal would double the record set by Bruce Springsteen, whose catalog grossed $550 million when it sold amid a series of blockbuster deals during Covid-19.

The band’s music consists of the ‘master’ copyright, i.e. the rights to the recordings, and the ‘publishing’ copyright, i.e. the written music and lyrics.

Disney Music Group owns the North American rights to Queen’s music. But the band retains worldwide rights through Britain’s Queen Productions Ltd, which earned £39 million ($48 million) in royalties in 2021.

Investors view music catalogs much like owning shares in companies that pay dividends. The $1.2 billion valuation for the Queen’s catalog is based on the annual returns an investor can expect over the next few decades.

Guy Blake, a leading music industry attorney who has worked on catalog acquisitions, told DailyMail.com that the Queen deal would be “seismic” and a “one-for-one” sale if it matches the rumored valuation of the entire the band’s portfolio.

“Overall, I don’t see a problem with this number ($1.2 billion) being accurate. I think there’s probably some truth to it,” said Blake, managing partner at Granderson Des Rochers.

“There aren’t many catalogs like Queen,” he said.

Blake said Queen would strike while the market is “at its peak”, adding: “I think you’ve seen the market grow to a crescendo and now it’s starting to decline slightly.”

Universal Music Group was rumored to be the frontrunner in the deal when details of the talks first emerged last summer. Sources said Billboard that negotiations may now have reached an ‘exclusive period with an undisclosed lover’.

The buyer of the Queen’s catalog will likely purchase the masters, publishing copyrights as well as “ancillary income,” including income from other sources.

In Queen’s case, this includes revenue from merchandise, cash generated by the 2018 biopic Bohemian Rhapsody and other future projects and licensing deals.

Queen earned a legion of new fans after the 2019 film Bohemian Rhapsody, a biographical film about the band. That means they’re one of the few ‘legacy’ artists who now count an army of younger followers – and can therefore enjoy huge streaming numbers

The catalog sale follows other mega deals from the likes of Bob Dylan, who sold the rights to his music in two separate deals worth an estimated $450 million in total.

In the streaming era, catalog ratings also rely heavily on a metric called “album consumption units,” which combine streams and downloads to estimate what the equivalent number of album sales would be. By industry standards, one album sale is equivalent to approximately 1,500 song streams.

Queen’s albums consumed in the US between 1991 and 2017 reached 25.9 million, then rose to 3.58 million in 2019 after the release of the Bohemian Rhapsody film, according to Luminate figures reported by Billboard.

The film’s popularity and continued airplay of Queen’s hits decades after they were released have helped the band earn a legion of young fans – something that has also increased the value of their catalog.

‘Queen has found a much younger audience. And that’s unique for an older catalog, Blake said.

‘I don’t know if there are many rock bands that can say they are as popular with people under thirty as Queen is now. There’s just something unique about so many of their songs that they keep coming back, generation after generation.”

Following Springsteen’s $550 million sale, Bob Dylan is estimated to have earned the second-highest amount for a music catalogue, having received approximately $450 million for two separate deals.

Dylan sold his songwriting rights to Universal Music in 2020 for $300 million, and a year later sold the rights to his recordings to Sony Music Entertainment for $150 million.

Those sales came amid a series of huge payouts for artists who cashed in on their catalogs during Covid.

Bieber’s catalog was sold to the Hipgnosis Songs Fund for $200 million in January 2023. Hipgnosis previously purchased a 50 percent stake in Neil Young’s catalog in January 2021 under a deal that valued the total collection at approximately $300 million.

Justin Bieber’s catalog sold to the Hipgnosis Songs Fund for $200 million in January 2023

Hipgnosis purchased a 50 percent stake in Neil Young’s catalog in January 2021 under a deal that valued the total collection at approximately $300 million.

The company, which owns 65,413 songs and 146 catalogues, also has the rights to music by the Red Hot Chili Peppers, Mark Ronson and Blondie, among others.

But Hipgnosis has suffered a decline in the value of its music assets over the past year. In December, the company said its assets fell 9.2 percent between March and September 2023.

In December, the company – which was founded by former Beyonce and Elton John manager Merck Mercuriadis and Chic guitarist Nile Rodgers – also sold 20,000 songs at a 14 percent discount to what they were valued at just months earlier.

Overall publisher valuations have fallen about 14 percent since their peak in 2019, according to a report from Shot Tower Capital, an investment firm specializing in the media industry.

Blake said skyrocketing prices during the pandemic were largely driven by low inflation rates, which prompted investors to pump money into assets that can generate reliable income. In the case of music catalogs, that means annual royalty income.

But despite the recent slowdown as interest rates have risen over the past year, bands like Queen will always be able to rake in huge payouts for their legendary catalogs.

Blake summed it up: “If you say to a private equity firm, “Hey, we think we have an opportunity to buy Queen,” they will find the money.”