The most successful investment strategy of the past decade revealed

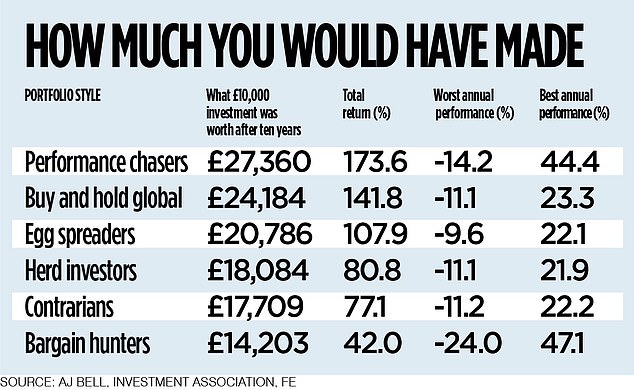

Wealth & Personal Finance decided to try an experiment. With the help of investment platform AJ Bell, we pitted six portfolios against each other, each with a different popular strategy. For each of them we asked this question: if an investor had put £10,000 into this portfolio ten years ago, how much money would he have made now?

The answer shocked Laith Khalaf, head of investment analysis at AJ Bell, who ran the numbers, and also surprised us at Wealth & Personal Finance.

Investors are endlessly looking for the winning strategy that will give them an edge. Everyone from casual investors to expert fund managers are looking for that holy grail: the formula that will grow their wealth a little more than everyone else every year.

Many believe they have found it. Some buy a wallet and hold on to it for years, no matter what. Others opt for so-called contrarian investing: buying what is unloved at that moment. Another couple hoovers up anything that looks cheap.

We wanted to know who is right. Our portfolios do not consist of individual stocks or funds. Instead, to be more representative, they consist of investment sectors such as UK corporate funds, North American funds, global funds and technology funds. These are all sectors defined by the Investment Association – an industry body. The six portfolios were:

Stand out from the crowd: herd investors who blindly followed their peers underperformed performance chasers over a decade

1) Achievement hunters

In this portfolio, we imagined that at the start of the ten-year period in 2014, the investor would put their £10,000 into healthcare, the sector that had the best performance the year before. Then, on January 1 of each subsequent year, the investor moved his entire portfolio to the best-performing sector of the previous year. In other words, they always invested in last year’s winners.

2) Buy and hold globally

This investor put his £10,000 into a global fund, which moves up and down with the global stock market. They left it untouched for ten years.

3) Egg spreaders

Here we imagined that at the start of the ten-year period the investor divided his £10,000 equally between UK funds, US funds, European funds, Japanese funds and global emerging market funds. In other words, instead of putting their eggs in one basket, they bought a little bit of everything, rebalancing each year.

4) Herd investors

This investor started with his £10,000 in the investment sector that was the most popular in 2013. He then shifted his money each year to the sectors that most people bought the year before, regardless of performance.

5) Opponents

For this portfolio, the investor did the exact opposite of herd investors. They put their £10,000 into the least popular sector of the previous year, and did the same on January 1 for the entire ten-year period.

6) Bargain hunters

Here the investor put his £10,000 each year into the worst performing sector of the year before.

And the winner is…

Achievement hunters – and not for a long time. After ten years, their £10,000 investment would be worth an impressive £27,360. The next best was the global buy-and-hold investor, with £24,184.

The biggest loser was the bargain hunter, making the investment £14,203. But even this portfolio managed to beat inflation – £10,000 in 2014 is worth £13,150 today.

Laith Khalaf says: “Everyone knows that chasing fund performance is a foolish endeavor. Except it has delivered great results over the past decade. Investors who put their money into the best-performing fund sector of the previous year each January would roll with it and post a 173.6 percent return over the decade.”

But was it a fluke?

You could argue that the past decade has not been typical for investors. It was a period when American technology companies – such as Facebook’s owner, Meta, and Google’s owner, Alphabet – accounted for much of the growth in global stock markets. Their star continued to rise. With these driving growth year on year, it’s perhaps no surprise that the performance-chaser portfolio did well over that period.

So we asked AJ Bell to try the same experiment, with the same portfolio styles, over different ten-year periods. And there isn’t a single 10-year period in the last 30 years where the performance hunter didn’t beat the buy and hold strategy – which is usually recommended by the investment industry to ordinary investors. Moreover, look further and you see that the technology sector was only the top performer in two out of ten years – and that India, healthcare and the resources sector were all top performers twice as well.

So, should you become an achievement hunter?

Not necessarily – and for several reasons. First, past performance is no guarantee of future returns – even if a strategy has been performing well for a number of years.

Jason Hollands of investment platform Bestinvest by Evelyn Partners says: ‘Chasing returns can work for a while, but then suddenly the best performing companies change. Unless you have a crystal ball, you can’t know when it will happen. It can take you by surprise.

‘If you strive for performance, you are also much more likely to be exposed when bubbles arise. In the 1990s, when the dot-com bubble burst, investors who piled into these hottest stocks would have suffered greatly.”

Second, performance hunters have endured a stomach-churning ride. Over the past decade, the largest annual decline for performance hunters was 14.2 percent. But if you go back to 2000, performance hunters would have suffered a 31 percent decline – compared to a 5 percent decline experienced by global buy-and-hold investors.

Khalaf adds: “In 2008, a performance-chaser portfolio would have fallen 45 percent, compared to a 24 percent decline for a global buy-and-hold portfolio. In 2009 it would have fallen again – this time by 11 percent – while the global buy-and-hold portfolio would have recovered by 23 percent.’ Ouch.

Third, it’s all well and good to compare the performance of hypothetical portfolios. But it’s a little more complicated if you manage one. In the case of a buy and hold portfolio, you literally have to do just that. Simply buy a well-diversified portfolio of sectors and geographies and then sit tight – adjusting occasionally to rebalance or as your investment goals or time horizon change.

But if you were to manage a performance-chaser portfolio – or one of the others, such as contrarians, herd or bargain hunters – you would need to figure out which funds to buy and sell each year to stick to your chosen strategy, and having to review your portfolio every time. years, and you’ll likely be charged every time you buy and sell.

A compromise?

A global buy-and-hold portfolio assumes that global stock markets tend to rise over the long term, but few of us can effectively predict which sectors will perform best, so they might as well put a little of every sector and hope for the best.

For many investors – especially those who want less drama – this is probably a good starting point.

However, if you have certain beliefs – about a particular investment style or trend, or about a sector, geography or company that you think will outperform the average – you can always tailor a balanced portfolio to reflect this. Buy some more of these investments, but don’t put all your money into them, just in case you’re wrong.

- What is your investment style? Email rachel.rickard@mailonsunday.co.uk

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.