Where do FIIs invest? Top Performing India Focused Offshore Equity Funds | Personal Finance – Business Standard

Illustration: binay sinha

The asset base of India-focused offshore funds and ETFs grew during the quarter ended December 2023, following the sharp rally in Indian equity markets and robust net inflows. Assets rose as much as 20.6 percent to $72.2 billion during the quarter, up from the $59.8 billion recorded in the previous quarter, data analyzed by Morningstar showed.

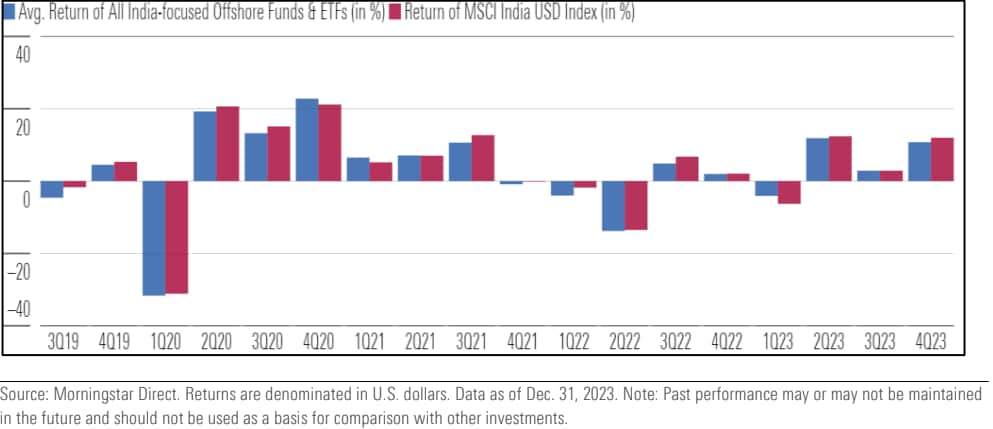

The India-focused offshore fund and ETF category posted a 10.75% gain during the quarter, while the MSCI India USD Index returned 11.98%.

Quarterly returns

The average performance of the India-focused offshore fund and ETF category registered a robust gain of 10.8% during the quarter, reflecting the overall upward trend of the Indian stock market. Similarly, the MSCI India USD Index also posted a growth of 12.0% during the quarter ended December 2023. Over a year, the category’s performance was superior to that of the index, but over a three-year time frame it has underperformed the index.

“Most India-focused offshore funds are actively managed and have significantly higher expense ratios than ETFs. Their continued popularity, despite higher costs, indicates that many foreign investors prefer active management over passive when it comes to investing in India. The lower expense ratio of offshore ETFs is certainly helping them gradually gain traction and increase their market share. That said, ETFs also offer easy exit options and are more cost-efficient than funds, many of which charge fees for early exits. have recently used this mode of investing extensively to easily enter and exit the country’s equity markets, in line with their rapidly changing views on the investment opportunities it offers,” said Himanshu Srivastava, Associate Director – Manager Research, Morningstar Investment Advisor India .

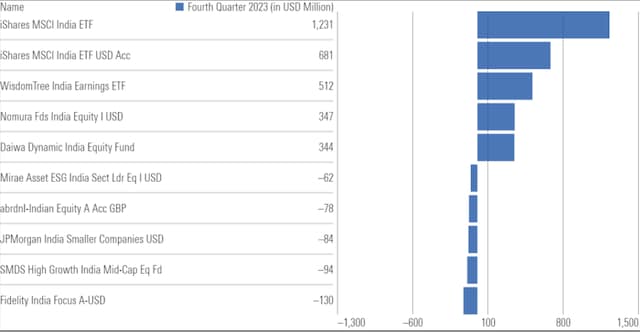

During the December 2023 quarter, iShares MSCI India ETF received the highest net inflows of around $1.23 billion. This fund was the second highest recipient of cash flows in the previous quarter, when it received net inflows of $874 million. It was followed by iShares MSCI India ETF USD Acc and WisdomTree India Earnings ETF, with net inflows of $681 million and $512 million. respectively.

5 India-focused offshore funds and ETFs with the highest and lowest value, based on estimated net flows in Q4 2023 (in millions of USD)

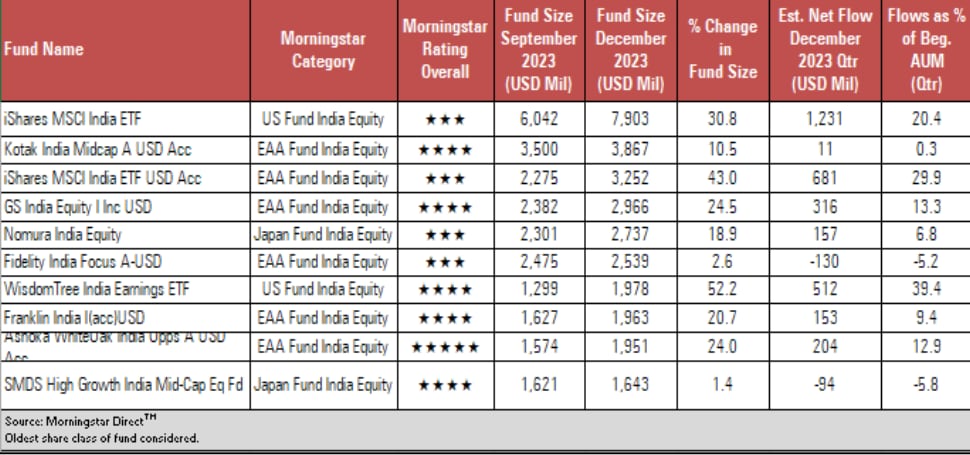

Assets of the top 10 India-focused offshore funds and ETFs rose as much as 23% to $31 billion in the quarter ended December 2023, up from $25 billion in the previous quarter. These funds account for nearly 43% of the assets of the India-focused offshore fund and ETF category.

IShares MSCI India ETF continues to maintain its top position as the largest fund in the India-focused offshore fund and ETF category. During the quarter, the country received net inflows of $1.23 billion, increasing its asset size by a whopping 30.8% to $7.90 billion, compared to $6.04 billion in the previous quarter.

WisdomTree India Earnings ETF recorded the highest growth in assets at 52.2%, driven by strong returns and quarterly net inflows of $512 billion.

SMDS High Growth India Mid-Cap Equity recorded the lowest growth in assets at 1.40%, which was attributed to net outflows of USD 94 million during the quarter.

10 largest India-focused equity funds and ETFs

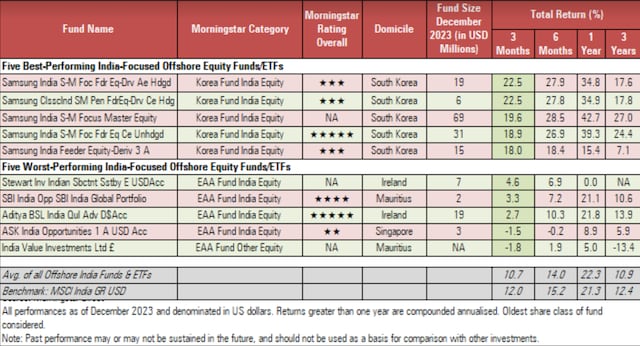

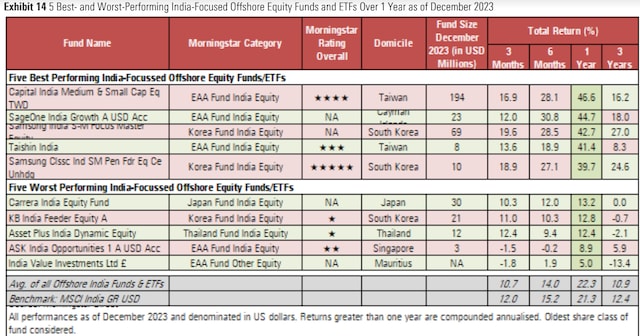

The five best and worst performing India-focused offshore equity funds and ETFs in the quarter ended December 2023

Samsung dominated the list of top performing funds during the quarter. The five best performing funds were Samsung funds. Driven by a strong rally in mid and small caps, Samsung India SM Foc Fdr Eq-Drv Ae Hdgd, Samsung Classic India SM Pension FdrEq-Drv Ce Hdg and Samsung India SM Focus Master Equity were the three best performing funds during the quarter. They were followed by Samsung India SM Foc Fdr Eq Ce Unhedged and Samsung India Feeder Equity-Deriv 3 A. Except for Samsung India Feeder Equity-Deriv 3 A, all other funds have delivered strong performance over the one and three year periods as well, and outperforms the category and index.

Over a one-year period, the India-focused offshore funds and ETF categories returned 22.3%, which is better than the 21.3% return of the MSCI India USD Index. Not a single fund in this category has posted a negative performance over a one-year period.

As you can see in the table below, Capital India Medium & Small Cap Eq TWD, a Taiwan-based fund, was the best performer over the one-year period, returning 46.6%.

First print: February 14, 2024 | 9:45 am IST