Should investors tempted by cash switch back to dividends? SIMON LAMBERT

Even staunch advocates of long-term investing will have given serious thought to the switch to cash over the past twelve months.

Many have diverted money that would normally have gone to investment accounts into savings deals.

Some may have even sold some of their shares and put the proceeds into cash.

Time to use your savings? As interest rates fall, the temptation to put money into savings instead of the stock market will diminish

It’s easy to understand why. Tegen een achtergrond van economische en mondiale politieke onzekerheid ziet dit soort rendement van een door FSCS beschermde spaarrekening er aantrekkelijk uit vergeleken met het risico en de volatiliteit van de aandelenmarkt.

Ironically, despite the concerns, the support stocks paid off, with the MSCI World stock index rising 24 percent, driven by the dominant U.S. stock market.

But now that inflation has fallen and interest rates appear to have peaked, those super savings rates are long gone.

The best one-year deal in our fixed rate savings tables now yields 5.16 percent – and rates are on a downward trajectory.

Meanwhile, our savings guru Sylvia Morris fears that the next thing banks will plunder will be easy-to-access savings deals, with the best interest rate currently at 5.15 percent in our savings tables.

There are a number of respected studies that support the case for long-term investing.

My preference is the Barclays Equity Gilt Study, the latest edition of which shows that even the mediocre UK stock market has delivered an average annual return of 4.9 percent above inflation over the 122 years to 2022.

You shouldn’t expect to make money investing in any given year, but do it over the long term and the evidence shows it’s better than cash.

There is no guarantee that this will continue to be the case, but the ability of companies to use money productively and make profits underlies the idea that this should be the case.

The easiest way to back up that theory is through a simple, low-cost global stock market tracker fund. It also means you don’t stray too far from the main benchmark for investment returns.

If you want to go off-piste and look for winners that beat the market, you can opt for an actively managed fund or investment trust. However, keep in mind that these often fail to perform consistently better.

However, some look interesting, especially those with stocks that didn’t benefit from the tech giant’s rally last year and still look cheap.

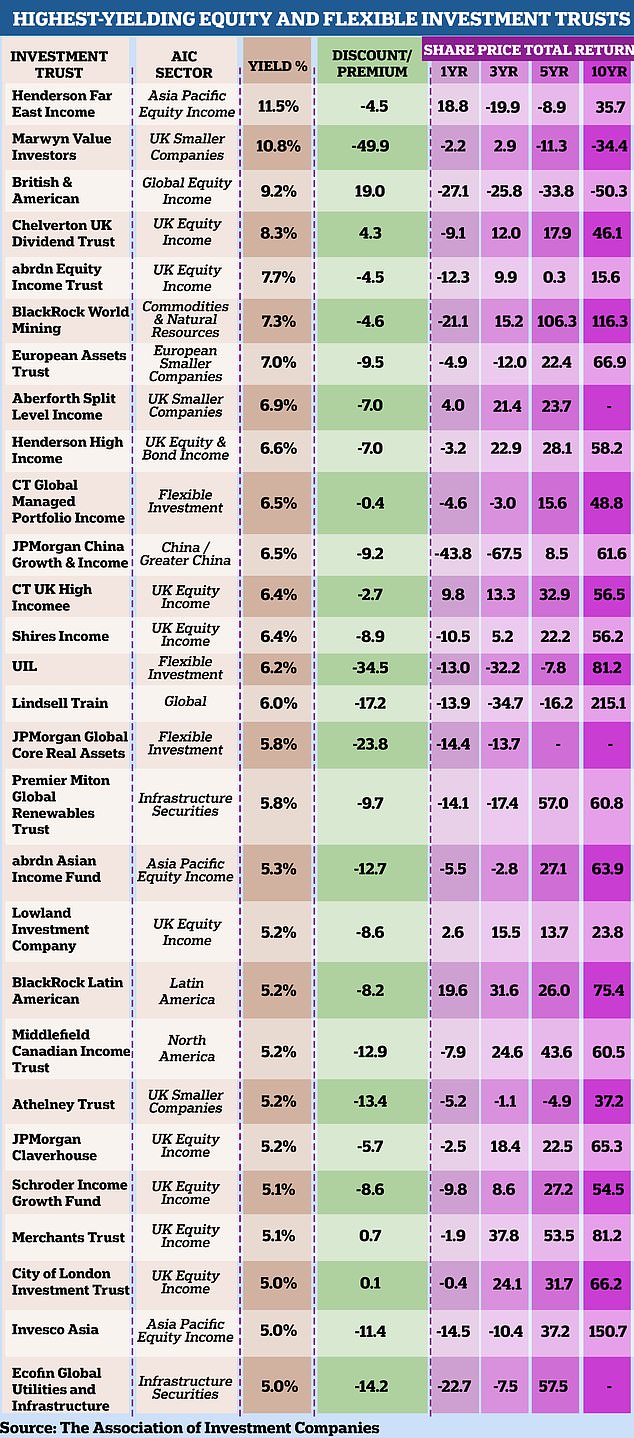

There are 28 investment companies that have a dividend yield of 5% or more

With savings rates falling, more dividend-paying mutual funds are looking tempting.

We are at a tipping point where a significant proportion of income trusts now match or even exceed savings rates. That’s no reason to invest in it, but it’s worth it

More details can be found in the 28 investment trusts paying dividends of 5 per cent or more and the AIC’s full list above.

Crucially, these trusts offer the prospect of both dividend income and growth – although your investments can also fall in value – and some of them back shares in parts of the market that look cheap (including the UK).

Not all of these investments will be good investments – the table above shows how some have fallen in value – but there are certainly some ideas for your portfolio if you’re considering putting a little less cash into play this year.

In any given year, shifting your focus to cash when interest rates are high isn’t necessarily a bad move. But if you do it year in and year out, you’re likely to lag behind both inflation and stock market returns.

Good times for investors? It depends on what you put your money into

For investors, 2023 was in theory a good year, but that largely depends on how and where you invested.

This will likely color their view of the 2024 outlook, but it’s always worth remembering that past returns are not necessarily a guide to future profits.

The global stock market has been dominated by the US for some time and the US stock market is now in turn dominated by the so-called Magnificent Seven.

This group of tech-influenced giants—a half-dozen billionaires, perhaps—includes Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia, and Tesla.

As our Magnificent Seven versus the stock market story from late last year showed, an M7-only portfolio returned 109 percent between the start of the year and the third week of December, while the main US index, the S&P 500, rose 26 percent. cent and the MSCI World Index rose by 23 percent.

The size of the Magnificent Seven means they have managed to spread the wealth, helping the S&P 500 and thus the return of the overall global index rise over the year.

If you did the sensible thing and bought a cheap global tracker fund, you would have a good year in 2023.

But investors who backed the FTSE 100 or All Share, or started to overweight more value-oriented shares, investment trusts or funds, will not have fared so well.

Both the FTSE 100 and the FTSE All Share had a total return of 7.9 percent, while the FTSE 250 had a total return of 8 percent.

Despite the allure of the quest for cash, even the UK stock market beat savings.

DIY INVESTMENT PLATFORMS

A.J. Bell

A.J. Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund trading and investment ideas

interactive investor

interactive investor

Invest for a fixed amount from € 4.99 per month

eToro

eToro

Investing in shares: community of more than 30 million

Bestinvest

Dear Investing

Free financial coaching

Affiliate links: If you purchase a product, This is Money may earn a commission. These deals have been chosen by our editors because we believe they are worth highlighting. This does not affect our editorial independence.

Compare the best investment account for you

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.