Dramatic moment ABC News Breakfast’s Lisa Millar brutally cuts off Treasurer Jim Chalmers over Anthony Albanese’s Stage Three tax cut broken promise

ABC News breakfast presenter Lisa Millar has questioned Treasurer Jim Chalmers about Anthony Albanese’s broken election promise on tax cuts, hammering him on the Prime Minister’s own claim that his ‘word is his promise’.

Mr Albanese will use a National Press Club speech today to lay out his case for reviewing the third phase of tax cuts, which he has repeatedly stressed he would maintain.

Labor has calculated that the political costs of breaking their promise to the Australian people will be reduced by the fact that almost 11 million Australians will be better off under the new plan.

But Ms Millar told Dr Chalmers that Mr Albanese’s sensational backslide – after promising not to change tax cuts no fewer than 36 times – had “won the opposition their advertising campaign for the next election”.

“Is the Prime Minister’s word his guarantee?” she asked Dr. Chalmers – with an explosion that seemed to throw the treasurer off balance for a moment.

Dr. Chalmers responded that ‘this is about people, not politics’ – before Millar immediately interrupted him.

“Is the Prime Minister’s word his guarantee?” she repeated.

ABC News breakfast host Lisa Millar has quizzed Treasurer Jim Chalmers about Labor’s backlash over the third stage of tax cuts, asking: is the Prime Minister’s ‘word his bond?’

Anthony Albanese will use a speech today to outline a case for overhauling the third stage of tax cuts, which Labor said will deliver more benefits to middle income earners.

“Of course,” he said. ‘Trust is built by making the right decisions for the right reasons, even when the politics are difficult and the opposition will of course pay for the usual silly, nasty, negative politics.’

Millar stopped him: “Why is it negative to pick up on broken promises?”

“How do we know in the next elections what you promise to deliver?”

Dr. Chalmers then said the decision was proof that Albanese could make tough decisions “in the interests of the people.”

“Even if the politics are tough and the reason I point out the nasty, negative and foolish politics being played by our opponents is because they don’t want your viewers to focus on the fact that everyone is still getting a tax cut.”

“More people are getting a bigger tax cut and their policy is to go to the election to raise taxes in central Australia so they can afford an even bigger tax cut for high-income earners.”

Ms Millar said that despite this, the Government would still struggle to convince people at the next election to stick to their big economic promises.

“If you say you’re not going to change capital gains tax or negative gearing, why wouldn’t people say, why should we trust you?”

Dr. Chalmers fired back, “Because what we’ve done here is we’ve come to a different position.

‘We have been honest about that.’

“We explain why the alternative we are putting before the Australian people is better than the old phase three tax cuts that Scott Morrison legislated five years ago.”

“The reason we’ve come to a different position is so we can provide a higher cost of living for more people in central Australia without putting upward pressure on inflation.”

Mr Albanese will rely on the advice of the Treasury this afternoon to argue for change.

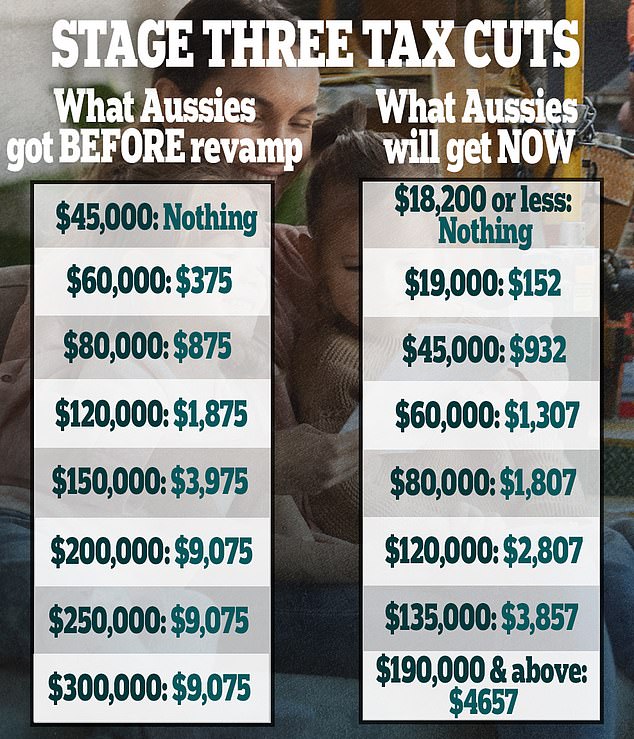

Most workers will be better off than they would have been under the existing package, while benefits for those on the highest incomes will be halved.

The changes will give someone earning an average wage of $73,000 a tax cut of more than $1,500 per year.

Those earning $50,000 will receive an additional $929 per year, while those earning $100,000 will receive $2,100.

Households with a median income of $130,000 will receive $2,600.

At the high end, phase three tax cuts for those earning $200,000 will be reduced from $9,075 to $4,500.

Albanese has leaked excerpts of what he will tell the Australian people later today.

He is expected to argue that global economic conditions have changed dramatically since the coalition’s third phase of austerity was introduced in 2018.

Inflation and interest rates were expected to remain low.

“Unexpected global events prevented these projects from being realized,” Albanese said, on advice from the Ministry of Finance.

He cited the same advice to allay fears of pressure on inflation.

“This option is largely revenue neutral, will not increase inflationary pressures and will support labor supply.”

The lowest income tax rate will be reduced from 19 to 16 cents on the dollar, meaning workers will pay less on the first $45,000 they earn.

Those with an average salary between $60,000 and $80,000 per year (left) will see their tax bill drop by up to $1,807, up from $875. The country’s top earners (right) would be $9,075 a year better off under the original tax cuts, but that has now been scaled back to $4,657

The low-income threshold at which the Medicare levy kicks in will also be increased.

The second tax rate will be reduced from 32.5 to 30 percent for people earning up to $135,000.

Labor will keep the 37 percent rate for people earning more than $135,000, and the top tax rate of 45 percent will be $190,000 instead of $180,000.

Mr Albanese said the tax cuts were “fairly and clearly targeted at central Australia”.

“Our government understands that middle-income Australians need help meeting their living costs now more than ever,” he said.

Labor MPs approved the tax package at a brief meeting on Wednesday, ahead of Albanese’s speech to open the political year.

The opposition has accused Mr Albanese of breaking his word and taking part in class warfare.

Labor will launch an advertising campaign to explain the changes to Australian workers, with Mr Albanese promising further relief.

“These broader and better tax cuts are not the beginning of our cost-of-living actions — and they won’t be the end,” he said.