Britain risks falling behind in EV arms race due to dependence on battery imports, report says

Britain is at risk of falling behind other markets when it comes to electric vehicle (EV) production due to our heavy reliance on battery imports, a new report has warned.

The country’s car industry is at a crucial point where it must ‘adapt, innovate and invest’ to ‘seize the opportunities presented by Britain’s electric vehicle market’, according to a new report from the Center for Business Prosperity from Aston University.

The need for immediate policy intervention and reduced dependence on battery imports is fundamental, the report concludes.

Gigawatts needed: Britain needs to increase battery production at home to ensure we can keep up with the EV revolution, according to a new report. Pictured: The EnvisionAESC giant currently under construction to supply batteries to Nissan’s Sunderland car plant

The car industry is a structural pillar of the UK economy with a turnover of £78 billion, investment of £3 billion in R&D and a contribution of 10 percent (£94 billion) to all exported goods.

As a sector, the sector directly employs 208,000 people at wages 14 percent higher than the UK average.

It is therefore vital that the UK car industry is in a position where it can continue to help domestic manufacturers meet the recently introduced Zero Emission Vehicle Mandate (ZEV) thresholds, which pose a threat to fines makers if they are not met succeed in selling sufficient electric vehicles every year.

To do this, and to remain competitive in global markets, electric car production must be supported by urgent policy intervention, he warns The Aston University research teamled by Dr. Professor Jun Du and Dr. Oleksandr Shepotylo.

It has set out a three-point plan for the automotive sector to follow if it is to ‘strengthen Britain’s global position in electric vehicle manufacturing’.

First, policymakers should negotiate a new tariff-free trade deal with the EU for electric vehicles.

The EU currently accounts for 72 percent of British exports. Swift action is needed to reach a long-term agreement to secure tariff-free access to the EU market.

The UK must comply with the terms of the Rules of Origin (RoO) set out in the Trade Cooperation Agreement (TCA) between the UK and the EU.

The gradual increase in the percentage of UK and/or EU content has been postponed until 2027, but that only acts as a temporary plug.

Intervention is needed to ensure that UK manufacturers and suppliers are fully integrated into the EU supply chain and R&D structures.

National Automotive Innovation Campus (NAIC) at Warwick University is a multi-million pound investment by Tata Motors in automotive R&D in the UK

Another major problem for UK manufacturers is the current dependence on battery imports, which poses a huge risk factor for the car industry.

Makers currently can only meet ZEV mandates by importing batteries – imports currently exceed exports by 10.5 times.

As of November 2023, China led global EV battery capacity with a 54 percent sector share, followed by the US with 15 percent, Germany with six percent and the United Kingdom in fourth place with four percent. Adamas Intelligence EV Battery Capacity and Battery Metals Tracker reported.

UK battery imports are more diverse than the rest of the world, with 40 percent coming from China and 30 percent from the rest of the world, but we still need more domestic production to end the dependency.

Half of the value of an EV is determined by the battery itself.

With massive advances in solid-state ultra-fast charging batteries on the way, this won’t change either.

To build supply chain resilience, Britain must invest smartly in domestic battery production facilities and turbocharging infrastructure by 2030, the Aston University report said.

China leads the way in electric vehicle production and global battery capacity, and Britain is currently heavily dependent on battery imports

Finally, it recommends the implementation of a ‘Future-Fit’ framework to measure and assess dependencies and vulnerabilities to accelerate progress and innovation.

This is necessary to make the British car market an attractive place for foreign investment.

In particular, the report argues that Britain should specifically pursue China. Rather than seeing China as a ‘threat’, the Aston team is pushing for closer cooperation.

Europe is seeing a huge influx of EV imports from Asia: a recent exclusive analysis from MailOnline and This is Money’s automotive division has found that the cheap supply of premium electric cars from China is having a huge impact on the UK car market.

BYD is one of China’s cheap premium EVs that is undercutting European offerings and capturing huge market share

Other emerging brands like GRW (Great Wall Motor) are taking the market and imagination by storm with unique EVs like the Ora Funky Cat

Companies like MG, GRW (Great Wall Motor) and BYD (Build Your Dreams) are undermining European supply, partly due to their leading position as rechargeable battery makers.

But Dr. Professor Jun Du is confident that ‘the implementation of these recommendations can effectively strengthen Britain’s leadership position in electric mobility, ensuring sustainable growth, competitiveness and innovation.’

What is being done to help the UK’s EV revolution?

The good news is that the Society of Motor Manufacturers and Traders (SMMT) has ‘confidence in Britain’s manufacturing and innovation capabilities’.

While global competition and geopolitical challenges still lie ahead, “a new Advanced Manufacturing Plan, supported by strategies for batteries, critical minerals and supply chains, will help to continue to position Britain as a leader on the global stage.”

Mike Hawes, CEO of SMMT, told MailOnline: ‘After a year that saw more than £20 billion of private and public investment in UK EV and battery manufacturing, we look ahead to 2024 with a renewed sense of optimism.

He added that ‘the upcoming Budget provides a new opportunity to introduce further measures to boost Britain’s competitiveness at home and abroad.’

Investments in industry

The British car industry is in the transition zone towards mass production of EV batteries. Although the Aston report highlights that the sector is not there yet, more investment in batteries is expected to come to British shores.

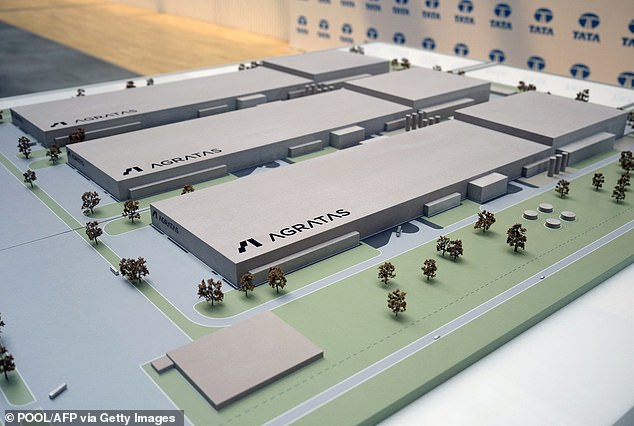

In July 2023, Tata (owner of Jaguar Land Rover) confirmed its plans to build one of Europe’s largest gigafactories in Somerset, England.

A £4 billion injection into the UK EV market will secure half of the UK’s EV battery supply until 2030 and create 9,000 jobs.

The plant will be one of Europe’s largest gigafactories – and Tata’s first outside India – and will supply 40 gigawatt hours annually, supplying other carmakers in Britain and Europe.

Investments in multi-billion dollar giants kicked off in 2023 thanks to investments from Tata and Nissan, creating thousands of jobs

Nissan followed suit in November 2023, with a £1.12 billion investment in its EV36Zero factory in Sunderland to make two new electric models, as well as a third UK battery factory.

In total, Nissan will invest £3 billion in three EV models across three gigafactories by 2023, together with its Chinese battery supplier Envision.

Government campaigns

Significant campaigns are already underway to move Britain towards its 2030 and 2035 EV targets.

In November last year, MPs from a cross-party committee released a report ‘Batteries for electric vehicles’. It highlighted that a lack of government support has made Britain less attractive for EV battery investment, leaving us behind global competitors.

Like Aston University, MPs said Britain has ‘little time to attract further investment in this sector over the next three years’, causing the UK car industry to shrink.

But MPs have welcomed the investment news from Nissan and Tata, with Labor Party leader Jim O’Boyle, cabinet member for jobs, recovery and climate change at Coventry City Council, saying: ‘I am pleased to report that we are now well advanced’ discussions with leading Asian battery manufacturers looking to develop a presence in the UK’.

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.