BLUE WHALE GROWTH FUND: Investment house continues to grow… and delivers a return of 105%

More than six years have passed since Stephen Yiu founded investment firm Blue Whale Capital with backing from Peter Hargreaves, his former employer at investment platform Hargreaves Lansdown, and now the company’s chairman.

Although it hasn’t been the easiest journey due to lockdowns and rising inflation, the flagship investment fund of the company Yiu manages – Blue Whale Growth – has been a great success.

Backed by an initial £25 million investment from Hargreaves – and followed by a series of investments totaling £70 million – the fund now has assets of £880 million, and investors have done quite well for themselves from the start.

They have achieved returns of more than 105 percent – far better than the 60 percent gain achieved by the average fund in its global peer group. Hargreaves’ £95 million has become £155 million.

Despite impressive long-term profits and surviving in an industry dominated by big, established brands, Yiu is taking nothing for granted. Indeed, he understands the pain his investors experience when the fund goes through a rough patch – such as in the first half of 2022, when the global economy was hit sideways by high interest rates and rising inflation.

“A lot of people invested in 2021 when we were doing well,” said Yiu, whose only personal investments are in Blue Whale Growth. ‘They then saw the value of their investments fall in 2022. It was disappointing and damaging – and many left the fund. Fortunately, last year we were able to prove that our investment strategy still works.’

The result is that losses in the first half of 2022 of just over 30 percent have been offset by returns of almost 36 percent in the subsequent 18 months.

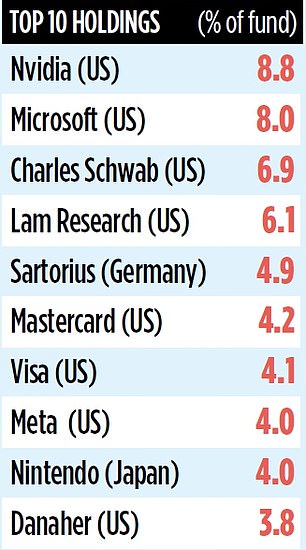

The fund, created to achieve capital growth rather than income, invests in 29 listed companies around the world. Although it has had the likes of Adobe, Mastercard, Microsoft and Visa since day one, it is now a somewhat eclectic portfolio.

As a result, stocks like artificial intelligence specialist Nvidia (the fund’s largest holding and biggest contributor to recent investment gains) rank alongside US financial services firm Charles Schwab, energy titan Canadian Natural Resources (CNR), German healthcare specialist Sartorius and Italy’s drinks company. Campari.

“The idea is to hold high-quality companies that will perform regardless of economic background,” Yiu says. “That means companies like Nvidia that are thriving on the boom in AI – and CNR, which should benefit from a stable oil price due to ongoing geopolitical tensions, especially in the Red Sea.” Not everything has worked – for example the move to North American railway companies (Union Pacific and Canadian National Railways) which ended at the end of last year.

“It was too slow-burning an investment idea,” he says.

Other fund sales include US software companies Autodesk and Intuit – and Dutch semiconductor giant ASML.

Yiu, 45, has built a solid investment infrastructure around the fund and is supported by a six-person investment team that is constantly looking for new opportunities. ‘The focus of the company should be on delivering returns for fund investors. Performance is all that matters,” he says.

He is excited about the fact that the average age of the team is only 35 years old. ‘We have a long road ahead of us and we want to serve our investors distinctively in the long term.’

Hargreaves has supported the fund since day one and has yet to sell any of his assets. The annual fund costs total 0.83 percent.