Hedge funds are raking in record profits by betting on ‘catastrophe’ bonds

The destroyed Pine Island Road after Hurricane Ian in Matlacha Isles, Florida, in 2022 | Bloomberg photo

For hedge funds, the science of catastrophe helped generate the best returns of any alternative investment strategy last year.

The calculations around natural disasters such as hurricanes and cyclones resulted in record profits for funds managed by companies such as Tenax Capital, Tangency Capital and Fermat Capital Management. All three delivered results that were more than double the industry benchmark, according to public filings, outside estimates and people familiar with the funds’ figures.

Behind these record returns were bold bets on catastrophe bonds and other insurance-linked securities. So-called cat bonds are used by the insurance industry to protect themselves against losses that are too large to cover. That risk is instead transferred to investors who are willing to accept the chance that they will lose some – or all – of their capital if disaster strikes. In return, they are rewarded with excessive profits if a contractually predetermined catastrophe does not occur.

Last year everything came together for these investors in a unique profitable cocktail.

“I don’t think we’ve seen a market like this since the rise of cat bonds in the 1990s,” said Toby Pughe, an analyst at Tenax. The London-based hedge fund’s portfolio of about 120 securities returned 18% last year.

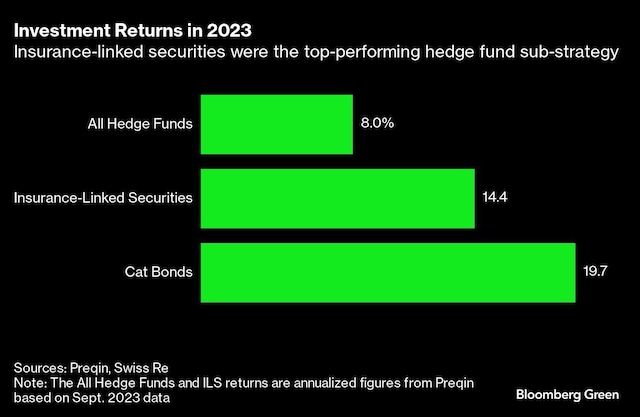

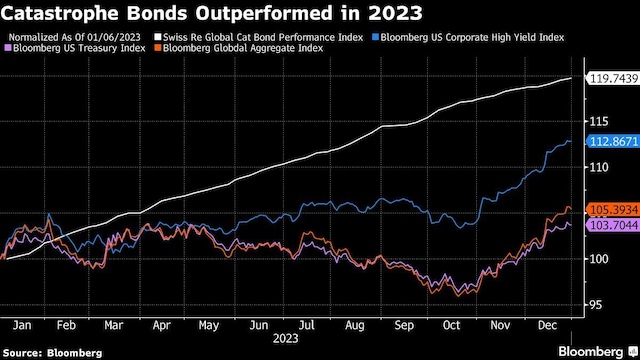

The best hedge fund strategy of 2023 was a bet on insurance-related securities (of which catastrophe bonds are the dominant subcategory), which returned more than 14%, according to Preqin, a consultancy that provides data on the alternative asset management industry. Preqin’s benchmark return for the sector – across all strategies – was 8%. That compares with a 19.7% gain in the Swiss Re Global Cat Bond Performance Index Total Return.

Cat bond issuance has accelerated due to concerns about extreme weather events, fueled by climate change, and decades of high inflation added to the costs of rebuilding after natural disasters.

But the seeds for 2023’s record performance were planted several years ago.

The securities were generally a bad bet in 2017, when several major hurricanes hit the U.S. and investors were urged to cough up the cash needed to cover real estate losses. Returns were also disappointing in 2019 and 2020.

Then, Hurricane Ian hit Florida in September 2022.

Ian was the most destructive storm in the state’s history, causing $100 billion in losses of which only 60% were insured, according to Munich Re. The event prompted insurers to shift more of the risk on their books to the capital markets. And with much higher reconstruction costs amid rampant inflation, the stage was set for a return of the cat bond market.

“The increase in insured values on the residential side went from 8% to 20%,” said Jean-Louis Monnier, Global Head of Insurance-Linked Securities at Swiss Re. “Insurers had to buy more coverage.”

According to Artemis, which tracks the insurance-related securities market, cat bond issuance reached a record high of $16.4 billion in 2023, including non-property and private transactions. Those deals brought the total outstanding market to a record $45 billion, the report estimates.

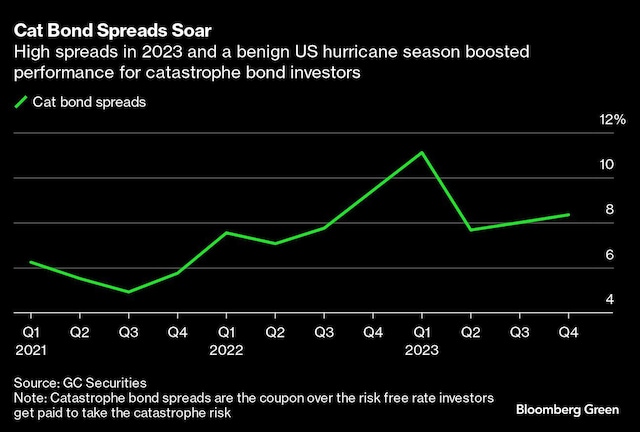

To accommodate the influx of newly issued risk, cat bond investors demanded (and received) much larger returns. Spreads – the premium above the risk-free rate that investors get for taking on ‘catastrophe risk’ – peaked in early 2023. Returns were then boosted by a relatively favorable hurricane season in the US, which meant fewer trigger events and more money for investors. .

Greg Hagood, co-founder of Nephila Capital, a $7 billion hedge fund specializing in reinsurance risk, said last year’s spreads were “probably the highest in my career, compared to the risk we’re taking.”

Dominik Hagedorn, co-founder of Bermuda-based Tangency Capital, said hedge fund interest in insurance-related securities has increased “quite significantly” over the past 12 to 18 months. “Given the spreads at the moment, I wouldn’t be surprised if that continues for another year or so,” he said.

The impact of global warming on weather patterns is a key feature of cat bond modeling, with recent changes paving the way for new loss patterns.

Karen Clark, a pioneer in catastrophe risk modeling, says there is increasing market interest in so-called secondary hazards, such as severe convective storms, winter storms and wildfires, because that is where the demand and opportunity lie.

“Climate change will have the greatest impact on wildfires,” with individual events expected to result in losses ranging from $10 billion to $30 billion, said Clark, co-founder of Boston-based Karen Clark & Co. to grow.”

Brett Houghton, managing director at Fermat, which returned about 20% of its roughly $10.8 billion in assets last year, said such secondary hazards are a good way to “help diversify your portfolio.” He also said they remain difficult to model, meaning they come with “some uncertainty.”

Global capacity for cat bonds has grown at about 4% per year over the past six years – adjusted for inflation – which is roughly in line with growth in exposure to natural catastrophes, according to the Swiss Re Institute. Globally, ILS capital stood at about $100 billion at the end of the third quarter of 2023, insurance broker Aon Plc estimates.

Cat bond investors hoping for another record year should note that inflows have tightened spreads, Tangency’s Hagedorn said. And Tenax expects cat bond yields to be around 10% to 12% this year, up from last year’s 18%. That assumes 2024 is another loss-free year, meaning no natural disaster is big enough to trigger the bonds’ carefully worded payment clauses.

“I obviously can’t tell you if there will be a hurricane or an earthquake this year,” says Hagood of Nephila Capital. “But what I can tell you is that spreads are near historic highs in the industry. Overall, we believe the market is well paid for the risk.”

First print: January 21, 2024 | 7:24 am IST