Boeing shares tumble by a FIFTH after Alaska Airlines mid-air blowout – as new report warns FAA investigation will open ‘whole new can of worms’

- Wells Fargo downgraded Boeing on Tuesday following the FAA’s announcement

- 737 MAX 9 remains grounded after door plug blew off an Alaska Airlines flight

- The aircraft manufacturer’s shares have fallen nearly 20% since the Jan. 5 incident

Boeing shares, which have fallen by more than a fifth since a mid-air explosion on an Alaska Airlines flight, are under further pressure after Wells Fargo analysts downgraded the stock on Tuesday.

The Wells Fargo report, titled “FAA Audit Opens a Whole New Can of Worms,” cites the FAA’s plan to review Boeing’s inspections of the 737 MAX 9 planes before they are allowed to fly again.

“Given Boeing’s recent track record and the FAA’s greater incentive to discover issues, we believe the likelihood of a clean audit is slim,” the analysts said.

“The FAA’s audit is limited to Max 9 for now, but it’s possible the findings could expand the scope to other Max models that share common parts.”

The FAA said Wednesday that inspections of an initial group of 40 Boeing 737 MAX 9 aircraft have been completed, a major hurdle to eventually dismantling the planes.

Boing’s shares closed Tuesday at $200.52, down nearly 20 percent from their Jan. 5 closing price before the Alaska Airlines incident

The Federal Aviation Administration has announced it will audit Boeing’s production line and its suppliers after the door blew off in mid-air on an Alaska Airlines plane

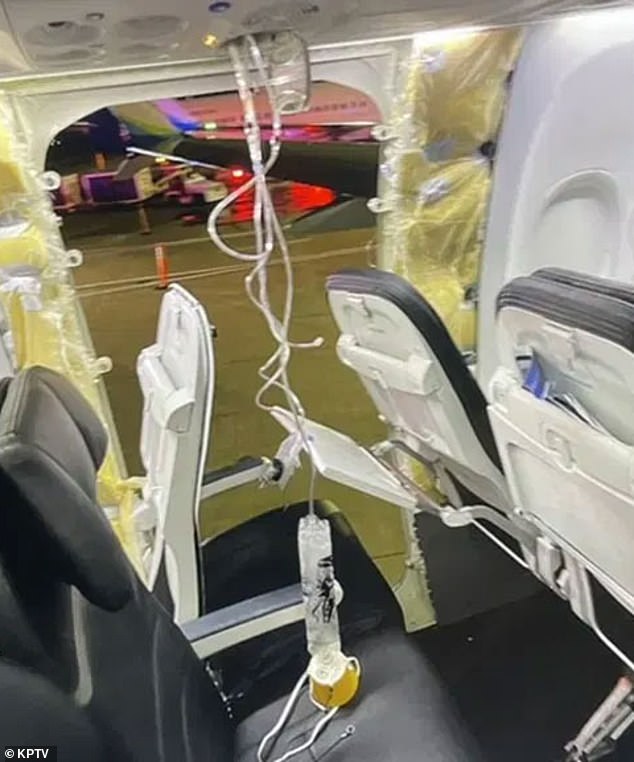

Boeing’s manufacturing processes have been under scrutiny since a panel on the Alaska Airlines plane tore off during flight near Portland, Oregon, on January 5, leaving a hole in the side of the plane.

The incident reignited concerns about Boeing’s MAX jets, a few years after a pair of crashes killed nearly 350 people. Investors are also concerned about possible delays in aircraft deliveries.

Boing’s shares closed Tuesday at $200.52, down nearly 20 percent from the Jan. 5 closing price before the Alaska Airlines incident.

The FAA grounded 171 MAX 9 aircraft on January 6 pending approval of inspections and maintenance requirements.

Alaska Airlines and United Airlines, the two American airlines that operate the affected aircraft, have had to cancel hundreds of flights since last week.

On Wednesday, the FAA said all 737-9 MAX aircraft with door plugs will remain on the ground pending the agency’s review and final approval of an inspection and maintenance process.

“The safety of the flying public, and not speed, will determine the timetable for returning these aircraft to service,” the agency said.

The chairman of the National Transportation Safety Board (NTSB) and the FAA safety chief will brief senators on the investigation on Wednesday, sources told Reuters.

Boeing on Tuesday appointed a retired US Navy admiral to advise the aircraft manufacturer’s CEO on improving quality control.

Kirkland H. Donald will serve as a special advisor to Boeing CEO Dave Calhoun, Boeing said.

Donald will lead a team of external experts in evaluating quality practices at Boeing Commercial Airplanes and its supply chain, and will make recommendations to the Calhoun and Boeing boards of directors.

An emergency exit used as a cabin window blew out of Alaskan Airlines flight from Portland to California at 16,000 feet

Appointing an outside consultant for the quality review is “hugely important” to ensure the findings are credible to the public, said Adam Pilarski, a senior vice president at consultancy AVITAS, who was previously chief economist at Douglas Aircraft.

“Boeing lost a lot of credibility on the MAX, and the FAA lost a lot of credibility on the MAX,” he said.

Ongoing MAX 9 investigations could increase pressure for management changes among Boeing’s top executives, analysts said.

“We would not be surprised if regulators, investors and customers push for turnover in senior management and the board of directors,” Bank of America’s Ron Epstein said in a letter to investors Tuesday morning.