Four more banks cut mortgage rates: when will two-year interest rates fall below 4%?

Another four mortgage providers cut their mortgage rates today, in the latest round of price reviews this year.

NatWest, HSBC, TSB and Metro Bank join a total of almost 50 other lenders who have cut their home rates since January 1.

The lowest five-year fixes are around 3.79 percent, while the lowest two-year fixes are now closer to 4 percent.

Price war: NatWest, HSBC, TSB and Metro Bank join a total of almost 50 other lenders who have slashed home rates since January 1

From today, NatWest reduced rates for homebuyers and first-time buyers by up to 0.4 percentage points on its two- and five-year fixed rate deals.

It means someone using a NatWest mortgage to move can get a rate of 3.94 per cent, with a fee of £1,495, if they have at least a 40 per cent deposit.

NatWest has also reduced rates for people refinancing. Two-year fixed deals have fallen by up to 0.35 percentage points, while five-year fixed deals have fallen by as much as 0.69 percentage points.

Someone remortgaging on NatWest’s cheapest five-year loan can now secure a rate of 3.89 per cent with a £1,495 fee. To qualify, they must have built up at least 40 percent equity in their home.

For a mortgage of € 200,000 that is repaid in 25 years, this could mean that you have to pay € 1,044 per month.

HSBC has also cut interest rates on its residential mortgages by 0.05 to 0.4 percentage points.

The cheapest deal is reserved for existing customers, who can receive a rate of 3.79 percent when remortgaging. Here too, they need at least 40 percent equity in the home to qualify for the cheapest rates.

Nicholas Mendes of mortgage broker John Charcol said: ‘This latest five-year deal at 3.79 per cent is particularly attractive if you are an existing HSBC customer, compared to some of the equivalent competitor refinancing deals in the market.’

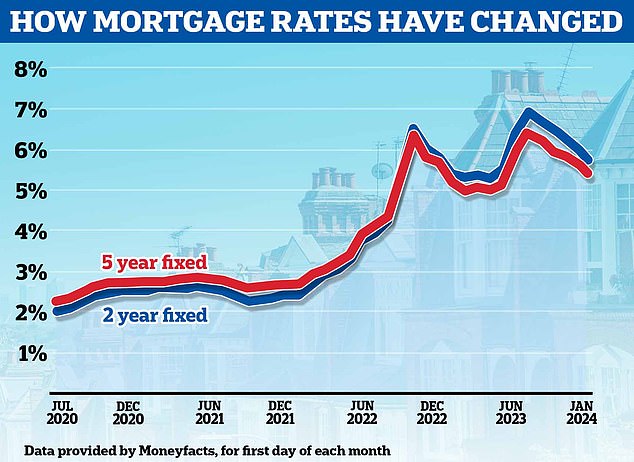

Downward trend: The average fixed mortgage interest rate has fallen since the summer

Cheaper deals for starters

First-time buyers can also benefit from HSBC’s latest cuts. Those with a 5 percent deposit can now get a five-year fixed interest rate of 4.99 percent from the bank. There are no costs involved and a cashback of € 1,000.

Those with a 20 per cent deposit can now secure a two-year fix of 4.78 per cent with HSBC. This costs £999 but offers £250 cashback.

Meanwhile, TSB has also announced a wave of rate cuts that will come into effect from tomorrow.

Internal product transfer agreements for TSB mortgage customers switching to a three- or five-year rate fix have been reduced by up to 0.7 percentage points.

Rohit Kohli, Managing Director, The Mortgage Stop said: “These rates from TSB will make every borrower think twice before signing a new deal with another lender.

“TSB has really thrown down the gauntlet with some of these cuts and we hope this rate war continues.”

Metro Bank has also announced interest rate cuts. Most notably, product transfer rates for existing customers fell from 6.19 percent to 4.79 percent.

Sofia Jones, mortgage and insurance adviser at Penny House, said: ‘It’s great to see Metro catching up with other lenders.

‘The product transfer speed will save one of my clients £35,200 in interest alone over two years.

‘The interest rate cuts we are now seeing have a hugely positive impact on people’s finances.’

Will two-year fixes fall below 4 percent soon?

According to Moneyfacts, the average two-year interest rate has fallen from 5.93 percent to 5.62 percent since the start of the month.

However, the cheapest two-year fixes for those with the largest deposits or the largest equity stakes in their homes approach the 4 percent mark.

Last week, Barclays’ cheapest two-year rate fix, reserved for those who buy with at least a 40 percent deposit, fell from 4.62 to 4.17 percent.

However, some mortgage brokers have warned that two-year fixed rates are unlikely to fall much lower than they are now.

The cheapest two-year solutions for people with the largest deposits or the largest equity stakes in their homes are approaching the 4% mark

This is because lenders tend to price their fixed-rate mortgages based on future market expectations for interest rates.

Market interest rate expectations are reflected in the swap rate. These swap rates are influenced by long-term market projections for the Bank of England base rate, as well as the wider economy, internal bank targets and competitor prices.

Sonia swaps are used by lenders to price mortgages. Five-year swaps are currently 3.51 percent. Two-year swaps now amount to 4.07 percent.

This is slightly higher than at the beginning of the year, when five-year swaps were 3.4 percent and two-year swaps were 4.02 percent.

Chris Sykes, technical director at broker Private Finance, said: ‘I’d like to see a sub-4 per cent fix for two years by the end of the year as I’m currently looking for a mortgage myself, but I won’t. think it’s realistic.

‘Two-year swaps are still more than 4 percent. We may see some cheap funding from lenders (like last week at the Co-op), but I don’t think we’ll see a consistent fixing of less than 4 per cent over two years for some time to come.”

Mark Harris, CEO of mortgage broker SPF Private Clients, is more optimistic that a 4 percent interest rate could be close.

He says: ‘The downward rate war continues to gain momentum, even though there is no guarantee that rates will continue to fall.

‘There will be dips again because it is still quite volatile out there, and there is a risk of inflationary pressure again, due to the problems in the Middle East.

“While the trajectory is generally downward, borrowers should be aware that if they like the look of an interest rate, it may not last long, so they need to secure it sooner or later.

“If this trend continues, fixes of less than 4 percent could be around the corner in two years.”

Nicholas Mendes of mortgage broker John Charcol suggests that if the inflation rate falls below market expectations, it could provide the necessary green light for a two-year fix.

“ONS data this morning provides more optimism about inflation, as the Bank of England’s inflation target of 2 percent is reached earlier than expected,” Mendes added. ‘As a result, the financial markets are pricing in further cuts in bank interest rates faster than last year.

“All of this plays into the swaps and lenders’ pricing is really taking advantage of the opportunity.

‘I do not rule out a correction of less than 4 percent over the next two years based on current market movements. We’ll have to wait for the inflation numbers and the governor’s notes to have an idea of when to expect them.”

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.