House prices will rise 3% in 2024, says property firm as it backtracks on 4% decline forecast

- Broker Knight Frank said just three months ago that prices would fall by 4%

- Widespread cuts in mortgage rates have led to a reversal in this forecast

- Since January 1, more than forty lenders have lowered interest rates

According to a major real estate firm, house prices will rise by 3 percent this year.

Broker Knight Frank had previously predicted a 4 percent decline by the end of 2024, but has reversed its forecast into positive territory due to falling inflation.

That forecast was made just three months ago, in October 2023, but the agency said a significant drop in mortgage rates since then had changed the outlook.

Positive: Knight Frank says average UK house prices will rise by 2024 – after previously saying they would fall

It also cited changing market expectations about what would happen to the Bank of England’s base rate in the coming year.

Knight Frank now predicts that house prices will rise by more than a fifth by 2028.

> Need a new mortgage? View the current rates on the This is Money mortgage finder

It said: ‘In October, financial markets had priced in a single interest rate cut of 0.25 percent by the end of 2024. They expected five at the end of last week.

‘The main reason for this changing outlook is that inflation is falling faster than expected.

‘As a result, mortgage lenders have cut their rates quite significantly in recent weeks, partly to attract customers in a low-volume market.

‘The best five-year fixed rate mortgage is now below 4 percent, which was made possible after the five-year swap rate fell by a full percentage point in the last quarter of 2023.

‘As a result of this more positive backdrop, we have revised our UK house price forecasts from three months ago.’

Since January 1, 44 lenders have reduced interest rates on products. The best five-year fixed deal is now 3.84 percent and the best two-year fixed deal is 4.24 percent.

However, deals are closing quickly, with some Co-operative Bank mortgages available for just three days.

Knight Frank also pointed to recent house price indexes that have produced more positive figures than previously forecast.

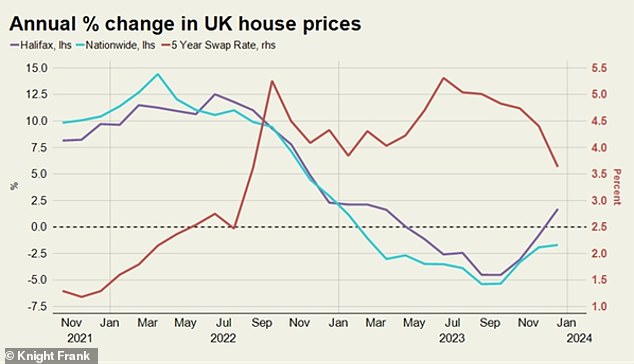

Fluctuations: This shows how the house price indexes have developed compared to the five-year swap rate. Swap rates show what the financial markets think the future holds for interest rates

Halifax reported a 1.7 per cent increase in 2023, while Nationwide recorded a 1.8 per cent decline – more positive than the 5 per cent decline both had forecast in August.

Knight Frank did say that London, one of the key markets, will see house prices rise by 2 percent less over the course of this year.

Looking further ahead, they predict that house prices will rise by a further three percent in 2025, followed by an increase of 4 percent in 2026, 5 percent in 2027 and 4 percent in 2028.

In total, this amounts to an increase of 20.25 percent over five years.

However, Knight Frank said these figures could be affected by the outcome of the next general election, as well as the ongoing conflict in the Red Sea, which could have an impact on global inflation.