California’s congested, crumbling streets will get even WORSE as EV sales rise and key gas tax revenues fall – after roads were rated ‘D’ on infrastructure report card

- Report warns California faces road funding shortage due to shift to electric vehicles

- Transportation revenues are expected to decline by $4.4 billion over the next decade

- The reimbursements for electric vehicles will not be enough to compensate for the lost tax revenue on gas and diesel

According to a recent report, California’s roads will face a funding gap as revenue from gasoline taxes that fund transportation infrastructure dries up due to the adoption of electric vehicles.

The report According to projects from the California Legislative Analyst’s Office, the state’s annual transportation revenues will decline by $4.4 billion, or 31 percent, over the next decade compared to current levels.

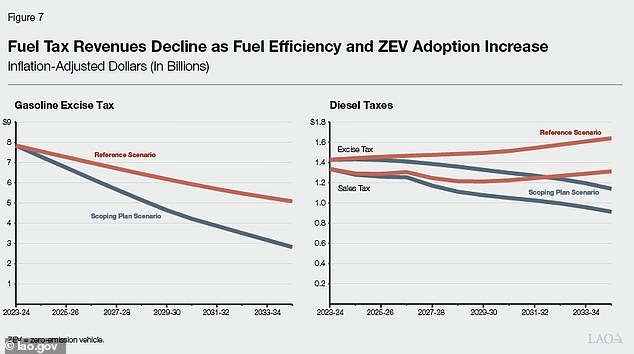

The decline includes a $5 billion, or 64 percent, decline in gasoline excise tax collections, as well as a $710 million decline in diesel tax revenues, or a 20 percent decline.

Declining fuel tax revenues would be partially, but not completely, offset by an expected $1 billion increase in annual registration fees for battery-electric and hydrogen fuel cell vehicles.

California’s roads are already among the worst in the country, receiving a penultimate “D” rating from the American Society of Civil Engineers in 2022, surpassing only Mississippi’s D-minus.

California’s roads will face a funding shortfall as gasoline tax revenues that fund transportation infrastructure dry up due to electric vehicle adoption

Gas tax revenues would fall below the base case anyway (red), but California’s plans to crack down on combustion vehicles (blue) will accelerate the trend, a report says

California’s transportation funding issue is an example of a dilemma many states will grapple with as they encourage the adoption of electric vehicles to reduce carbon emissions and combat climate change.

Thanks to generous tax breaks for owners, California is leading in electric vehicle adoption, with a 25 percent market share, according to data from the Alliance for Automotive Innovation.

In 2022, California regulators approved a measure, backed by Governor Gavin Newsom, that would effectively ban the sale of new gas-powered vehicles by 2035.

The recent report states that such measures will accelerate the shortfall in transport revenue.

“While we estimate that overall revenues would decline even below the baseline forecast due to continued increases in fuel efficiency and increased interest in zero-emission vehicles, the state’s recently adopted and planned policies will significantly accelerate these underlying trends,” it warns report.

California has the highest gasoline tax in the country, at 57.9 cents per gallon, on top of a 2.25 percent sales tax on fuel.

California’s long-term gas tax dilemma comes as the state faces pressing budget shortfalls.

According to the policy news site, revenues from fuel taxes and vehicle fees fund about a third of the state’s transportation spending CalMatters.

“As the state seeks to achieve its ambitious climate goals through the adoption of zero-emission vehicles and greater fuel efficiency in conventional vehicles, the report finds that we will see a decline in fuel tax revenues,” said Frank Jimenez, a senior tax advisor. policy analyst at the Legislative Analyst’s Office, the outlet told us.

California’s longer-term gas tax dilemma comes as the state faces pressing budget shortfalls.

Governor Newsom on Wednesday predicted a deficit of nearly $38 billion for the 2024-2025 budget year.

That’s less than the $68 billion the nonpartisan Legislative Analyst’s Office projected last month.

However, the shortage is so large that it could delay a minimum wage increase for more than 400,000 health care workers and force cuts to several housing and climate programs.