Fake tweet causes chaos in cryptocurrency: FBI investigates cyber breach… while regulator backs Bitcoin plans

Last night, a new bitcoin investment was finally approved, even as the FBI investigates a dramatic cybersecurity breach that sent shockwaves through the “Wild West” cryptocurrency industry.

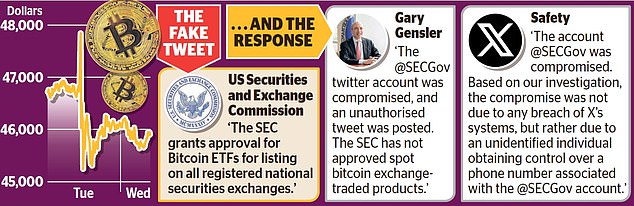

In a major embarrassment for authorities, a hacker broke into the U.S. Securities and Exchange Commission’s (SEC) X account and published a message Tuesday evening saying Bitcoin had received a regulatory boost.

Minutes later, SEC Chairman Gary Gensler corrected the record on his personal X account, saying the agency’s social media had been “compromised” and that the post on

But in a further twist, the regulator issued a new statement last night, saying the first so-called exchange-traded funds (ETFs) linked to bitcoin have been approved. The back and forth wreaked havoc on the crypto markets.

Bitcoin hit a two-year high of almost $48,000 on Tuesday evening after the fake tweet, before falling sharply after the clarification and rising again last night after approval was finally given.

Major decision: A bitcoin ETF is being heralded as a game-changer for the sector as it gives investors exposure to the world’s largest cryptocurrency without having to directly own it

An investigation has been launched into how the SEC account was hacked.

In a statement last night, a spokesperson for the regulator said: “The SEC continues to investigate the matter and is coordinating with appropriate law enforcement agencies, including the FBI.”

And commenting on the approval given to the ETFs, Gensler said: “While we approved the listing and trading of certain spot bitcoin ETP shares today, we have not approved or endorsed bitcoin.

Investors should remain cautious regarding the numerous risks associated with bitcoin and products whose value is tied to crypto.”

A bitcoin ETF is being heralded as a game-changer for the sector as it offers investors exposure to the world’s largest cryptocurrency without having to directly hold it.

Investment giants Blackrock and Fidelity back the idea and plan to launch products.

But the cyber breach threatened to overshadow the decision and further undermine confidence in the sector in the wake of scandals such as the collapse of crypto exchange FTX and the conviction of founder Sam Bankman-Fried for fraud.

Rogue tweet: A hacker broke into the US Securities and Exchange Commission’s X-account and posted that Bitcoin had gotten a regulatory boost

It is also very embarrassing for X, his boss Elon Musk, the SEC and Gensler.

Kurt Gottschall, former regional director of the SEC, said, “The irony here is that the SEC has not shown much sympathy for publicly traded companies and asset managers who have experienced cybersecurity incidents.”

Gensler, 66, who has led the SEC since 2021, once vowed to be the “cop on the beat” overseeing the “Wild West” of the cryptocurrency industry.

He has filed dozens of lawsuits, including against exchanges Binance and Coinbase.

US politicians used the security problem as an opportunity to launch an attack on the agency.

“It is unacceptable that the agency charged with regulating the epicenter of the world’s capital markets would make such a colossal mistake,” said US Republican Senator James David Vance.