Dave Ramsey shares his tips on how to become a millionaire – and four small steps are essential

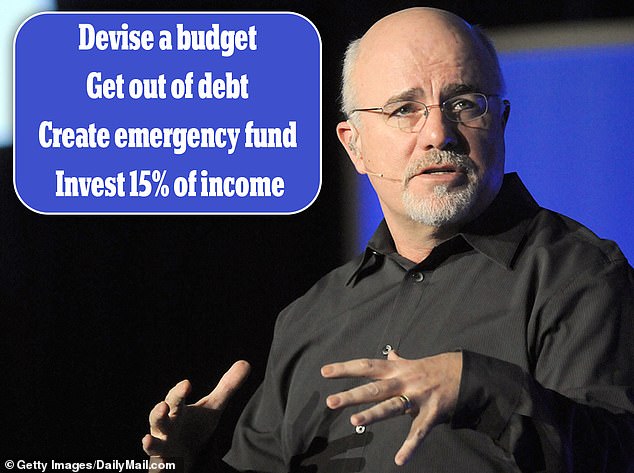

Personal finance guru Dave Ramsey has provided a set of instructions for Americans to follow if they want to become millionaires – and there are four key steps.

The best-selling author and podcast host shared its strategy with GOBankingRates and it includes planning a budget, eliminating debt, building an emergency fund, and ultimately investing in a retirement fund.

Although Ramsey noted the importance of income in generating wealth, the simple idea of spending less than you earn underpinned his entire approach.

He therefore described the lifestyle often associated with millionaires as a 'myth'.

“The typical millionaire has never had a credit card balance in their entire life, spends $200 or less on restaurants every month and still shops with coupons,” he said, referring to the recent National Study of Millionaires.

Personal Finance radio host Dave Ramsey (pictured) has shared a set of instructions for Americans to follow if they want to become millionaires

Ramsey's full rationale is outlined below:

Come up with a budget

According to Ramsey, it all starts with clearly identifying all expenses in a budget. This involves listing your income and expenses and keeping track of the difference.

“The first step is to make sure you're living on a written monthly budget,” says Ramsey.

“Give every dollar a name – and a job – before the month starts. This is the only way you can be sure how much money you have to work with,” he added.

According to his strategy, every transaction must be recorded and the budget updated before each month.

Getting out of debt

Ramsey suggested that the process of building wealth must begin with eliminating all debt. He called the method he recommended 'the snowball method'.

Perhaps counterintuitively, the point is to tackle the smallest debts first.

'Make a list of all your debts, from smallest to largest, regardless of the interest rate. Pay a minimum on all but the smallest debts and throw as much money at them as you can,” he said.

“Once that debt is gone, take its payment and apply it to the next smallest debt, while continuing to make minimum payments on the rest. Repeat this method as you work your way through debt.'

According to Ramsey, it's important to focus on smaller debts before larger ones to keep morale up.

“If you start with the biggest debt, you won't see real results for a long time,” he said. “When this happens, most people lose their strength and quit before they get close to finishing.”

Once three to six months of expenses have been saved in an emergency fund, Ramsey recommends investing about 15 percent of income in a retirement fund such as a 401(k) or Roth IRA.

Build an emergency fund

Once expenses are less than expenses and all debt has been eliminated, it's possible to start saving, Ramsey advises.

First, he recommended setting up an emergency fund that can be tapped in the event of job loss or unexpected expenses, such as a medical bill.

“Make sure you have an emergency fund where you can save three to six months of expenses before investing for retirement,” Ramsey wrote.

“If you start investing before you've built an emergency fund, you'll end up having to tap your investments when the unexpected happens—and potentially ruin your financial future in the process.

“The fastest and right way to become a millionaire is to invest consistently over a long period of time.” That can only be done if debt is eliminated and emergency funds are prepared, Ramsey said.

To invest

Finally, Ramsey suggests that once that emergency fund is saved, you can invest any extra income you save each month into some type of fund.

“Invest 15 percent of your gross income in retirement accounts such as a 401(k) and Roth IRA,” Ramsey said.

“Do this for a few decades, and you will be able to live and give like no other.”