You can now get a mortgage below 4% with a 10-year fix from HSBC and First Direct

First Direct is the latest major mortgage provider to announce it will reduce mortgage rates.

It joins HSBC, TSB, Halifax, Mpowered Mortgages and Gen H in what has become a price war between major lenders to boost the year.

From tomorrow, First Direct will reduce rates across its entire fixed rate product range and include two sub-4 percent deals, one of which has a ten-year term.

This will bring the total number of sub-4 percent mortgage deals on the market to 10; eight of these are for five years and two for ten years.

Lock-in: from tomorrow, the number of mortgage agreements under 4 percent on the market will increase to 10. Eight of these are for five years and two for ten years

First Direct's lowest ten-year fixed rate mortgage will drop from 4.97 percent to 3.99 percent and is available to borrowers with at least a 40 percent deposit or an equity interest in their home.

This involves a mortgage amount that does not exceed 60 percent of the home value.

Earlier today, stablemate HSBC also released a ten-year 3.99 per cent solution, aimed at people taking out a new mortgage with at least a 40 per cent equity stake in their home.

The bank also announced that existing customers who have 40 percent equity in their home will be able to access a 3.87 percent deal, with a fee of £999.

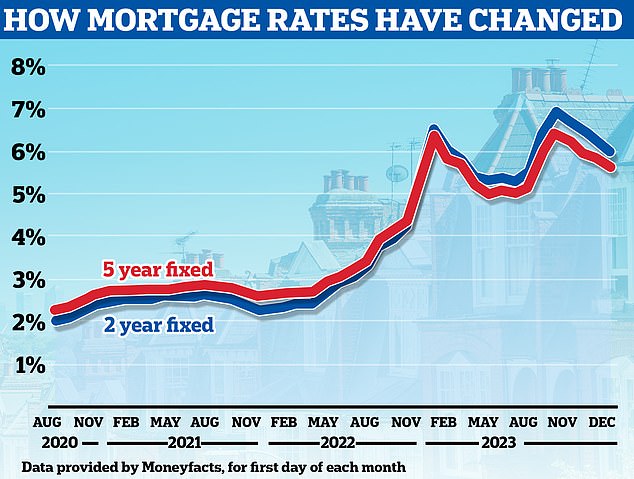

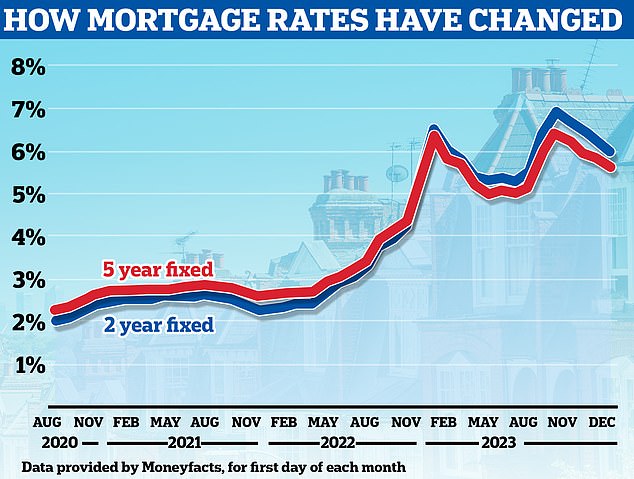

After two years of volatile mortgage rates, which have seen the average rate swing from a low of 2 percent to a high of nearly 7 percent, some borrowers may be tempted to hold on for the long term.

David Hollingworth, associate director at L&C Mortgages says: 'The big advantage is that you know where you will be in the next ten years.

'This could be suitable for people who still have ten years left on the term of their mortgage, have no plans to move and want to avoid further interest rate fluctuations.'

The big advantage is that you know where you will be in the next 10 years. The disadvantage is that if interest rates continue to fall, this could mean that better rates become available, but the borrower is bound for the entire fixed-rate period.

David Hollingworth – L&C

Chris Sykes, mortgage technical manager at private finance broker, adds: 'The big advantage is the certainty and the fact that you save on refinancing costs every two to five years, which can add up.

“This, in addition to not having to worry about the need to refinance, could be over quite quickly in two or five years.”

Although a ten-year fixed rate period can provide borrowers with certainty about their monthly payments in the future, it also means that they cannot close the mortgage early without paying fees.

Hollingworth added: 'The downside is that if interest rates were to continue to fall, this could mean better rates become available, but the borrower would be locked in for the full fixed rate period.

'This can also limit the flexibility they have if they want to revise their rate later, for example because of a move.

'The mortgage is transferable and can therefore be taken to a new property, but there is no guarantee that the borrower will be able to meet the lender's criteria at that time, or that, if he needs to borrow more, what rate he will get at a can receive any supplement.'

David Hollingworth says the problem with ten-year fixed rates is that if rates continue to fall, it could mean better interest rates become available, but the borrower is locked in for the entire fixed rate period.

As a result, some borrowers will be reluctant to commit for such a long period, preferring to reconsider in a few years, especially if they think interest rates will fall.

Currently, lenders are lowering interest rates almost every day. So far in January, both HSBC and Halifax have cut rates, while MPowered Mortgages signed some great five-year fixed rate deals earlier today.

TSB and a new lender Gen H have also introduced some low rates. TSB's two-year First Time Buyer mortgages have been reduced by up to 0.55 per cent, with rates now starting at 4.54 per cent for those with the largest deposits.

“I doubt there will be much take-up of these ten-year fixed rates,” says Sykes, “with the general expectation among borrowers that rates will continue to fall, so probably leaning towards two or five-year fixed rates, especially if five-year prices are at a low level. similar level now in many circumstances.

He adds: 'Ten-year fixes have never had much interest because they generally have significant early repayment charges and the ten-year term is difficult to predict.'

Falling: Average fixed-rate mortgage rates have fallen since September last year and further cuts are expected

Mortgage brokers say much more is coming.

David Hollingworth of L&C Mortgages added: 'We can't rule out further cuts and I expect many borrowers will want to see where things progress from here.'

Chris Sykes added: 'I have heard on good authority from other lenders that we will see higher rates of less than 4 per cent in the coming week.'

The advice for those approaching their remortgage date or even those looking to buy is to obtain a mortgage offer as soon as possible.

Mortgage deals typically have a term of six months, meaning borrowers can lock in an interest rate within six months before their current deal expires.

In the meantime, they can always secure another offer if rates continue to fall.

Hollingworth added: 'It is possible to secure one of the better rates on the rise, so that is in the bag and then subject to another review in the next six months.

'If rates continue to fall, it is possible to switch to a new rate, but if there is a change in rate, at least a product is already available.

'If you want to see what happens, you shouldn't wait until the last minute. It is better to secure a deal a few months in advance, so that you can smoothly switch to a new deal and you do not slide into a high standard variable interest rate.'

What other deals has First Direct made?

First Direct also offers a five-year fix of 3.99 per cent for people who need a mortgage of no more than 60 per cent of a home's value.

For the two- and three-year fixed interest rates, rates start at 4.54 percent for new customers and 4.49 percent for switching customers.

It has also announced significant cuts, aimed at those buying or remortgaging with lower deposits or lower equity.

Those who need a mortgage covering 90 per cent of a property's value can get interest rates from 4.69 per cent through the five-year Fixed Standard mortgage.

All First Direct deals have a low product cost capped at £490, giving borrowers unlimited overpayments each year.

The unlimited overpayments differ from most other lenders, who typically limit overpayments to 10 percent of the mortgage amount per year.

Liam O'Hara, head of mortgages at First Direct, said: 'While our main rate cuts are in the ten- and five-year periods, we are also making substantial cuts of up to 0.45% across our two- and three-year rates. product ranges with a fixed annual rate.

'Whether people are taking their first steps on the ladder, moving or taking out a new mortgage, we offer a range of flexible features designed to add value and support our customers.

'These include unlimited overpayments on all our mortgages, maximum terms of 40 years and product booking fees capped at £490.'

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.