Apple lost $100 billion in market value in one day – more than combined worth of Ford and GM – and ‘lackluster’ sales of one gadget are to blame

Apple's stock price fell more than four percent last day, wiping more than $100 billion from its market value.

The one-day drop is greater than the combined value of Ford and General Motors.

Sluggish sales of the $1,599 iPhone 15 – and fears that even the next model, due in September, will also disappoint – led Barclays to announce on Tuesday it would cut shares.

That caused an immediate 4 percent drop in the stock price, which now hovers around $184 — a seven-week low — after being above $192.

Apple's valuation fell by $107 billion, according to Refinitv data.

Apple's stock price fell to a seven-week low on Wednesday, dropping its market value by $107 trillion. During normal trading hours, it closed at $184.25, down $8.19 – or 4.26% – from five days ago

An analyst at Barclays downgraded Apple shares, causing them to fall in value. Barclays said sales of the iPhone 15 – held up by Apple CEO Tim Cook – were “lackluster”.

AirBnB, Fed Ex, Citigroup and Starbucks are all worth less than that amount. Together, Ford and GM, once two of the largest companies in the world, are not even worth that amount.

Barclays thinks Apple shares will fall to $160, and is advising its clients to sell shares if they have them.

Barclays analyst Tim Long said sales of Apple's iPhone 15 smartphones were “lackluster” and that the upcoming iPhone 16 “should be the same.”

“We don't see any features or upgrades that are likely to make the iPhone 16 more attractive,” the note adds.

Apple has been dealing with a slowdown in demand since early last year and expects sales during the holiday quarter to be below Wall Street estimates, especially for the iPhone, which makes up the bulk of its revenue.

Sales of Mac computers and iPads were also weak, and service revenue (for example, iCloud, Apple TV+ and Music fees) is not expected to grow more than ten percent.

'We expect a return [of the share price] after a year in which most quarters were missed and the stock outperformed,” Long said.

Huawei P60 Pro challenges Apple's iPhones in China

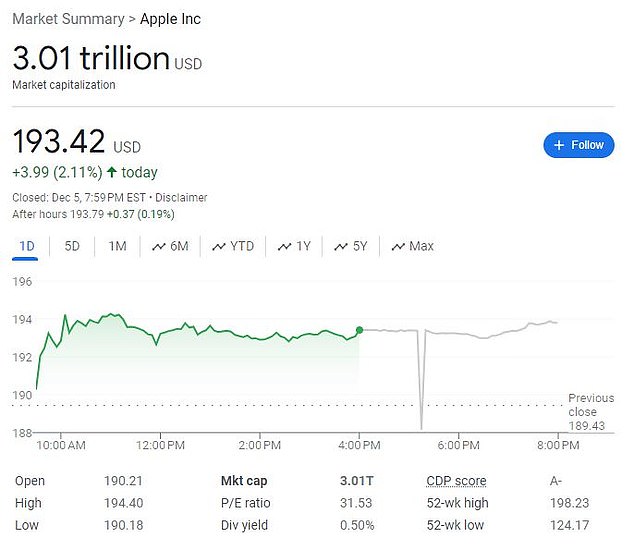

Apple shares rose 50 percent to hit a record high last year, making it the first company with a market value of more than $3 trillion. It reached the milestone first in June and then again in early December, when shares were above $193.

The sales slowdown in China is the biggest problem for Apple, according to analysts. This happens for two main reasons.

Chinese rivals such as Huawei are gaining market share there, and Beijing has placed restrictions on the use of iPhones by government workers.

According to BloombergSmartphone data company IDC has lowered its 2024 forecast for Apple's Chinese sales.

“Huawei's success has the biggest impact on Apple's growth in China,” said IDC research director Nabila Popal.

Huawei's share of high-end smartphones rose to 24 percent in the third quarter of 2023, compared to 11 percent the year before.

AJ Bell's head of financial analysis Danni Hewson said it's not just China: Americans are also spending less, which is hitting Apple

“Once again, Chinese competition is a factor,” she said Business insider“But because high interest rates do the job they're intended to do and consumers continue to think carefully about high-dollar purchases, technology like iPhones are the ultimate nice to have, so many potential customers end up delaying their purchase until their budget runs out. less limited.'

Barclay's downgrade means Apple has five Sell or equivalent ratings, according to Bloomberg.

But there are still 34 analysts who rate it a Buy, and 14 consider it a Hold.

Sales of the latest iPhone 15, which cost up to $1,599, were disappointing

Tensions between the US and Chinese governments have affected Apple's plans in other ways. The tech giant has started moving production of iPhones out of China – and hopes to soon have one in four made in India.

Companies are increasingly concerned about their overdependence on China, fueled by diplomatic efforts by the US and its allies to block Beijing's access to advanced technology.