How many credit cards should you have? The answer isn’t zero, say experts

Nearly three in 10 Americans believe credit cards are “dangerous,” a survey suggests. But should we really be so afraid of a small debt?

Financial advisors and credit experts emphasize that everyone should have at least one card to ensure they build a good credit score, as long as they are responsible.

“I would say two cards are optimal and three are maximum to keep finances simple,” certified financial planner Cathy Curtis of Oakland, California, told me. CNBC.

Two is beneficial because if an individual relies on it, they run the risk of not being able to use it in some stores.

Bruce McClary, senior vice president at the National Foundation for Credit Counseling, told us CNBC: 'In those cases it may make sense to have two different card types: Visa and Mastercard, for example.'

Financial advisors and credit experts say that two credit cards is the optimal amount to own, while three is a maximum

Ted Rossman, senior industry analyst at Bankrate.com, recommends spreading loan applications over periods of two or six months.

He added that business owners may also want to separate their personal and business expenses by using two cards.

According to the Consumer Federation of AmericaBy managing your credit responsibly, households qualify for lower interest rates and fees, allowing them to save more.

But users need to understand how to use it responsibly by keeping their balance small and paying it off regularly.

As a general rule of thumb, experts recommend using no more than 30 percent of your total balance and paying it off in full each month when their statement is due. Someone with an available limit of €10,000 must therefore avoid going more than €3,000 into the red.

But if someone needs the money urgently, having two cards can help users spread out their credit usage and keep the two balances low.

However, McClary warned that having too many cards makes individuals appear as “compulsive borrowers” to lenders – even if their balances are under control.

Ted Rossman, senior industry analyst for Bankrate.com, recommends spreading applications over two- or six-month periods.

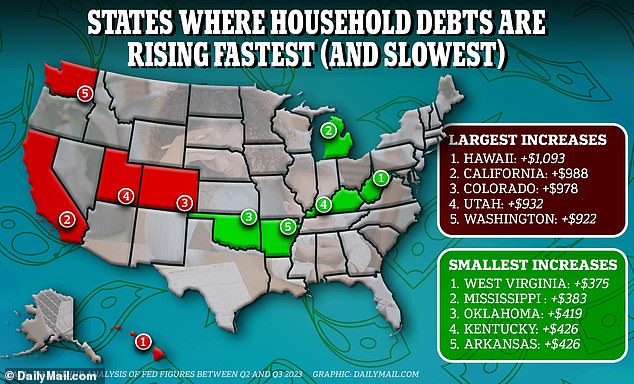

New York Federal Reserve data shows US credit card balances rose 4.7 percent to $1.08 trillion in the third quarter of the year

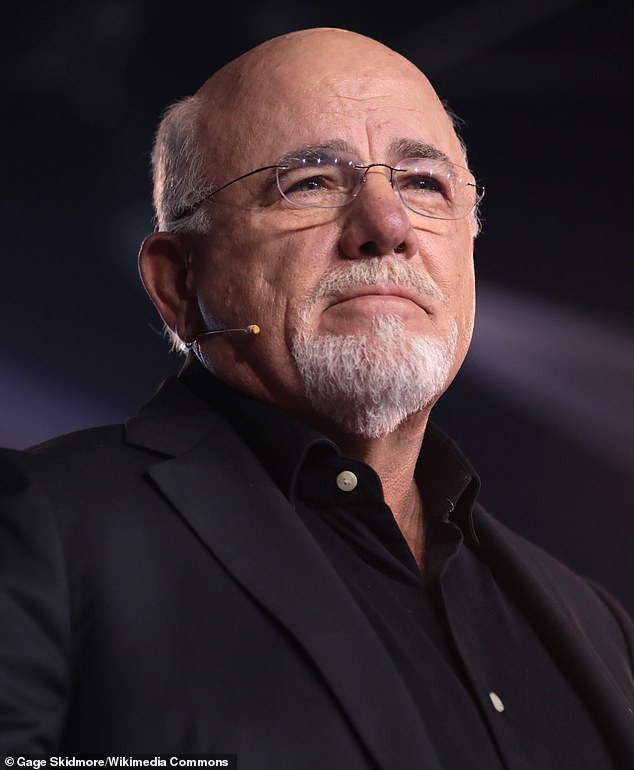

Outspoken personal finance expert Dave Ramsey is completely against the use of plastic and regularly advises his followers to cut theirs up

He adds that new cardholders should try to find a card with no annual fees and no interest.

Bank ratetogether with NerdWallet And CreditCards.comoffer comparison services to help customers find the best deals.

The forecast comes amid concerns about rising U.S. credit card debt caused by high inflation.

Data from the New York Federal Reserve shows that credit card balances in the US rose 4.7 percent to $1.08 trillion in the third quarter of the year.

The problem is exacerbated by the fact that the Fed has raised interest rates in 2023 to a 22-year high of between 5.25 and 5.5 percent. This, in turn, has pushed the average credit card interest rate to 20.74 percent.

It's no wonder that the topic of credit can be controversial.

Outspoken personal finance expert Dave Ramsey is completely against the use of plastic and regularly advises his followers to cut theirs up.

And a recent study from NerdWallet found that 26 percent of Americans considered credit cards “dangerous,” even though 51 percent said they were “useful.”