FTSE 100 ends 2023 on a high as Rolls-Royce and M&S make major revivals

- London's main stock index ends the final trading session of 2023 at 7733.2

- This was 3.8% higher than at the end of last year

- That represents an increase of £71 billion in the combined value of its constituent companies

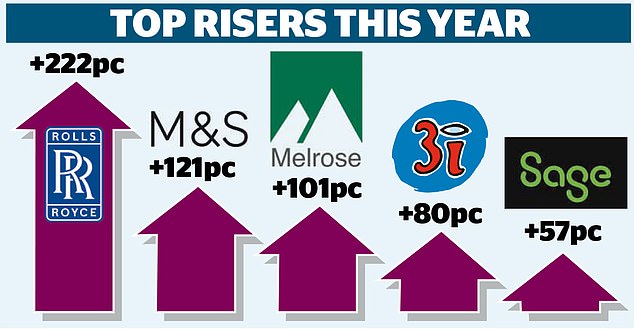

The FTSE 100 has made a profit for the third year in a row – boosted by spectacular turnarounds from British giants such as Rolls-Royce and Marks & Spencer.

London's main stock index ended its final trading session of 2023 at 7733.2, which was 3.8 percent, or 281.5 points, higher than the end of last year.

That represents an increase of £71 billion in the combined value of its constituent companies.

The more domestically focused FTSE 250 gained 4.4 percent over the year.

Gains: London's main stock index ended its final trading session of 2023 at 7733.2, which was 3.8 percent, or 281.5 points, higher than the end of last year

However, UK indices have underperformed compared to US and European rivals – something that will not help efforts to stem an exodus of UK listed companies to foreign stock exchanges.

It's been a strong year for the pound, which rose more than six cents, or 5 percent, against the US dollar to over $1.27, its best performance since 2017.

In terms of shares, the value of engine manufacturer Rolls-Royce has more than tripled over the year under new CEO 'Turbo' Tufan Erginbilgic.

The eye-popping rise came after Erginbilgic, who described the company as a “burning platform” shortly after his arrival, announced proposals to cut costs, cut jobs and boost profit margins.

At the same time, the company has benefited from the recovery of air travel after the pandemic.

Meanwhile, Marks & Spencer, led by CEO Stuart Machin, has regained its luster with shares more than doubling, amid signs that efforts to revive sales of women's clothing are finally paying off.

However, at 272.4p the share has only just returned to 2019 levels.

The broader FTSE 100 has been supported in recent weeks by growing hopes of interest rate cuts from major central banks next year.

On a day of low market activity yesterday, the price rose by a modest 10.5 points.

But for December as a whole, rates rose by as much as 3.7 percent, the best monthly performance since January, helping to put a positive glow on the year as a whole.

The turbulent 12 months saw the index rise to more than 8,000 points in February, a stormy start to the year before a banking crisis that claimed US Silicon Valley Bank and Swiss giant Credit Suisse dragged the index down.

Traders are also concerned about when central banks in the US, Britain and Europe will cut interest rates.

Increasing signs that they will do so from next spring have fueled the latest rally. They have also stimulated demand for bonds, whose yields fall as their prices rise.

Responsible: Tufan Erginbilgic is the CEO of Rolls-Royce

Ten-year UK bond yields were yesterday on course for the biggest monthly fall since 2008, when the Bank of England cut rates during the financial crisis.

But the rally for London shares was meager compared with elsewhere.

In New York, stocks rose to their highest levels ever this week, or close to them.

And Wall Street's S&P 500 index is up 25 percent this year, while Germany's Dax is up more than 20 percent.

Susannah Streeter, head of money and markets at Hargreaves Lansdown, said: 'The FTSE 100 has stumbled over the edge, making modest gains this year but failing to put out the lights.'

Streeter said the FTSE's gains this year were a “paltry increase” compared with global peers.

“The FTSE 100 reached the heady heights of 8047.06 in February but has struggled to regain its form,” she added.

'Britain's blue-chip index still seems unloved, with the attention drawn to the bright lights of Wall Street and the tech-heavy makeup of the New York stock exchanges, with a frenzy for all things AI that stimulates purchasing behavior.

“Although the Brexit hangover has subsided, the stagnant economy and volatile political scene of recent years appear to be deterring investors.”