Bond Street glittering this Christmas despite luxury slump

Bond Street, London's chicest shopping street, puts on a dazzling show this Christmas.

The glossy boutiques of the luxury brands are decorated with the most striking decorations. However, the exuberance of the displays belies the gloomy sentiment surrounding the shares in these companies.

The post-pandemic urge to spend lockdown savings on expensive bags, clothes, jewelery and spirits has waned due to pressure on the cost of living. The slowdown was particularly pronounced in America and China.

Best foot forward: Bond Street, London's chicest shopping street, is putting on a dazzling show this Christmas

For a while, LVMH, the industry's £330 billion titan, seemed almost untouchable, thanks to the pull of Sephora, Tiffany, TAG Heuer and its other 'houses'.

But last month, in a shocking move, Edouard Aubin, the influential Morgan Stanley analyst, cut his price target for shares in LVMH from €860 (about £740) to €790 (which is almost £680), citing declining demand for LVMH. goods. These include the £2,240 Loop Boho Louis Vuitton bag.

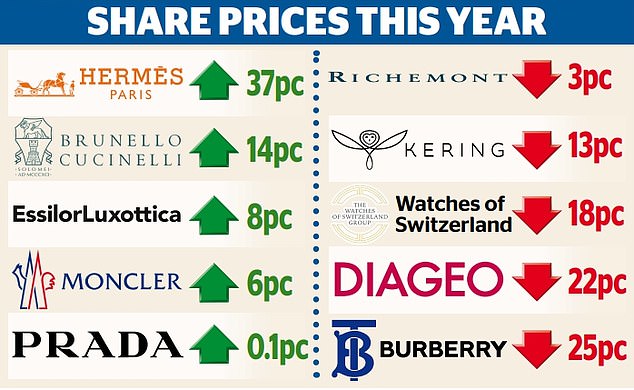

As I walked down Bond Street, I paused to admire the merchandise in the glittering windows Burberry, whose shares have fallen 28 percent since January. I also looked at fashion at Gucci, a division of the Kering empire, which has seen its price drop 17 percent.

The jewelry at Cartier, worn by singer Taylor Swift and actor Timothee Chalamet, was another reason to stick around. Cartier is one of the trinkets in Richemont, the Swiss conglomerate.

Have stocks fallen? Yes, by 11 percent, regardless of these star associations. These declines led me to plan how I could focus my buying on luxury stocks, betting that these names would have the creativity and power to overcome their trials.

Claudia D'Arpizio and Federica Levato of consultancy Bain remain optimistic, predicting that global luxury sales will reach a record £311 billion 'despite near-term uncertainties'.

In the fall, LVMH CEO Bernard Arnault began buying the company's shares after disappointing second-quarter earnings. In the spring, Arnault was briefly the richest man in the world, suggesting a certain level of investment acumen.

Stock buying: In the fall, LVMH CEO Bernard Arnault, pictured, started buying the company's shares after disappointing second-quarter results

Goldman Sachs analyst Louise Singlehurst rates LVMH a 'buy' with a price target of €950 (£816). Arnault's confidence in the prospects may rest on such estimates.

It may also be based on the view that consumers have not lost their taste for premium products, but are instead making different choices. The crisis in the Chinese real estate market has led to Chinese billionaires to – slightly – cut back on cognac.

Swetha Ramachandran, manager of the Artemis Leading Consumer Brands fund, says: “They used to drink the $3,000-a-bottle Remy Cointreau cognac. They have not stopped drinking cognac, but are switching to the slightly cheaper versions.'

In contrast, some wealthy people are buying less, but better, in a flight to quality that explains why the S&P Global Luxury Index is up 8.7 percent from the start of the year. Some luxury stocks haven't lost their shine.

Take for example Brunello Cucinelli, famed for its £940 cashmere sweaters. Shares in this Italian company have risen 13 percent since January. Hermes, the 186-year-old maker of the status symbol Birkin and Kelly handbags, is also up 32 percent.

Ramachandran says Hermes has price and staying power that provide a defensive moat against upstart rivals, essential qualities for inclusion in the fund. She expects the road to be bumpy, but adds, “The long-term runway for growth is strong.”

Her optimism is based on the growing number of affluent consumers in Asia, where five people join the middle class every second.

You may not be convinced that America and China will regain their taste for £47,000 TAG Heuer Carrera watches in any reasonable time. But your fortune will depend on the fate of some of these companies if you have money in several popular funds.

Burberry is a holding company of Lindsell Train UK Equity and Finsbury Income & Growth. Fundsmith owns LVMH and L'Oréal, whose luxury beauty lines include Yves Saint Laurent. Meanwhile, Smithson has a stake in Moncler, whose quilted jackets are worn by singer Dua Lipa.

I am an investor in both Fundsmith and Smithson. But on my Christmas list is the Amundi S&P Global Luxury exchange traded fund (ETF), and in the new year I will be looking for more weakness in Kering, LVMH, Richemont and the rest.

I love glamorous accessories, but I also want the value of my portfolio to be appreciated like a good cognac.

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.