The rise of the solo female homebuyer! Single women now make up 19% of Americans buying property – DOUBLE the number of men, new study shows

- This is in stark contrast to forty years ago, when the proportion of single women and men buying a house was about the same

- The share of recent buyers who are married has also fallen to 59 percent – the lowest level since 2010

- According to the National Association of Realtors, the typical single female buyer is slightly older than the average male buyer

While home buying has traditionally been the preserve of married couples, homeowners in the U.S. are now increasingly single women.

Female buyers alone now make up 19 percent of U.S. homebuyers — nearly double that of single men — according to the latest figures. facts of the National Association of Real Estate Agents (NAR).

This is in stark contrast to forty years ago, when the share of single women and men buying a house was about the same: 11 percent and 10 percent respectively. As of 2023, the share of single men buying property has remained stable at 10 percent.

According to the NAR, the share of recent buyers who are married has also fallen to 59 percent – the lowest level since 2010.

In 1981, when the organization began analyzing the profiles of buyers and sellers, married couples made up 73 percent of homeowners.

Female real estate buyers alone now make up 19 percent of U.S. homebuyers – nearly double that of single men

The share of unmarried couples buying a home has also risen slightly over the past four decades, from 6 percent in 1981 to 9 percent in 2023, the data show.

According to the NAR, the typical single woman buying her first home is 38 – compared to 33 for a man.

In general, home buyers are also getting older. In the 1980s, the average first-time homebuyer was 29 years old, compared to 35 this year.

It comes after analyst Meredith Whitney warned that younger people are missing out on $21 trillion in equity that older generations have built through home ownership.

Whitney, once dubbed the “Oracle of Wall Street” for accurately predicting the 2008 financial crisis, said young people have been priced out of the housing market due to high mortgage rates and rising prices.

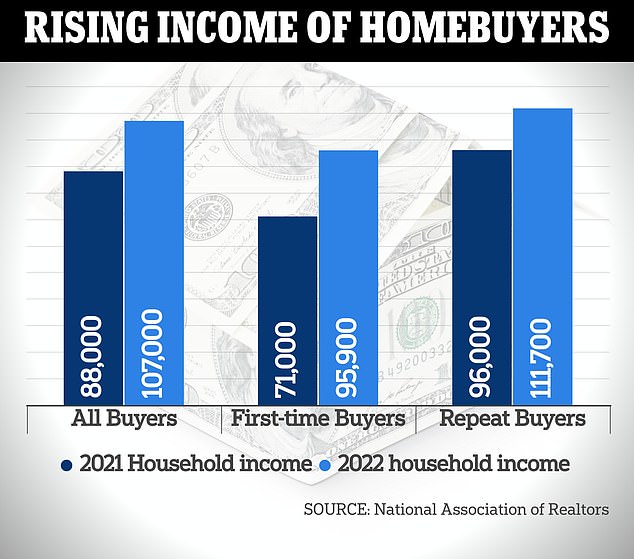

The NAR report also shows that the average homebuyer’s income increased this year to $107,000 from $88,000 in 2022 as home prices trend upward amid low inventory.

The median income for first-time buyers also rose to $95,900, up from $71,000 last year.

“Given the erosion of housing affordability due to higher home prices and mortgage rates, household income for those who successfully purchased homes has increased by nearly $20,000 and is above six figures for only the second time in our archives,” said Jessica Lautz, deputy chief economist and vice president of research at NAR Bloomberg.

The NAR report also found that the average homebuyer’s income rose from $88,000 to $107,000.

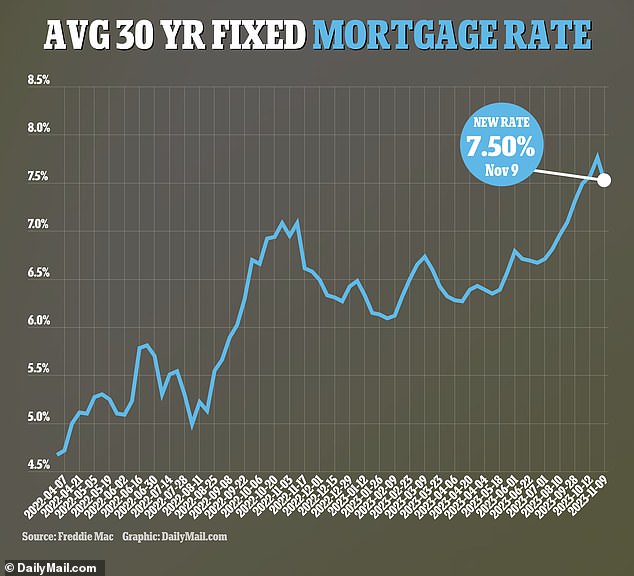

The average interest rate on a 30-year mortgage has fallen to 7.50 percent, according to the latest figures from November 9.

According to the NAR, the average home buyer will also buy cash more often this year.

About 20 percent of buyers paid cash in 2023 – to avoid rising mortgage rates.

That’s up from 13 percent in 2021, before the Federal Reserve began its brutal rate hike campaign in an effort to curb persistent inflation.

The average 30-year fixed-rate mortgage agreement has remained high this year, rising nearly 8 percent last month.

According to the latest figures from government-backed lender Freddie Mac on November 9, the average interest rate has fallen slightly to 7.50 percent.