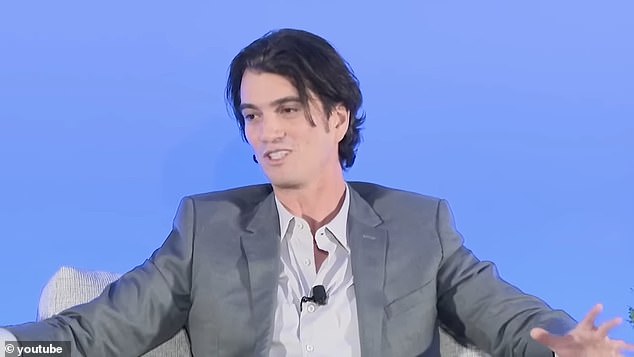

Disgraced Adam Neumann spends his days SKATEBOARDING near $44M Florida mansion after his start-up WeWork collapsed into bankruptcy

WeWork may be bankrupt, but founder Adam Neumann and his wife are living a sunny life in South Florida, where he now spends his days skateboarding and looking for new investors.

Neumann, 44, bought the two adjacent waterfront properties in 2021 for $44 million — just weeks after he was ousted from WeWork and handed a nearly $1 billion golden parachute amid accusations of mismanagement and fostering a toxic work environment.

The company has since filed for bankruptcy, but Neumann and his wife Rebekah, a cousin of Gwyneth Paltrow, are reportedly living peacefully in Bal Harbor, just 10 minutes from their friends and fellow New York City exiles Ivanka Trump and Jared Kushner.

The Israeli-American and his family have become a major presence in the Jewish community in the affluent area, and he is often seen skateboarding and socializing — and still looking for investors for his next idea, as reported by The New York Post .

Neumann is reportedly promoting a new, world-changing idea in Miami, saying it will change the way people “live at home” while claiming, “I am a creator, not a destroyer.”

Adam Neumann and his wife Rebekah live in Bal Harbour, Florida

Neumann, 44, bought the two adjacent waterfront properties for $44 million in 2021 — just weeks after he was kicked out of WeWork

“Adam skateboards all the time, all over town, taking business calls. Everyone encounters him; he is very friendly. He stops and kibitzes with people,” a source told the outlet.

While Neumann has been working in the city looking for investors, Rebekah, 45, has reportedly kept a low profile and cared for their six children.

The properties, which total 50,000 square meters, offer multiple berths in the marina. As part of the deal, Neumann received a $1 million fee for unfinished construction.

At the time of the purchase, Neumann said one of the lots will be used to build a 14,000-square-foot home. The other lot was an empty lot. All together, the two hug 360 feet of coastline.

The hard-partying Neumann was once seen as a star of the business world, but his reputation was left in tatters after investors balked at his tequila-fueled management style and eccentric ways, derailing plans for a 2019 initial public offering.

While Neumann’s investors were willing to entertain his eccentricities after he co-founded WeWork in 2010, his freewheeling ways and party-loving lifestyle came into focus when he failed to get the company’s IPO going.

Neumann oversaw one of the biggest corporate implosions in recent history, after WeWork’s valuation fell from $47 billion in early 2019 to less than $8 billion later that year.

In total, the company had raised about $11 billion from investors to build a company that is still worth less today.

The company provides shared office space, internet connection, cleaning service and a reception desk, making it popular with small businesses and tech startups.

The properties, which total 50,000 square meters, offer multiple berths in the marina

Neumann is reportedly promoting a new, world-changing idea in Miami, saying it will change the way people “live at home” while claiming, “I am a creator, not a destroyer”

Rumors of the company’s bankruptcy filing have dogged them for some time, after they told regulators there was “substantial doubt” about its ability to remain in business in the coming year.

Shares of the flexible workspace provider fell 32 percent in extended trading after the Wall Street Journal first reported the news. This year they are down about 96 percent.

Last month, WeWork said it had reached an agreement with creditors for a temporary deferral of payments on some of its debt, with the deferment period nearing an end.

The company had net long-term debt of $2.9 billion and more than $13 billion in long-term leases as of the end of June, at a time when rising financing costs are hurting the commercial real estate industry.

It was a stunning turnaround for the company that was privately valued at $47 billion in 2019, and a black mark for billion-dollar investor SoftBank.

The company has been in turmoil since its plans to go public in 2019 imploded

The company has been in turmoil since plans to go public in 2019 imploded due to investor skepticism over its business model of taking long-term leases and renting them out for the short term, and concerns about large losses .

WeWork’s problems did not abate in subsequent years. It ultimately managed to go public in 2021 at a much lower valuation. Its main backer, Japanese conglomerate SoftBank, has invested tens of billions to back the startup, but the company has continued to lose money.

The company in August expressed “substantial doubt” about its ability to continue as a going concern, with numerous top executives, including CEO Sandeep Mathrani, leaving this year.

Since leaving WeWork, Neumann has been trying to drum up support for his startup Flow, which promises to “build rental communities that will foster a sense of ownership and community.”

He claims the company will transform the way people interact with their homes and give them a sense of ownership, even if they rent.

To illustrate this idea, he said tenants would duck into their own toilets instead of calling the supers.