Better deals? New St James’s Place clients face higher fees

New pension fund clients of St James’s Place (SJP) are facing higher fees – despite the UK’s largest asset manager recently bowing to pressure to offer better deals.

The recently introduced consumer rights rules require financial firms to focus on ‘fair value’ and ‘good outcomes’ for customers.

In response, SJP, which has long been criticized for high and opaque costs, has unveiled the biggest overhaul of its fee structure in its 31-year history to comply with the new rules. These include removing controversial early inclusion fees from all new products in the second half of 2025, which also covers investment bonds and pension activities.

But an analysis of SJP’s updated fee structure has found that new pension fund customers will soon be paying more – and will continue to do so for up to 17 years.

Pensions make up a large part of SJP’s business, accounting for £81 billion of the £159 billion it managed at the end of September 2023.

Sign of the times: Analysis of SJP’s updated fee structure finds new pension fund customers will soon pay more – and continue to do so for 17 years

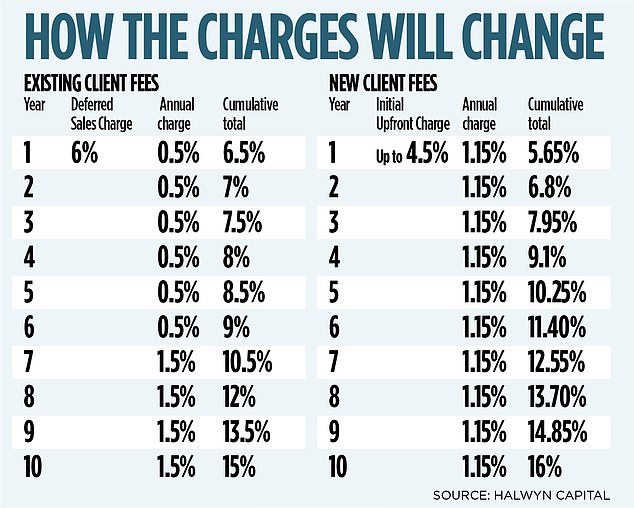

SJP currently charges a ‘deferred sales charge’ – effectively a commission – of 6 percent on a pension investment, plus an annual fee of between 0.5 percent and 1 percent. This brings the cumulative costs after ten years to 15 percent, see below.

The new pension charges include a smaller initial prepayment of up to 4.5 percent and annual charges of 1.15 percent. But the total costs after ten years are higher than before: 16 percent.

“SJP may be simplifying and unbundling fees for new pension customers, but they have failed to mention that what replaces them will cost customers more,” said Philip Rose, co-founder of Edinburgh-based investment firm Halwyn Capital, which is the analyzed figures.

Rose sees two risks in this strategy. ‘First, by treating your customer base and the wider industry like fools, you run the risk of a Ratner-like moment.

‘They have formulated their price change publication very carefully, so that they deliberately do not mention whether it is more or cheaper for pension customers. And they presented it as if they were doing customers a favor and not charging them more.

“Second, one of their largest shareholders was quoted as not understanding his costs, so what chance does an SJP advisor or client have?”

Rose is also concerned that SJP is charging more for poor performance. The pension funds invest in corresponding SJP unit trusts, but according to the company’s most recent assessment, only seven out of 45 of these underlying investment vehicles delivered ‘total value’ for clients.

“This suggests that pension customers aren’t getting good value either – and that’s before prices rise,” says Rose.

“SJP has not been clear about the increase in overall costs for new pension customers, despite several opportunities to do so in their public statements,” he added.

“This appears disingenuous on the part of the company and creates reputational risks.” The Financial Conduct Authority, the city’s watchdog, has been criticized for failing to curb skyrocketing fees but insists it is not a prices regulator.

“We want competitive markets with products that are clearly marketed and fairly priced,” a spokesperson said. ‘Consumer duty is not about determining the price. It means that financial companies prove to themselves, and if necessary to us, that what they charge reflects the value customers receive. If they can’t do that, they need to make changes.”

SJP, whose own share price has fallen as investors balked at the estimated £150m cost of implementing the rate changes, said the majority of new customers will benefit from lower costs across its product range, including those in bonds and pensions – if they remain invested for the long term. The new initial fee structure to cover advice provided was simpler and comparable to the rest of the sector, it added.

“While some new, shorter-term customers will pay more under the new structure, the majority will pay less, as part of an overall reduction in costs,” a spokesperson said.

“The fee structure will compare favorably with that of the broader asset management industry,” he added.