Which cars hold their value? EVs depreciate faster than any other vehicle – but trucks are most likely to be a safe investment

New cars are increasingly retaining their value as demand for used cars has risen, a study shows.

Electric cars have lost by far the most in value over the past five years, losing nearly 50 percent of their retail value, while trucks fared the best, losing about 35 percent.

A new study by iSeeCars looked at how much the 1.1 million model year 18 cars sold between November 2022 and October 2023 had depreciated in the five years since they were new.

It then compared these results to a previous study of the depreciation of model year 2014 cars over a five-year period through 2019.

(SCROLL DOWN FOR THE 25 MOST AND LEAST DEPRECIED MODELS)

A new study shows that used cars of all classes are retaining their value better than in 2019

Trucks experienced the least five-year depreciation at about 36 percent, the study found. Pictured is the 40 millionth Ford F-Series truck on display at the Dearborn plant in 2022

Recently, Japanese cars from Subaru, Toyota and Honda seemed to hold their value the best, while European cars fell in value the most. These manufacturers included Maserati, BMW, Audi, Volvo and Jaguar.

The research also revealed which types of vehicles were often better investments. SUVs depreciated the most after EVs, but interestingly, hybrids held their value significantly longer than fully electric cars.

“Some manufacturers have reduced or even exited the hybrid market in favor of electric cars, but these figures suggest consumers can still appreciate the combination of hybrid fuel efficiency and zero range,” iSeeCars analyst Karl Brauer said in the report.

Luxury cars lost an average of 48.1 percent of their value after five years. That compared to the industry average of 38.8 percent and 36.8 percent for non-luxury cars.

Overall, the amount that cars fell in value between 2019 and 2023 appeared to have fallen significantly across the board, by almost 11 percent. According to Brauer, this is due to a shortage of new cars.

“Limited production of new cars for the 2020 through 2022 model years continues to increase used car values,” Brauer said.

“While all used cars retain their value better than before the pandemic, electric cars still lose about half their value after five years, far more than any other vehicle type.”

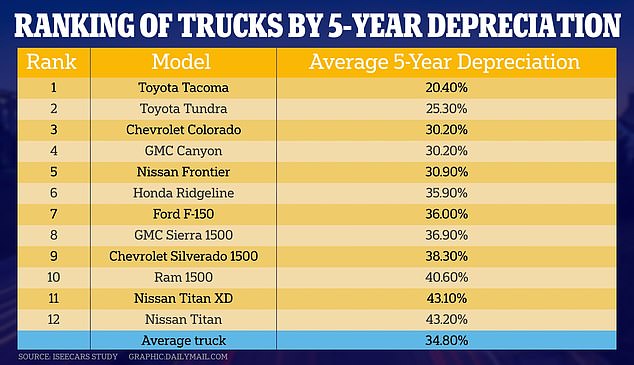

While trucks seemed to do well across the board in terms of depreciation, midsize trucks generally held their value better than full-size models.

Hybrid vehicles retain their value significantly better than fully electric cars, indicating strong demand for fuel-efficient vehicles that are not limited by their range, the study said. Pictured is a 2021 hybrid Toyota Yaris

While trucks seemed to be doing well across the board with an average depreciation of about 35 percent, there was still some variation between trucks.

Toyota Tacomas and Tundras have depreciated the least, down 20 and 25 percent, respectively, while Nissan Titans have depreciated the most, both down about 43 percent.

“Medium trucks retain their value better than full-size models,” Brauer says.

“Trucks like the Colorado, Frontier and Tacoma have become so capable in recent years that they can replace a full-size truck for many buyers while remaining much easier (and cheaper) to drive, park and operate.”

The Ford F-150’s depreciation was 36 percent greater than the average for trucks and slightly less than the average car. GMC Sierra 1500s, RAM 1500s and Chevrolet Silverado 1500s all also depreciate more than the average truck.

But the individual models that suffered both the most and the least depreciation were sports cars. Certain Porsche 911 models had lost only 9.3 percent in value from their retail price, while the Maserati Quattroporte had lost around 65.5 percent of its value.

“Several sports cars are among the top vehicles that are retaining their value, including four of the top 10 models,” Brauer said.

Cars sold in model year 2014 have depreciated more in five years than cars sold in 2018, according to iSeeCars research. The photo shows a 2015 Ford Explorer

EVs were the vehicle class that fell in value faster than any other car, with 2018 model year cars losing about 49 percent of their value by 2023

“We saw a spike in demand for ‘fun’ cars during the pandemic lockdowns, and demand for them remains strong in the post-pandemic world.”

And according to the study’s author, the higher price of used cars is a trend that is likely to continue for some time.

“Until limited production of new vehicles from model years 2020 through 2022 moves entirely through the used car market, there will be a shortage of vehicles to meet demand,” he said.

“That means better residual values for car owners, but also higher prices for buyers in the near future.”

| Rank | Fashion model | Average depreciation over 5 years | Average $ difference from MSRP |

|---|---|---|---|

| 1 | Porsche 911 (coupé) | 9.30% | $18,094 |

| 2 | Porsche 718 Cayman | 17.60% | $13,372 |

| 3 | Toyota Tacoma | 20.40% | $8,359 |

| 4 | Jeep Wrangler/Wrangler Unlimited | 20.80% | $8,951 |

| 5 | Honda Civic (sedan/hatchback) | 21.50% | $5,817 |

| 6 | Subaru BRZ | 23.40% | $8,114 |

| 7 | Chevrolet Camaro | 24.20% | $10,161 |

| 8 | Toyota C-HR | 24.40% | $6,692 |

| 9 | Subaru Crosstrek | 24.50% | $7,214 |

| 10 | Toyota Corolla | 24.50% | $5,800 |

| 11 | Ford Mustang | 24.50% | $10,035 |

| 12 | Porsche 718 Boxster | 25.10% | $20,216 |

| 13 | Toyota Tundra | 25.30% | $12,588 |

| 14 | Kia Rio 5-door | 25.80% | $5,006 |

| 15 | Porsche 911 (convertible) | 26.00% | $42,227 |

| 16 | Honda HR-V | 26.20% | $7,318 |

| 17 | Subaru Impreza | 26.20% | $6,927 |

| 18 | Kia Rio | 26.30% | $4,959 |

| 19 | Chevrolet Spark | 26.60% | $4,784 |

| 20 | Toyota RAV4 | 27.20% | $8,858 |

| 21 | Hyundai accent | 27.40% | $5,353 |

| 22 | Toyota4Runner | 27.40% | $13,147 |

| 23 | Chevrolet Corvette | 27.50% | $22,712 |

| 24 | Nissan Kicks | 27.50% | $6,560 |

| 25 | Subaru Impreza | 27.80% | $7,158 |

| Overall average | 38.80% | $17,221 |

| Rank | Fashion model | Average depreciation over 5 years | Average $ difference from MSRP |

|---|---|---|---|

| 1 | Maserati Quattroporte | 64.50% | $90,588 |

| 2 | BMW 7 series | 61.80% | $72,444 |

| 3 | Maserati Ghibli | 61.30% | $58,623 |

| 4 | BMW 5 Series (hybrid) | 58.80% | $37,975 |

| 5 | Cadillac Escalade ESV | 58.50% | $63,885 |

| 6 | BMW X5 | 58.20% | $44,828 |

| 7 | INFINITI QX80 | 58.10% | $47,399 |

| 8 | Maserati Levante | 57.80% | $55,858 |

| 9 | Jaguar XF | 57.60% | $39,720 |

| 10 | Audi A7 | 57.20% | $48,917 |

| 11 | AudiQ7 | 56.80% | $41,731 |

| 12 | Cadillac Escalade | 56.50% | $59,093 |

| 13 | Audi A6 | 56.30% | $38,252 |

| 14 | Volvo S90 | 55.80% | $35,365 |

| 15 | Nissan Armada | 55.70% | $36,875 |

| 16 | Mercedes-Benz S-Class | 55.70% | $70,563 |

| 17 | Lincoln navigator L | 55.50% | $57,224 |

| 18 | Mercedes-Benz GLS | 55.50% | $54,523 |

| 19 | Tesla Model S | 55.50% | $60,145 |

| 20 | BMW 5 series | 55.30% | $39,856 |

| 21 | BMW X5 | 54.70% | $39,992 |

| 22 | Lincoln Navigator | 54.70% | $53,582 |

| 23 | BMW X5 M | 54.00% | $66,277 |

| 24 | Land Rover Range Rover | 53.90% | $68,874 |

| 25 | CadillacXT5 | 53.90% | $31,737 |

| Overall average | 38.80% | $17,221 |