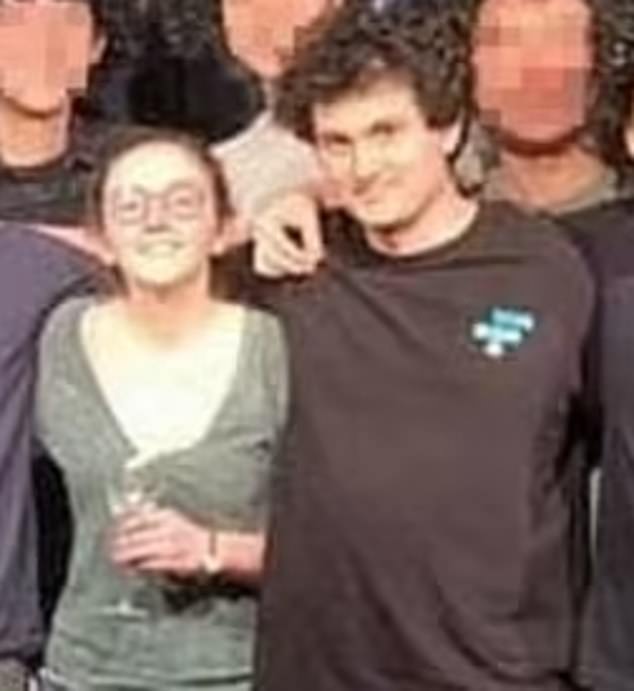

How Caroline Ellison became celebrated Alameda CEO before being exposed as fraudster and testifying against ex-boyfriend Sam Bankman-Fried

Before the massive collapse of FTX and Alameda Research, Caroline Ellison was celebrated as a Stanford mathematician who reached the top of the crypto ladder at the age of 28.

But when the world discovered that she was using the investment firm she ran as a personal piggy bank for her ex-boyfriend Sam Bankman-Fried, a picture emerged of a young woman completely unequipped for a CEO position in the crypto exchange industry .

Hoping to receive a lesser sentence for her own role in the massive scam, Ellison pleaded guilty to fraud and testified last month in the Bankman-Fried fraud trial, alleging that he instructed her to steal $14 billion in customer funds from Alameda to FTX.

Ellison, the daughter of MIT economics professors, became involved in Bankman-Fried’s doomed venture in March 2018 while she was an intern at Jane Street, a boutique investment firm where he worked as a trader.

The two bonded over their interest in “effective altruism” – the idea of getting rich to give billions to charity.

Caroline Ellison, the former CEO of Alameda Research

Ellison and Bankman-Fried bonded over their interest in “effective altruism” – the idea of getting rich to give billions to charity

“The idea was that it would be best for the world if I became extremely rich, and then donated it… it’s incredibly self-interested,” Tom Gill, a former trader at Jane Street, told Forbes.

Over coffee in Berkeley, California, Bankman-Fried asked Ellison to join Alameda Research, a digital currency hedge fund that he wanted to use to exploit the differences in Bitcoin prices in different countries. He reportedly claimed he wanted to make billions to give to charity.

Ellison said in court that she and Bankman-Fried first slept together in the fall of 2018 and then dated from the summer of 2020 to the summer of 2021 and that she dumped him because he was “distant” and ” paid attention to her’.

She had only 18 months of trading experience when she moved to Alameda. She became co-chief executive of Alameda in 2021 – at a time when she and Bankman-Fried were ‘on hiatus’ – and chief executive in 2022.

Bankman-Fried had started FTX two years after founding Alameda Research in an effort to create what he saw as a modern cryptocurrency exchange. He eventually decided to leave Alameda to focus on FTX full-time and gained fame as a “crypto czar” – with celebrities like Tom Brady promoting the new exchange.

In the summer of 2021, under Ellison’s leadership, Alameda was trading about $5 billion per day and was on Forbes’ 20 Under 30 list.

In interviews portraying her as a young mathematical genius, Ellison often spoke of the importance of being “comfortable” with taking risks to achieve professional success.

“Being comfortable with risk is very important,” Ellison said on a podcast in 2022. “There are a lot of people who are very smart, but not necessarily good at the messy world of trading, especially in crypto.”

Just a few months after becoming Alameda’s sole CEO, the trading company and FTX were exposed as a scam.

Ellison was born and raised in Boston with her father Glenn Ellison, head of economics at MIT, and Sara Fischer Ellison, lecturer in economics at the prestigious university

Ellison told the jury that Bankman-Fried ‘directed’ me to commit fraud, and that all the crimes were ‘committed with Sam’

After the FTX crash, attention turned to Alameda’s $10 billion in assets and claims that the company diverted FTX customers’ money to make risky investments.

Soon, Ellison’s behavior and quotes, initially seen as precocious genius, were seen as evidence of malpractice.

“This was a lot like, oh yeah, we don’t really know what we’re doing,” she had told Forbes about Alameda’s success before the fall.

She even once bragged that she only needed “basic math” to run the business and claimed to dislike common trading safeguards such as stop-loss orders, a way to limit losses and reduce risk.

The entire operation is described as “run by a gang of kids in the Bahamas.” According to CoinDesk, she was one of nine friends who lived with the former tycoon in a luxury penthouse in the Bahamas.

Bankman-Fried and Ellison apparently weren’t the only couple having a good time in the Bahamas, with reports that the group were all dating.

Ellison was born and raised in Boston with her father Glenn Ellison, head of economics at MIT, and Sara Fischer Ellison, lecturer in economics at the prestigious university.

In a now-deleted Tumblr post called WorldOptimization, Ellison wrote that “women are better suited to being housewives and raising children than to having a career.”

In a list titled “˜cute boy things,'” Ellison added, “controls most major world governments.”

Ellison had also written about her exploration of polyamory, which she said led her to believe that “everyone should have a ranking of their partners, people should know where they rank in the rankings, and there should be a vicious power struggle for the higher ranks.’

In what prosecutors call “one of the largest financial frauds in American history,” FTX allegedly loaned Alameda billions in clients’ money without their knowledge or consent. The crisis at FTX arose when customers rushed to withdraw their money, but the company was unable to pay out.

Ellison was portrayed as a mathematical genius before the FTX collapse and even once bragged that she only needed “basic math” to run the company. She will appear on a podcast in 2022

Testifying as the prosecution’s key witness, Ellison said Bankman-Fried created the loopholes in the computer system that allowed the fraud to occur.

In an unpublished 250-page memo, Bankman-Fried blamed Ellison for the fraud, arguing that she was ill-equipped for the role he gave her, and she refused to implement his trading strategies that could have prevented the collapse.

He wrote: “She continually avoided talking about risk management – dodging my suggestions – until it was too late… Every time I reached out with suggestions, it only made her feel worse. I’m sure being exes didn’t help.

According to the memo, the couple’s relationship “ended the same way most of my relationships end: they want more intimacy, commitment, and public visibility than I do, and I feel claustrophobic.”

Bankman-Fried argued that Alameda would have remained solvent if Ellison had agreed to hedge his aggressive trading strategy, as he claims he proposed.

“If Alameda had hedged, it would have remained solvent and avoided the whole unfortunate story,” he wrote.

Ellison, 28, told a New York court last year that she headed Alameda Research and effectively had access to an “unlimited” amount of FTX client money.

She pleaded guilty to fraud and admitted that she agreed with Bankman-Fried to issue “materially misleading financial statements” to conceal the scheme – which she knew was illegal.

Bankman-Fried, 31, has denied 13 charges between 2019 and 2011, including bank fraud, money laundering and violations of campaign finance laws, leaving him facing a possible 115 years in prison.

Assistant U.S. Attorney Danielle Sasson asked Caroline Ellison what Bankman-Fried said about spending money on politics.

Ellison said: ‘He thought it was very effective, you could get a very high return in terms of influence by spending relatively small amounts of money.

“He gave $10 million to (Joe) Biden and that was a relatively small amount. He felt this was something that would give him influence and recognition.