Krispy Kreme becomes latest junk food giant to panic about Ozempic – as investors fear America will fall out of love with doughnuts

Weight loss drugs like Ozempic and Wegovy continue to scare financial advisors when it comes to investing money in junk and fast food companies.

Some experts predict that these companies — already grappling with an increase in health-conscious customers — could face a tobacco downfall as the drugs become increasingly popular, which reduce cravings and help people feel full longer.

Donut company Krispy Kreme is the latest company to feel the effects of the weight-loss movement, seeing its stock price fall on Monday.

Investment advisory firm Truist Securities downgraded Krispy Kreme’s shares from “buy” to “hold” and lowered its price target to $13 from $20, citing the uncertain impact drugs like Ozempic and Wegovy could have on packaged snacks.

Donut company Krispy Kreme is the latest company to feel the effects of the weight-loss movement, seeing its stock price, the value of a company’s stock, plummet on Monday

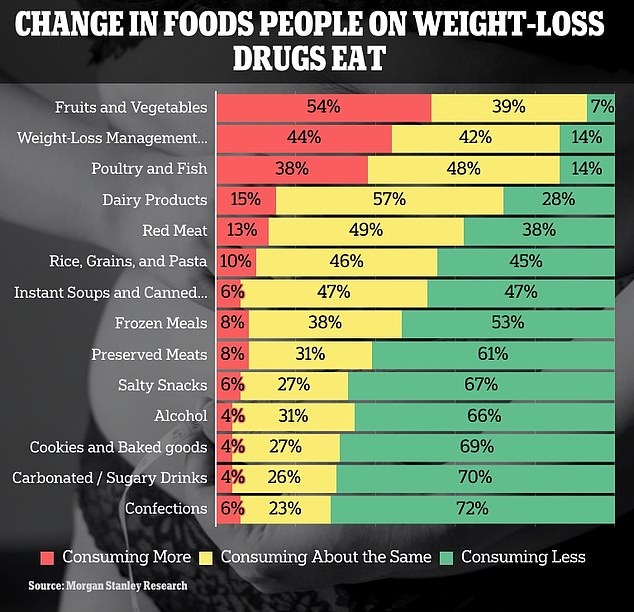

Research found that 73 percent of people taking weight-loss medications ate fewer sweets, including sugary sweets, chocolate and some pastries.

Company financial analysts no longer recommend that investors buy shares in Krispy Kreme.

The downgrade of shares to ‘hold’ means that people who have invested money in the company are not allowed to do anything – neither buy nor sell.

Shares of the donut company fell as much as 3.6 percent on Monday, but overall the shares are up 25 percent since the market closed on Monday.

Bill Chappell, a financial equity analyst at Truist Securities, wrote in a note to investors on Monday that the company has a hard time recommending Krispy Kreme to investors because it has “no idea” what the impact of weight-loss drugs will be or how long it will last. will last. will persist, though Chappell speculated it wouldn’t fade in six to 12 months, “if not longer.”

The boom in weight-loss drugs has made financial advisors less confident about many shares in companies that produce junk or sugary foods, and the entire sector is facing a potential crisis.

Earlier this month, investment bank Barclays lowered its recommendation on Swiss chocolate manufacturer Barry Callebaut and German sugar company Suedzucker.

The analysts said weight-loss drugs came with the threat of falling stock prices.

Big banks like Morgan Stanley have done that predicted 24 million peopleBy 2035, seven percent of the American population will use weight-loss medications.

An analysis by the bank also predicts that patients prescribed the drugs will consume a quarter of the sweets, confectionery and other junk food they used to eat – saving billions of dollars in annual revenue.

A survey conducted by Morgan Stanley found that 73 percent of people ate fewer confectionery products, including sugary sweets, chocolate and some pastries

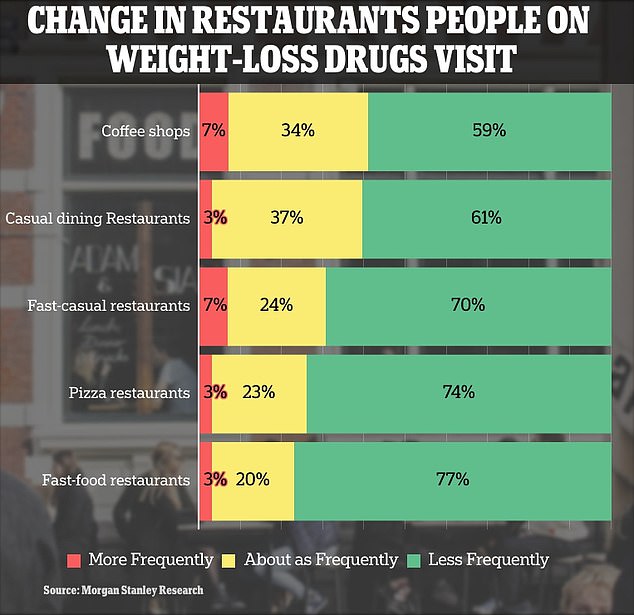

Major players in the fast food industry, such as McDonald’s, Burger King and Yum Brands, owner of KFC and Taco Bell, could see declining demand

Morgan Stanley’s food analyst Pamela Kaufman said in a report: “The food, beverage and restaurant industries could see weaker demand, especially for unhealthier foods and high-fat, sweet and salty options.”

The new class of drugs could lead to a 20 to 30 percent reduction in daily calories, and people tend to eat fewer foods high in sugar and fat, meaning the makers of chips, cookies and pastries could take a hit , where the banks A decline in consumption is predicted by as much as three percent until 2035.

Research from Morgan Stanley found that 73 percent of people taking the weight-loss drugs ate fewer sweets, including sugary sweets, chocolate and some pastries.

This drastic reduction could spell trouble for the mega-producers of these foods, including Krispy Kreme, Oreo maker Mondelez International, Nestle, which makes Hot Pockets and Häagen-Dazs, and Kraft Heinz, which produces products like Jell-O and macaroni. and cheese.

Such companies dominate the global snack food market, currently valued at half a trillion dollars, and they must brace for declines in demand – possibly by billions of dollars.

While any negative impacts are likely to occur gradually, companies are already spooked and investors and top executives are starting to worry.

A recent analysis shows that executives at junk food companies are increasingly talking to investors about the drugs.

Reuters Breakingviews scoured the transcripts of company presentations, events and earnings calls – a conference between a company’s management – financial analysts, media and investors.

In 2022, 18 mentions of Wegovy, Ozempic and Mounjaro were found. So far in 2023, at least one of these drugs has been mentioned at least 71 times in phone calls.

Despite Chappell’s advice earlier this week, he said he does believe in Krispy Kreme and noted the company will grow in 2023 as it “continues to refine” its business model.