US Fed set to hold fire again on interest rates ahead of Bank of England decision

- Markets are betting that the Fed Funds rate will reach its current 22-year high of 5.25-5.5%

- But the Fed may not be ready yet due to concerns about the strength of the US economy

The Federal Reserve is expected to keep interest rates at their current 22-year high for the second time in a row later today as the US economy continues to show resilience.

Markets expect the Federal Open Market Committee to opt for another pause and keep the federal funds rate at current levels of 5.25 to 5.5 percent.

But continued labor market tightness, surprising consumer strength and solid economic growth mean the Fed is likely to re-emphasize that further rate hikes cannot be ruled out as the central bank continues its battle against inflation.

The Bank of England is also expected to opt for a new pause at 5.25 percent when its Monetary Policy Committee meets on Thursday.

Fed Chairman Jerome Powell has previously warned that signs of an overheating economy could mean interest rates will have to rise again

CME Group’s Fed Watch tracker shows markets are now pricing in a 99.2 percent probability of a break, up from 96.7 percent yesterday and 81.7 percent a month ago.

In contrast, markets are estimating the likelihood of a Fed rate hike from just 0.8 percent to 5.5 to 5.75 percent, up from 18.3 percent a month ago.

And while markets yesterday thought there was a slim 3.3 percent chance of a rate cut, prices now point to a zero probability.

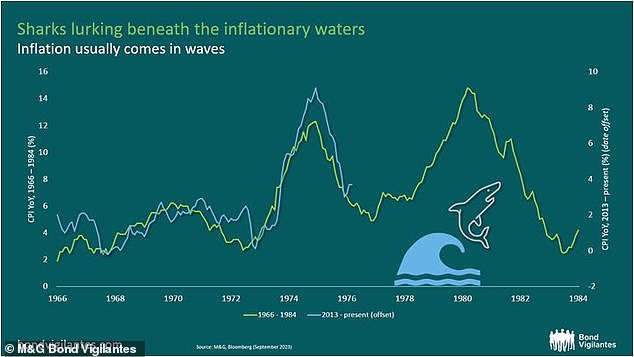

M&G’s ‘creepy’ charts: Inflation usually comes in waves

The Fed has opted for eleven rate hikes since March 2022, bringing US inflation to 3.7 percent in September, up from 3.67 percent last month and 8.2 percent last year.

But inflation remains above the Fed’s target of 2 percent, raising concerns that the bank’s tightening cycle is not enough to sufficiently suppress demand.

The US economy remains strong, with annual GDP growth of 4.9 percent in the third quarter, solid consumer spending and historically low unemployment – all drivers of inflation.

The war on the Middle East, the related oil price rise and a sell-off in government bonds further complicate matters.

Fed Chairman Jerome Powell warned in October that signs of an overheating economy could mean interest rates would have to rise again.

Isabel Albarran, investment officer at Close Brothers Asset Management, said: “The Fed will be alarmed by the continued resilience of the US economy, particularly reflected in robust retail data and stronger-than-expected third-quarter growth rates.

“Nonetheless, we think the Fed will err on the side of caution and leave rates unchanged at the November meeting.”

Franck Dixmier, Global Chief Information Officer for Fixed Income at Allianz Global Investors, added: “We believe the Fed has completed its rate hike cycle.

‘Of course we cannot rule out the possibility of a final rate hike at the end of the year, which the markets anticipate with a low probability (30 percent).

‘But we think this will have only a limited impact on the markets. Investors are looking further ahead and preparing for a long period of stable interest rates, with the first cut expected in mid-2024.”

M&G’s ‘spooky’ charts: ‘Real interest rates’ back in positive territory, making recession more likely