UAW strike intensifies as 5,000 General Motors workers who build SUVs at Texas plant walk off the job – as company reveals labor action is already costing it $200M per week

The United Auto Workers union increased pressure on General Motors on Tuesday when another 5,000 workers walked off their jobs at a highly profitable SUV factory in Arlington, Texas.

The move comes just a day after the union added a strike at a Stellantis plant in Sterling Heights, Michigan, north of Detroit, turning the Ram pickup into a cash cow for the company.

Even before the latest strikes, the strike against the “Big Three” Detroit automakers was costing General Motors about $200 million a week in lost profits, the company announced in its latest quarterly results.

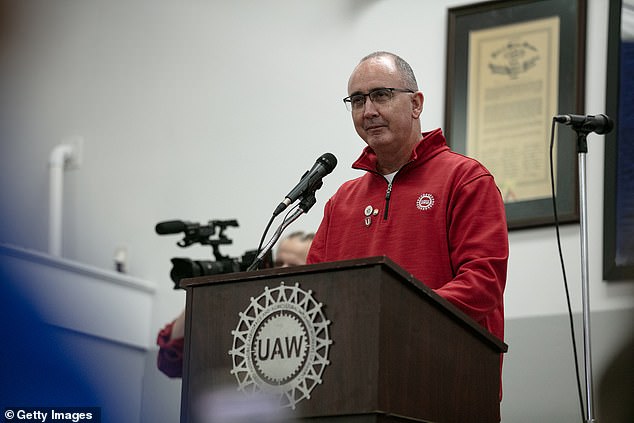

UAW President Shawn Fain threatened further strikes last week in an effort to get GM, Ford and Stellantis to increase their wage offers.

But GM CEO Mary Barra said during the earnings conference call Tuesday morning that the company has already made a record offer and will not agree to a contract that jeopardizes the company’s future.

GM CEO Mary Barra said during Tuesday morning’s earnings conference call that the company has already made a record offer

UAW President Shawn Fain threatened further strikes last week in an effort to get GM, Ford and Stellantis to increase their wage offers

GM reported net income of $3.1 billion for the quarter ended last month, down 7 percent from a year ago due to production losses due to the strike and higher warranty costs, the company said.

The company also withdrew its previous profit guidance for 2023, citing uncertainty over the duration of the strike and the number of factories that would ultimately be closed.

The UAW strike, which began on September 15, has followed a gradual strategy of attacking a handful of factories and expanding the locations of the strikes as time passed without a deal.

GM says the strikes have cost $200 million through the end of September, and another $600 million this month, with ongoing damage to profits estimated at $200 million per week based on factories currently closed.

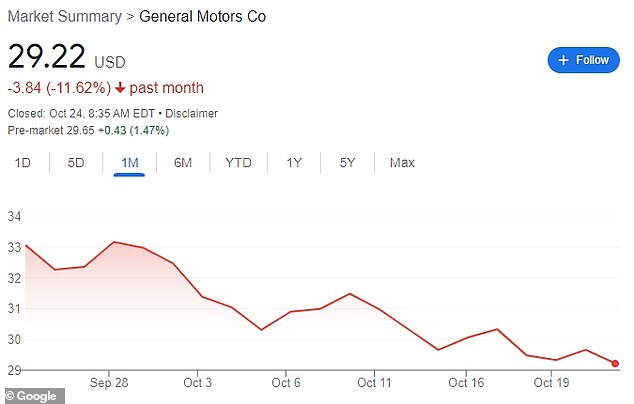

Despite the strike’s disruptions, GM said it earned $2.28 per share, excluding one-time items, easily surpassing Wall Street estimates of $1.87 and sending the company’s shares up more than 1 percent in the pre-market alleys.

GM’s revenue of $44.13 billion rose 5.4 percent from last year and also surpassed analyst estimates of $42.48 billion, according to data provider FactSet.

In addition to GM, the UAW attacks also target automakers Ford and Stellantis, the maker of Dodge, Jeep and Ram.

On Monday, another 6,800 union members walked out of Stellantis’ plant in Sterling Heights, Michigan, which makes Ram pickup trucks, a huge profit center for the company.

The strike launched Tuesday against GM’s Texas plant targets a factory that makes large SUVs that are among the company’s most profitable vehicles. These include the Chevrolet Tahoe, GMC Yukon and Cadillac Escalade.

After the Arlington strike was announced, GM said it was disappointed with the escalation and called the strike “unnecessary and irresponsible.”

The company said the strike will harm workers and “will have negative impacts on our dealers, suppliers and the communities that rely on us.”

GM shares have fallen more than 10 percent over the past month but rose slightly on Tuesday

UAW members walk out as they launch another strike against a highly profitable GM plant in Arlington, Texas, that makes SUVs including Chevrolet Tahoe, GMC Yukon and Cadillac Escalade

The General Motors headquarters at Detroit’s Renaissance Center can be seen from Hart Plaza

United Auto Workers President Shawn Fain, left, listens as President Joe Biden spoke to striking UAW members outside a General Motors facility last month

UAW chief Fain tied the new strike to GM’s financial results, saying in a prepared statement that GM exceeded Wall Street expectations and that its offering is lagging behind Ford’s.

“It’s time for GM workers, and the entire working class, to get their fair share,” Fain said.

Barra said GM’s record offer rewards workers but does not jeopardize the company’s or UAW’s jobs.

“Accepting unsustainably high costs would jeopardize our future and the jobs of GM team members, and endangering our future is something I will not do,” she said in a statement.

About 46,000 workers are now on strike against all three automakers, or about 32 percent of the union’s 146,000 members at the Detroit Three.

The strikes, now in their sixth week, affect seven assembly plants and 38 parts warehouses across the three companies.

The union is demanding a 36 percent pay increase over four years, a four-day work week and other improvements to compensation and benefits plans.

In previous strikes, the union has targeted one company and reached an agreement that has served as a model for a deal with the other two, but this time it is taking a different approach by attacking all three companies at once.

So far, GM’s sales and prices in North America have remained steady despite the strike.

The average sales price for GM vehicles was $50,750 in the latest quarter, down slightly from the previous quarter, said Paul Jacobson, GM’s chief financial officer.

“To date, consumers have held up remarkably well with us, as evidenced by average transaction prices,” Jacobson said. “They’re hanging in there and I think they’ve exceeded most of the expectations from the beginning of the year.”

Jacobson said GM executives are concerned about rising interest rates and the conflict in the Middle East and whether that could impact consumer behavior.

But he did not echo Tesla CEO Elon Musk’s pessimism about the impact of rising interest rates on consumer demand.

Jessica Caldwell, head of insights for the automotive site Edmunds.com, said GM’s sales figures looked good at first glance, but that could change in the next few months.

As the weather gets colder, market participants tend to look for larger vehicles with all-wheel drive.

But she said a prolonged strike could close factories, cut production of those lucrative vehicles and “harbinger sales declines for a significant portion of the coming calendar period.”