When $300,000 a Year is STILL Not Enough to Own a Home: Fascinating Study Shows How Much Salary Buyers in Every US Metro Need to Afford Real Estate

The annual salary needed to afford an average home in the US has risen more than 50 percent in the past two years, a new study shows.

A homebuyer needed to earn $115,000 a year in August to afford the median-priced home, up from $99,000 a year ago and $75,000 the year before, according to a report from Redfinwhich also considered the 100 most populous metro areas separately.

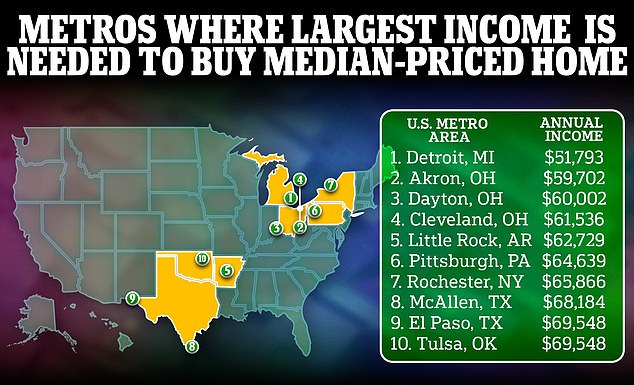

Overall, the cities where homebuyers needed the highest income were in California and parts of the Northeast. The smallest incomes were needed around Texas and the Midwest.

All seven cities where homebuyers needed the highest annual income were in California. In the Bay Area – San Francisco and San Jose – they had to make more than anywhere else: $400,000.

Of the five cities where the lowest salaries were enough to buy an average home, three were in Ohio: Akron, Dayton and Cleveland. In Detroit, homebuyers needed the smallest annual salary, just $52,000.

The cities where homebuyers needed the highest income money were in California and parts of the Northeast, according to the Redfin study

The smallest incomes were needed around Texas and the Midwest. Six of the top seven were in California

Pictured is an east-side suburb of Detroit, Michigan. In Detroit, homebuyers needed the smallest annual salary: just $52,000

(SCROLL TO BOTTOM FOR THE COMPLETE LIST OF THE 100 MOST POPULAR METROS)

Required salaries in the US are being driven up by the combination of high home prices and high mortgage rates.

Many American homeowners are locked in their homes because they have cheap mortgage rates of around 3 percent, compared to the current interest rate of around 8 percent.

As a result, fewer homes come onto the market, causing prices to rise. And due to the high mortgage interest rates, monthly mortgage costs are higher than ever.

‘In a home buyer’s ideal world, rising mortgage rates would reduce demand and house prices enough to offset high interest payments. But that’s not what’s happening now: Although the number of new listings is rising slightly, inventory is still near record lows as homeowners hold on to their low mortgage rates – and that’s boosting prices,” said Chen Zhao, head of Redfin Economics Research.

‘Buyers – especially first-time buyers – who want to move into a house now, have to think outside the box. Consider a condo or townhouse, which are cheaper than a single-family home, and/or consider moving to a more affordable part of the country, or to a more affordable suburb.”

Three houses in Akron, Ohio. To purchase the average-priced home in Akron, a home buyer needs an annual income of approximately $60,000

Aerial view of a residential neighborhood in San Jose, South San Francisco Bay Area, California. The annual income needed to purchase the average-priced home in San Jose was $402,000

Necessary income rose the least over the past year in places where Americans bought homes during the pandemic, according to the report.

In Austin, Texas, buyers had to earn $126,000 to afford the average-priced home, up 8 percent from a year ago.

That is the smallest increase of all metros. Another city that attracted people during the pandemic, Boise, Idaho, rose 9 percent to $127,000.

The biggest increases occurred in Miami and Newark, where homebuyers had to earn 33 percent more than a year ago to afford the average home.

The study was based on an analysis of average monthly mortgage payments in August 2023 and August 2022. A monthly mortgage payment is considered affordable if the homebuyer spends no more than 30 percent of their income on housing.

Monthly average mortgage payments were calculated assuming the buyer made a 20 percent down payment. The average mortgage rate in August 2023 was 7.07 percent, while the average mortgage rate in August 2022 was 5.22 percent.

| METRO AREA | ANNUAL INCOME REQUIRED | MEDIAN HOUSE SALE PRICE |

|---|---|---|

| Detroit, MI | $51,793 | $189,900 |

| Akron, OH | $59,702 | $218,900 |

| Dayton, OH | $60,002 | $220,000 |

| Cleveland, OH | $61,536 | $225,625 |

| Little Rock, AR | $62,729 | $230,000 |

| Pittsburgh, PA | $64,639 | $237,000 |

| Rochester, NY | $65,866 | $241,500 |

| McAllen, Texas | $68,184 | $249,999 |

| El Paso, Texas | $69,548 | $255,000 |

| Tulsa, OK | $69,548 | $255,000 |

| Buffalo, NY | $70,093 | $257,000 |

| St. Louis, MO | $70,912 | $260,000 |

| Baton Rouge, LA | $71,184 | $261,000 |

| Oklahoma City, OK | $71,457 | $262,000 |

| Gary, IN | $72,125 | $264,450 |

| Louisville, KY | $73,612 | $269,900 |

| New Orleans, LA | $75,003 | $275,000 |

| Philadelphia, PA | $75,003 | $275,000 |

| Greensboro, NC | $76,503 | $280,500 |

| Birmingham, AL | $76,912 | $282,000 |

| Cincinnati, OH | $77,730 | $285,000 |

| Des Moines, IA | $79,094 | $290,000 |

| Memphis, TN | $79,094 | $290,000 |

| Indianapolis, IN | $81,794 | $299,900 |

| Warren, MI | $82,571 | $302,749 |

| Omaha, NE | $83,185 | $305,000 |

| San Antonio, Texas | $87,273 | $319,990 |

| Albany, NY | $87,276 | $320,000 |

| Milwaukee, WI | $87,548 | $321,000 |

| Greenville, SC | $87,821 | $322,000 |

| Allentown, PA | $88,639 | $325,000 |

| Grand Rapids, MI | $88,639 | $325,000 |

| Lakeland, FL | $88,639 | $325,000 |

| Kansas City, MO | $89,185 | $327,000 |

| Columbus, OH | $90,276 | $331,000 |

| Wilmington, DE | $90,412 | $331,500 |

| Camden, NJ | $91,367 | $335,000 |

| Chicago, Ill | $91,367 | $335,000 |

| New Haven, CT | $91,367 | $335,000 |

| Houston, Texas | $92,185 | $338,000 |

| Elgin, IL | $92,730 | $340,000 |

| Virginia Beach, VA | $93,003 | $341,000 |

| Hartford, CT | $94,640 | $347,000 |

| Lake County, Illinois | $95,458 | $350,000 |

| Fort Worth, Texas | $98,185 | $360,000 |

| Jacksonville, FL | $99,549 | $365,000 |

| Tucson, AZ | $99,549 | $365,000 |

| Bakersfield, CA | $100,258 | $367,600 |

| Knoxville, TN | $102,276 | $375,000 |

| Richmond, VA | $102,276 | $375,000 |

| Tampa, FL | $103,613 | $379,900 |

| Baltimore, MD | $103,640 | $380,000 |

| Minneapolis, Minnesota | $103,640 | $380,000 |

| Atlanta, GA | $107,731 | $395,000 |

| Cape Coral, FL | $108,249 | $396,900 |

| Orlando, FL | $108,597 | $398,175 |

| Charlotte, NC | $108,822 | $399,000 |

| Charleston, SC | $112,231 | $411,500 |

| Las Vegas, NV | $113,186 | $415,000 |

| Fresno, California | $114,275 | $418,995 |

| Fort Lauderdale, Florida | $114,549 | $420,000 |

| Dallas, Texas | $115,913 | $425,000 |

| Worcester, MA | $118,640 | $435,000 |

| Raleigh, NC | $120,004 | $440,000 |

| Phoenix, AZ | $121,368 | $445,000 |

| Northhaven, FL | $123,888 | $454,240 |

| Nashville, TN | $124,095 | $455,000 |

| Providence, RI | $125,459 | $460,000 |

| West Palm Beach, FL | $125,459 | $460,000 |

| Austin, Texas | $126,208 | $462,748 |

| Boise City, ID | $126,869 | $465,170 |

| Montgomery County, PA | $130,886 | $479,900 |

| Salt Lake City, UT | $139,096 | $510,000 |

| New Brunswick, NJ | $141,823 | $520,000 |

| Miami, FL | $143,187 | $525,000 |

| Stockton, California | $144,550 | $530,000 |

| Frederick, MD | $145,407 | $533,140 |

| Portland, OR | $149,023 | $546,400 |

| Tacoma, WA | $149,855 | $549,450 |

| Washington, DC | $150,005 | $550,000 |

| Riverside, CA | $151,369 | $555,000 |

| Sacramento, CA | $156,824 | $575,000 |

| Denver, CO | $158,187 | $579,999 |

| Newark, NJ | $159,551 | $585,000 |

| Nassau County, NY | $177,279 | $650,000 |

| Bridgeport, CT | $182,734 | $670,000 |

| Honolulu, Hello | $188,188 | $690,000 |

| Boston, MA | $194,188 | $712,000 |

| New York, NY | $197,734 | $725,000 |

| Seattle, WA | $214,904 | $787,956 |

| Oxnard, CA | $233,190 | $855,000 |

| Los Angeles, CA | $237,281 | $870,000 |

| San Diego, CA | $241,372 | $885,000 |

| Oakland, CA | $249,554 | $915,000 |

| Anaheim, California | $300,010 | $1,100,000 |

| San Jose, CA | $402,287 | $1,475,000 |

| San Francisco, CA | $404,332 | $1,482,500 |