Are Banking Correspondents Worth It?

In the ever-evolving landscape of modern finance, Banking Correspondents have emerged as a critical link between financial institutions and the unbanked or underbanked populations. These intermediaries offer various services, from basic banking functions to facilitating financial inclusion in remote areas.

This comprehensive guide dives deep into the question: Are Banking Correspondents worth it?

What is a Banking Correspondent?

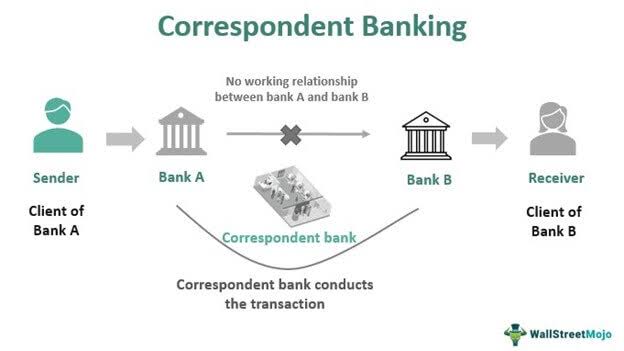

A Banking Correspondent, sometimes called a “banking agent” or “business correspondent,” is a person or entity authorized by a bank or financial institution to provide certain banking services on their behalf. They can be individuals, small businesses, or even local shops that offer basic banking services like deposits, withdrawals, and fund transfers. Essentially, they bring the bank to your neighborhood.

Advantages of Banking Correspondents

The advantages of banking correspondents are numerous and are crucial in extending banking services to underserved populations. Here are some key advantages:

1. Enhanced Financial Inclusion

Imagine a small village where there’s no bank for miles. With banking correspondents, these villagers can open savings accounts, deposit money, and access other financial services right in their community. This is called financial inclusion, and it’s super important.

When more people have access to banking, they can save, invest, and plan for the future. It’s like giving them a ticket to be part of the financial world.

2. Increased Accessibility

Think about how far you have to travel to reach a bank. For some, it’s a long journey. But with banking correspondents, banking becomes much closer and more accessible. These agents set up shop in local stores, post offices, or small businesses, making it easy for everyone to do their banking nearby.

Accessibility means saving time and effort. You don’t have to travel for hours or wait in long lines at a distant bank branch. Instead, you can pop into your local store and handle your banking needs quickly and conveniently.

3. Cost-Efficient Banking

Banking correspondents make banking not only easier but also more cost-effective. These agents operate from existing local businesses, like a neighborhood store. This means the bank doesn’t need to spend a fortune building new branches.

They can use existing infrastructure, which is way more budget-friendly. This cost-saving trick can lead to lower transaction fees for customers.

4. Increased Customer Base

These agents set up shop in different neighborhoods, drawing in new customers. This means more people can open accounts, get loans, and access various financial services.

By reaching more folks through banking correspondents, banks can increase their revenue. It’s a win-win – more people get access to banking, and banks get more customers. It’s all about making the financial world a more inclusive place for everyone.

5. Diverse Service Offerings

Banking correspondents aren’t just about basic banking services like deposits and withdrawals. They’re like a one-stop shop for financial needs. These agents can present various services, like helping you open a bank account, purchase insurance, or even apply for a loan. This diversity in service offerings points you can get more done in one place.

6. Improved Data Collection

Imagine you’re making a puzzle, but some pieces are missing. Data is like those missing puzzle pieces. Banking correspondents collect important information about the local financial landscape.

They gather data on what people need and how they use banking services. This data helps banks understand their customers better and tailor their services to meet local demands.

Invest in Banking Correspondents Today

Investing in Banking Correspondents today isn’t just about expanding your financial reach; it’s about embracing a powerful tool for positive change. So, whether you’re a financial institution looking to extend your services or an individual seeking greater financial inclusion, consider Banking Correspondents’ role in your journey.