The rise of the MEGA bankruptcy: 459 US firms have filed for bankruptcy this year – the most since 2020 – and 16 had more than $1 billion in assets

The rise of the MEGA bankruptcy: 459 US firms filed for bankruptcy this year — the most since 2020 — and 16 had more than $1 billion in assets

- Economists warn large-scale bankruptcies can have devastating consequences

- Some 459 firms have filed for bankruptcy so far this year – already more than in 2021

- Bed Bath and Beyond, trucking firm Yellow and Silicon Valley Bank among the biggest casualties

Large-scale corporate bankruptcies are at their highest level since 2020 as rising interest rates continue to hit businesses.

This year, giants like Bed Bath and Beyond, trucking firm Yellow and wedding retailer David’s Bridal filed for Chapter 11 bankruptcy thanks to a perfect storm of rampant inflation, high tariffs and supply chain disruption.

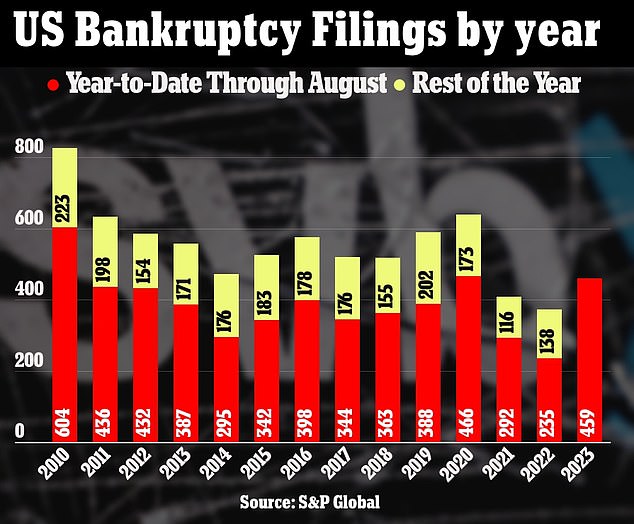

Some 459 corporate firms have filed so far this year, already surpassing the 373 in 2022 and 408 in 2021, according to S&P Global figures compiled by Withinr.

What’s more, so-called ‘mega-bankruptcies’ – those by companies with more than $1 billion in assets – reached 16 in the first half of the year.

By comparison, figures from consultancy Cornerstone Research show there were an average of 11 ‘mega-bankruptcies’ in the first six months of each year between 2005 and 2022.

Some 459 corporate firms have filed so far this year, already surpassing the 373 in 2022 and 408 in 2021, according to S&P Global figures cited by Insider

Analysts at Cornerstone added the largest corporate bankruptcy this year was SVB Financial Group, the parent company of Silicon Valley Bank, which had $175.4 billion in customer deposits at the time of its filing.

Economists warn the increase in large-scale crashes could have devastating effects on the economy.

For example, the demise of trucking company Yellow — which reportedly had $2.15 billion in assets at the time of filing — reverberated through domestic shipping and real estate markets to Wall Street.

The rise in bankruptcies along with a weakening stock market and surge in credit card crime have raised fears that the US is heading for a recession.

But Steven Blitz, US chief economist at GlobalData TS Lombard, insisted that any downturn would be less severe than the 2007-09 recession.

He told the Wall Street Journal: ‘You’re not going to see the kind of bankruptcies and balance sheet stress that you saw during that period.’

He added that the economy is not ‘heading for some kind of doom-and-death loop.’

What’s more, so-called ‘mega-bankruptcies’ – those by companies with more than $1 billion in assets – reached 16 in the first half of the year. Bed Bath and Beyond reportedly had assets of $4.4 billion when it filed for bankruptcy in April

Figures from the US Labor Department showed that employers added 336,000 jobs in September. The unemployment rate also remained at 3.8 percent last month.

And consumer spending remained strong, having increased 0.4 percent in August – the latest figures available.

Despite this, businesses have struggled to keep up with higher interest rates. Many ran up debt when rates were extremely low – making them vulnerable to any rises.

The Fed’s funds rate is currently between 5.25 and 5.5 percent – up from 0.5 percent in April 2020 – after deciding to keep it steady at last month’s meeting. Economists predict another increase will take place before the end of the year.

Amy Quackenboss, an executive director at the American Bankruptcy Institute, told the WSJ: ‘Companies have survived the last few years by taking advantage of the ultra-low interest rates.

“But many of these corporations are now seeing those loans coming, and they’re struggling to refinance because the interest rates are now significantly higher.”

Aircraft leasing company Voyager Aviation Holdings is among those that blamed its bankruptcy – filed this summer – on higher interest rates.