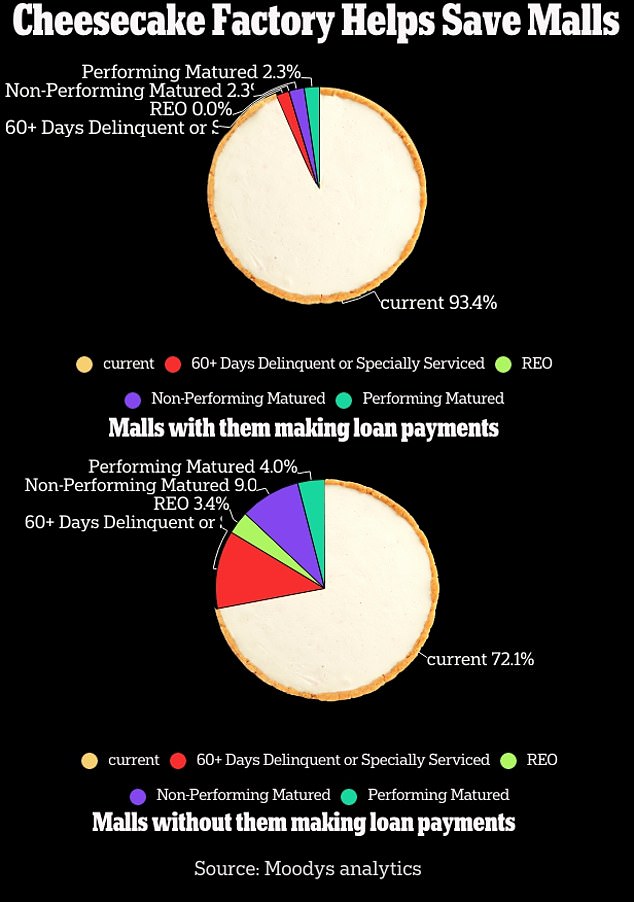

More than 90% of malls with a Cheesecake Factory are current on loan payments, while only 72% without them see the same financial success

The presence of a Cheesecake Factory in a shopping center could be used as an indicator of the facility’s financial health, a new report shows.

Somewhat surprisingly, the correlation was aired Tuesday in an article written by Moody’s Analytics titled ‘Get in loser! We’re Going Shopping!: Checking In to American Malls,’ released in honor of ‘Mean Girls’ Day on October 3.

Personally written by Matt Reidy, the company’s director of commercial real estate, the report looks at trends that coincide with and help explain the demise of enclosed shopping centers in recent years.

Once a fixture of American society, the complexes are currently collapsing, and the presence of certain stores — such as a Lululemon or an Apple — can be “an unscientific measure of the prospects of one mall over another,” according to Reidy. who writes the same applies to the chain known for its 38 different types of cheesecake.

In terms of loan performance – a good measure of financial health – he found that about 93 percent of loans backed by chain-proud malls are current on their payments, compared to a paltry 72 percent of those who don’t.

The presence of a Cheesecake Factory in a shopping center could be used as an indicator of its financial health, according to a report from Moody’s Analytics on the demise of the American shopping center

In terms of loan performance – a good measure of financial health – he found that about 93 percent of loans backed by chain-proud malls are current on their payments, compared to a paltry 72 percent of those who don’t.

“The causal link,” Reidy explained, “is likely the result of strong site selection by the company, rather than the restaurant saving a failing shopping center.”

Still, the relationship exists and the restaurant has had a measurable impact on the mall’s performance, the data shows – in a decade when the giants are in danger of being replaced by websites and tech commerce.

Today there are 700 enclosed shopping centers across the country – fewer than the more than 2,500 in the 1980s – and 200 of them have a Cheesecake Factory.

Looking at the percentage of loans within a financial institution’s loan portfolio that are delinquent, Reidy’s research found that non-chain shopping centers have long-term interest rates that are four times higher.

“Regardless of whether it’s strong selection of locations by the company or, less likely, the restaurant’s impact on the mall’s performance,” he wrote, “the relationship is certainly there.”

The correlation is one of many studies Reidy has conducted on the hundreds of closed malls over the past two decades — a phenomenon that began around the release of Mean Girls in 2004 — and the struggles of the remaining malls.

Within the commercial mortgage-backed securities market, Reidy found, gated shopping centers face long-term interest rates more than three times those of outdoor stores, and more than ten times those of centers on city main streets .

The statistic shows the transition of department stores to e-commerce and changes in consumer preferences, such as today’s consumers who prefer to walk straight into a store rather than navigate a maze of storefronts in a mall.

In response to this decline, mall owners have chosen to introduce add-ons such as movie theaters and more restaurants — as well as more showcased chains like Apple and Lululemon.

In his report, Reidy noted that while Cheesecake Factory — which is largely limited to U.S. malls — is mentioned less frequently than its counterparts, it “could also be a useful indicator of a stronger mall location.”

Since opening as a bakery in the late 1970s, the chain’s popularity grew in the late 2000s and early 2010s, around the time malls featured in movies like Mean Girls were falling into disrepair.

Reidy’s report shows how the chain has since managed to carve out a market in the declining mid-market, with almost all stores opened over the past two decades being in closed facilities.

In a final parting thought aired by the study, Reidy revealed how the mall featured in the Lindsay Lohan-led film Westfield Old Orchard outside Chicago has a Cheesecake Factory.

Cheesecake Factory, a chain restaurant known for its 38 different types of cheesecake, has more than 200 locations in the US, most of which are located in enclosed shopping centers.

It’s still open amid the recent series of closures, but also has a movie theater and a wide variety of restaurants aside from its desert destination.

On a more serious note – about the future fate of shopping centers as an institution – Reidy wrote: ‘Although we have taken a rather light-hearted approach in this article, the subject remains extremely serious.

‘There is still a long way to go in the recovery of the dying, closed shopping centers. Experienced and well-capitalized store operators who continue to adapt and embrace new trends and business strategies are better prepared to weather the storm.

“Those who don’t or can’t do that,” he warned, “will probably end up on deadmalls.com.”

DailyMail.com has contacted Cheesecake Factory for comment. Though they didn’t make a statement, the company’s social media appeared to take note of Moody’s research on Tuesday — while marking the Mean Girls holiday with a tasteful meme.

Rachel McAdams’ Regina George showed the moment Rachel McAdams’ Regina George said the lines found in the study’s title, and the post’s accompanying caption in turn offered another tribute, simply: “Cheesecake? So get it.’